Sheng Siong Group Ltd – Seasonal and Base Effect Bump

traderhub8

Publish date: Mon, 29 Apr 2024, 10:20 AM

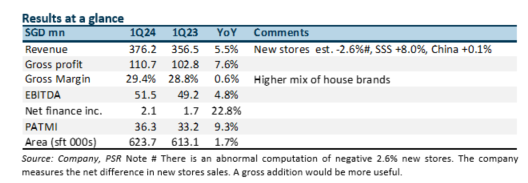

- 1Q24 revenue and PATMI were within expectations at 26%/26% of our FY24e forecast. Same-store sales growth accelerated to 3.6% benefitting from the later lunar new year.

- Only one new HDB store was secured in 1Q24. The pipeline is healthy with three stores tenders submitted and another six to be tendered out. The lack of new stores will keep growth muted this year.

- We maintain our FY24e forecast and target price of S$1.66. Our valuations are based on historical PE of 18x. Only two stores were opened last year. The lack of new stores will be a drag on revenue this year. With industry-leading margins, it will be challenging for Sheng Siong to expand further. Supply chain bottlenecks include distribution centres. Another avenue for growth is acquisitions, as the company has built up a record net cash hoard of S$352 million.

The Positive

+ Acceleration in revenue and margins. Same-store sales jumped 8% (effective growth from 63 matured stores is 3.6%). This year, the longer days between Christmas and Lunar New Year provided an additional runway for festive shopping. It was much closer last year, where shopper fatigue can occur. Margins were supported by higher house brand sales, especially the successful rollout of frozen products.

The Negative

– Only one new store was secured this year. Only one new store opened this quarter in Clementi. A positive has been the narrowing number of bidders for the stores. There are now typically three bidders for stores compared to four or five in the past.

Source: Phillip Capital Research - 29 Apr 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | May 15, 2024

Created by traderhub8 | May 14, 2024

Created by traderhub8 | May 13, 2024