Lendlease Global Commercial REIT – Rental Upside to Come From Sky Complex Milan

traderhub8

Publish date: Tue, 07 May 2024, 05:22 PM

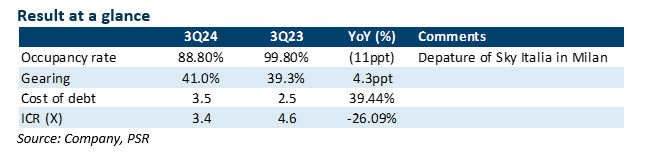

- No financials were provided for 3Q24. Portfolio committed occupancy plunged 11% YoY to 88.8% in the face of the departure of the anchor tenant of Sky Complex, which returned one-third of the space. However, on a QoQ basis, it improved by 0.9% due to the backfilling of Sky Complex by 8.1%.

- Rental reversion for both retail and office remained resilient, achieving 15.3% and 1.5%, respectively. We expect rental reversion to maintain at the current level for FY24e and earnings to be supported by the long-lease office tenant, which accounted for c.22% of the total income.

- We reiterate our BUY recommendation with an unchanged DDM-TP of S$0.83 and FY24e-25e DPU forecast of 4.16-4.59 Singapore cents. We expect potential upside from the high rental reversion upon the successful backfilling of Building 3 Sky Complex Milan and the completion of Live Nation in Grange Road.

The Positives

+ Robust retail rental reversion of 15.3% with 313 achieving c.20% and Jem delivering resilient performance of c.10%. Rental reversion for offices saw a slight cooling down, landing at 1.5% in 3Q24. However, stable support comes from tenants with long lease periods, contributing to c.22% of the total gross rental income. We expect rental reversion for the whole year FY24e to be c.15% (FY23: 4.8%).

+ Potential rental uplift from Jem and Sky Complex. We anticipate rental upside from Building 3 Sky Complex Milan, driven by healthy office demand in the surrounding area and lower-than-average rental rates previously signed by Sky Italia. In 3Q24, LREIT secured 8.1% of the net lettable area (NLA) leases through internal sourcing. LREIT expects backfilling to be completed by 50% by the end of 2024, with the rental reversion of c. 30-40% to match current market rates. Jem is also reviewing its rental at the end of 2024, and the current market rental is c.20% higher than the previous rent signed five years ago. We expect rental escalation to be in the high-teens, resulting in an improvement in revenue by c.2% upon successful negotiation.

The Negative

– NIL

Source: Phillip Capital Research - 7 May 2024

More articles on Trader Hub

Created by traderhub8 | May 15, 2024

Created by traderhub8 | May 14, 2024

Created by traderhub8 | May 13, 2024