Trader Hub

ComfortDelGro Corp Ltd – Zig Platform Led the Recovery

traderhub8

Publish date: Thu, 16 May 2024, 10:51 AM

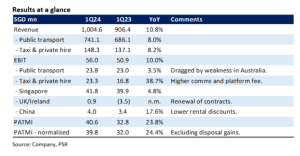

- 1Q24 results were within our expectations. Revenue and PATMI were 25%/20% of our FY24e forecast. 1Q24 net profit increased 24% YoY to S$40.6mn.

- Taxi operations enjoyed the strongest growth with a 39% YoY jump in 1Q24 earnings. Public transportation continues to earn paltry operating margins of 3%, dragged down by lower margin contract renewals in Australia. 1Q is typically the weakest seasonally.

- We maintain our FY24e and DCF target price of S$1.63. Our BUY recommendation is unchanged. Earnings growth is still underway led by higher platform fees and commission charged by Zig Singapore, continuous margin improvement from UK bus re-contracting and expansion, lower taxi rebates, contribution from CMAC acquisition and increased taxi fleet size in China and volume improvement in Singapore rail operations. Australia is the weak spot due to lower margin bus contract renewals.

The Positive

+ Operating leverage from Zig platform. Taxi earnings jumped around 39% YoY to S$23mn. The rise was due to higher commission rates and platform fee charged on the Zig ride-hailing app. Another boost to earnings was the turnaround in China from lower rental discounts.

The Negative

– Decline in Australia earnings. Australia’s operating earnings declined by 16% to S$9.2mn. Lower margins in public bus renewals especially in Sydney and other New South Wales routes dragged earnings lower.

Source: Phillip Capital Research - 16 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

CSOP IEdge S-REIT Leaders Index ETF – The Deeper Discounted Singapore REIT ETF

Created by traderhub8 | Jun 12, 2024

Valuetronics Holdings Ltd- Get Paid as Customer Base Is Refreshed

Created by traderhub8 | Jun 03, 2024

Singapore Telecommunications Ltd – Down Under Is Turning Around

Created by traderhub8 | May 27, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments