BRC Asia Ltd – Bountiful Five Years Ahead

traderhub8

Publish date: Mon, 13 May 2024, 11:15 AM

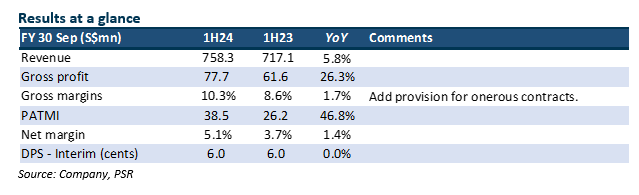

- 1H24 results were within expectations. Revenue and PATMI were 44%/46 of our FY24e forecast. 1H24 PATMI jumped 47% YoY to S$38.5mn. Revenue recovered as construction site disruptions normalized. Margins rebounded after the sharp price contraction last year. An interim dividend of 6 cents was announced (1H23: 6 cents).

- The order book remains healthy at S$1.3bn (1H23: S$1.4bn). Demand is strong, especially from the public sector. Industry steel bar demand climbed 34% YoY to 240k tons in YTDFeb24. The commencement of the Changi Airport Terminal 5 project will be another major boost to orders next year.

- We maintained our FY24e earnings. From higher growth assumptions, we raised our target price from S$1.99 to S$2.27. Our ACCUMULATE recommendation is unchanged. The availability of construction projects will remain elevated in the next five years. A golden era for construction. However, the timing to deliver the projects is less certain as the industry faces capacity constraints and bottlenecks.

The Positives

+ Recovery in revenue. 1H24 revenue rose 6% YoY to S$758mn. The recovery is after the 10% revenue decline in 1H23 following disruptions caused by worksite safety measures. Industry steel bar demand has remained healthy, with a rise of 34% YoY to 240k tons in YTDFeb24.

+ Gross margin normalised. As the pace of selling price eases, gross margins have started to recover to normalised levels of 10%. We expect margins to remain healthy due to a resilient order book and healthy flow of public and private projects in the coming 2-3 years. Steel bar prices contracted 12% YoY in 1Q24 (1Q23: -20%).

The Negative

– Constraints emerging in project delivery. The company mentioned that the lack of resources from the consulting engineering and architectural segments and regulatory challenges could cause delays or slow-down at project sites.

Source: Phillip Capital Research - 13 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024