Prime US REIT – Pricing in Some Refinancing Risk

traderhub8

Publish date: Mon, 13 May 2024, 11:15 AM

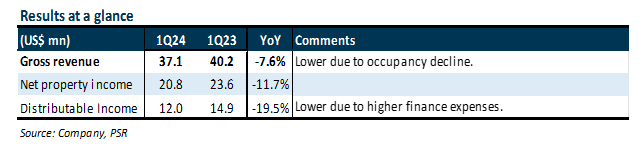

- 1Q24 results were within expectations. Gross revenue/distributable income was 23%/22% of our FY24e forecast. DI was 19.5% lower YoY due to lower portfolio occupancy (1Q24: 80.9%) and higher finance expenses.

- Management is confident that it will refinance the US$480mn (69% of total) debt before its July 2024 maturity as: 1) Prime is in the final stages of securing the loan, 2) the lenders are a syndicate led by Bank of Amerca. US banks are relatively more comfortable with financing US commercial real estate on a 65% LTV and an ICR of 1.5x, and 3) Prime’s assets are still generating income and cash-flows. However, credit spreads and interest cost may widen.

- Downgrade from BUY to ACCUMULATE with a lower TP of US$0.12 from US$0.30. We peg our TP to 0.2x P/NAV (from DDM), in line with its peers. We are pricing in the refinancing risk by changing our valuation from DDM to P/NAV that is in-line with US office peers. We believe this is warranted due to the short two-month window to refinance the debt. Prime is now focusing on deleveraging and has set a target to execute US$100mn of deleveraging in 2024. A successful refinancing of the US$480mn loan maturing in July 2024 we believe will help narrow the discount to NAV to 0.3x P/NAV and a target price of US$0.18. Based on our assumption of a 25% payout ratio in FY24e, the current share price implies an FY24e DPU yield of 9.5%. Prime is currently trading at 0.19x P/NAV.

The Positive

+ Leasing volume more than doubled YoY. Over 171.3k sq ft of leases were signed in 1Q24 (1Q23: 64.4k sq ft; 4Q23: 304.1k sq ft). Rental reversion for 1Q24 was -1.8% due to a 31.8k sq ft 11-year lease renewal in Reston Square with rents below preceding rents but above market rents. Management indicated strong leasing momentum at some of its properties, with notable leasing discussions underway at One Washingtonian Center (OWC), Park Tower, and 101 Hanley, albeit with relatively longer lead times.

The Negatives

– Two months left to refinance US$480mn or 69% of total debt due July 2024. Management is actively discussing refinancing this loan with lenders and believes it will be completed before maturity. 79% of total debt are either on fixed rate or hedged, with US$330mn of the US$480mn debt due for refinancing in July 2024 already hedged till June 2026. The cost of debt rose 0.1%pts QoQ to 4.1%. Aggregate leverage stood at 48.1%, with an ICR of 2.9x.

– 1Q24 Portfolio occupancy fell to 80.9% (FY23: 85.4%) after Sodexo vacated OWC. OWC is now undergoing an asset enhancement initiative to rejuvenate the asset, which is expected to be completed in 2H24. Excluding OWC, occupancy was 84.7%.

Source: Phillip Capital Research - 13 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024