Frasers Centrepoint Trust – Robust Operating Performance in 1H24

traderhub8

Publish date: Fri, 26 Apr 2024, 05:47 PM

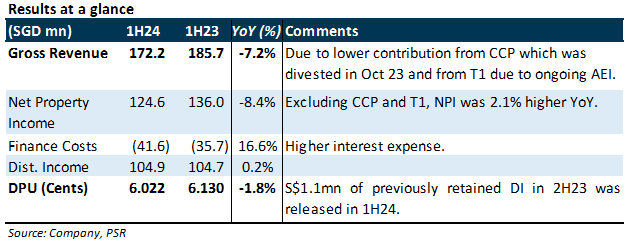

- 1H24 DPU of 6.022 Scts was 1.8% lower YoY, in line with our expectations. Gross revenue/NPI fell 7.2%/8.4% YoY due to the divestment of Changi City Point (CCP) in Oct 23, and ongoing AEI work at Tampines 1 (T1). Excluding these factors, gross revenue/NPI would have risen 2.9%/2.1% YoY.

- 1H24 retail portfolio occupancy was high at 99.9%, with portfolio rental reversions at +7.5%. 2Q24 shopper traffic and tenants’ sales were up 8.1% and 4.3%, respectively. This was an improvement from 1Q24 shopper traffic growth of 3.1% and tenants’ sales decline of 0.7% YoY.

- Maintain ACCUMULATE, with an unchanged DDM TP of S$2.38. We expect 7% positive rental reversion for FY24e, supported by the low occupancy cost of 15.5%. Share price catalysts include more accretive acquisitions and lower-than-expected interest costs. The share trades at an FY24e DPU yield of 5.6%. There is no change in our estimates.

The Positives

+ 2Q24 retail portfolio occupancy remained almost full at 99.9% (unchanged QoQ). Occupancy was at least 99% across all the malls. 1H24 rental reversion of +7.5% exceeded our expectations, and it was above 1H23 rental reversion of +4.3%. We expect this healthy positive rental reversion trend to continue for the remaining 14% of leases (by GRI) that expire in FY24.

+ Improvements in tenants’ sales and shopper traffic. 2Q24 tenants’ sales and shopper traffic were 4.3% and 8.1% higher YoY, respectively. Portfolio shopper traffic is now only 2% below pre-COVID levels, while tenant sales are c.20% higher than pre-COVID levels. We expect tenants’ sales to remain robust, supported by the various government handouts to Singapore residents in 2024.

+ All-in cost of debt improved 10bps QoQ to 4.2%, as FCT used the proceeds from the divestments of Changi City Point and interest in Hektar REIT to pay off some of the higher-cost debt. Aggregate leverage rose 1.3%pts QoQ to 38.5% as loans were drawn down to finance the increased stake in NEX and the Tampines 1 AEI. 68.5% of debt is hedged to a fixed rate. FCT has no debt expiring in FY24, and its ICR is 3.26 times. FY24e all-in cost of debt is expected to be low 4%.

The Negative

– nil

Source: Phillip Capital Research - 26 Apr 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | May 09, 2024

Created by traderhub8 | May 07, 2024

Created by traderhub8 | May 02, 2024

Created by traderhub8 | May 02, 2024

Created by traderhub8 | Apr 29, 2024