Silverlake Axis Ltd – Higher OPEX Hurt Earnings

traderhub8

Publish date: Thu, 16 May 2024, 10:51 AM

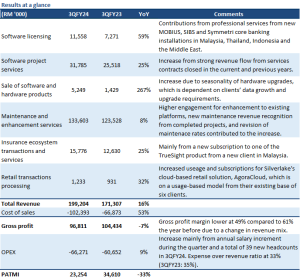

- 3QFY24 earnings of RM23.3mn were below our estimates. 9MFY24 earnings were at 62% of our FY24e. The 33% YoY dip in earnings came from higher-than-expected cost of sales and OPEX despite an increase in total revenue.

- 3QFY24 recurring revenue comprising maintenance and enhancement services, insurance ecosystem transactions and services, and retail transactions processing revenue grew 10% YoY, while non-recurring revenue comprising software licensing, software project services and sale of system software and hardware products rose 42% YoY. Higher cost of sales (+53% YoY) and operating expenses (+9% YoY) dragged down earnings. Order backlog of RM180mn going into the rest of FY24 with the total deals pipeline at RM1.2bn.

- Downgrade to ACCUMULATE with a lower target price of S$0.33 (prev. S$0.36). We lower FY24e earnings by 19% as we lower gross profit margin estimates and increase OPEX estimates for FY24e. The quality of Silverlake’s earnings is improving. Recurrent revenue is building up from new products (MOBIUS, Symmetry), and maintenance revenue is expanding with the rising security enhancement of core SIBS software. Our target price is pegged to 21x P/E FY24e. We expect MOBIUS and the recovery in bank IT spending after two cautious pandemic years to be the key growth drivers for the company.

The Positives

+ Recurring revenue rose 10% YoY. Recurring revenue comprises maintenance and enhancement services, insurance ecosystem transactions and services, and retail transactions processing revenue. Maintenance and enhancement services grew 8% YoY to RM134mn from new maintenance revenue recognition for projects that had been successfully completed and handed over to clients and revised maintenance rates for some clients upon maintenance renewal. There was also continued engagement from customers to enhance, modernise and provide up-to-date features in the platforms that were previously acquired. Silverlake expects this segment to continue to grow as new maintenance contracts and support will commence when current projects are completed and successfully handed over to clients. Insurance ecosystem transactions and services revenue rose 25% YoY, mainly due to new subscriptions to one of the TrueSight products from a new client in Malaysia. Retail transaction processing revenue grew 32% YoY from increased usage and subscriptions to new modules for Silverlake’s cloud-based retail solution, AgoraCloud. As this is a usage-based model, Silverlake has seen increased usage from its existing base of six clients.

+ Non-recurring revenue grows 42% YoY. Non-recurring revenue comprises software licensing, software project services, and the sale of system software and hardware products. Software licensing revenue rose 59% YoY due to contributions from professional services from new MOBIUS, SIBS, and Symmetri core banking installations in Malaysia, Thailand, Indonesia, and the Middle East. Software project services revenue grew 25% YoY as a result of new revenue flow from strong revenue flow of services contracts closed in the current and prior years, while sales of seasonal system software and hardware products surged 267% YoY.

+ Order backlog healthy. Silverlake has a long track record and a proven client base in Southeast Asia. Three of the five largest Southeast Asia-based financial institutions use its core banking platform, and it has largely retained all its clients since bringing them on board its platform. Silverlake’s project pipeline is healthy, at RM1.2bn (2QFY24: RM1.4bn), with contract wins of RM99mn in 3QFY24 and an order backlog of RM180mn going into the rest of FY24. Silverlake is beginning to close more deals and is witnessing an uptick in inquiries about its financial services market solutions and capabilities.

The Negatives

– OPEX continues to climb. Operating expenses were 9% higher YoY due to an annual salary increment exercise, and new headcount to support business development, business expansion, improved sales and market coverage, and retirement gratuity granted to key management personnel. Notably, 39 new headcounts were added in 3QFY24 compared to 3QFY23. Other OPEX increases include IT-related expenses, particularly in software subscription and support, as well as laptop leasing for new headcounts, business travels and a conference held by Silverlake.

Source: Phillip Capital Research - 16 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024