CapitaLand Investment Limited – Capital Recycling Picks Up Pace

traderhub8

Publish date: Mon, 29 Apr 2024, 10:21 AM

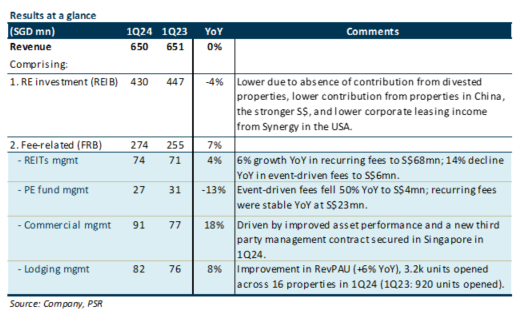

- Limited financial details were provided in this business update. 1Q24 revenue was flat YoY at S$650mn. Fee-related revenue (FRB) grew 7% YoY to S$274mn, while Real Estate Investment Business revenue (REIB) fell 4% to S$430mn.

- In 1Q24, CLI made S$600mn worth of divestments, up from S$35mn in 1Q23. More than 75% were divested into CLI’s fund vehicles. It is on track to hit its S$3bn annual divestment target, with the bulk of assets in the divestment pipeline coming from China and the USA.

- Maintain BUY with an unchanged SOTP TP of S$3.38. Our SOTP-derived TP of S$3.38 represents an upside of 32.6% and a forward P/E of 16.7x. We like CLI for its robust recurring fee income stream and asset-light model. We expect the FRB to continue to improve, supported by the lodging business as more units are opened and the return of event-driven fees.

The Positives

+ 1Q24 FRB revenue continues its growth trajectory, rising 7% YoY. This was due to improvements in commercial management fees (+18%), lodging management fees (+8%), and recurring fund management fees (+5%). Event-driven fees under the fund management platform remain a drag (-33% YoY), but we expect these to pick up this year as global transaction volumes gradually recover. Additionally, private funds recorded S$1bn in total investments in 1Q24, taking deployed funds under management to S$91bn from S$90bn in FY23. There is still S$9bn of dry powder pending deployment. CLI remains committed to double FUM to S$200bn in five years.

+ Faster pace of capital recycling. In 1Q24, CLI made S$600mn worth of divestments, up from S$35mn in 1Q23. More than 75% were divested into CLI’s fund vehicles. Divestment proceeds will be used to lower gearing and to pare down higher-cost debt. CLI is on track to hit its S$3bn annual divestment target, with the majority coming from China and the USA.

The Negative

– REIB revenue remains weak, falling 4% YoY. This was due to asset divestments, weaker operating performance in China, and lower revenue from the lodging platform Synergy in the USA.

Source: Phillip Capital Research - 29 Apr 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024