Cromwell European REIT – A Resilient 1Q24

traderhub8

Publish date: Fri, 03 May 2024, 04:38 PM

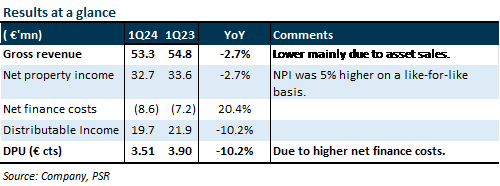

- 1Q24 DPU of 3.505 €cents was within expectations at 25.5% of our FY24e forecast. It was 10.2% lower YoY, due to higher finance costs. NPI fell 2.7% YoY mainly due to the divestments of Bari Europa, Bari Trieste and Piazza Affari. Excluding these, NPI was 5% higher YoY on a like-for-like basis.

- Portfolio occupancy stood at 93.4%, down 0.9%pts QoQ. It is expected to increase to 95% with the full lease-up of the recently completed developments. Portfolio rental reversion was strong at +9.2%, with no debt expiring until November 2025.

- Maintain BUY, with an unchanged DDM TP of €1. We like CERT for its clear divestment and redevelopment strategies, which will help to keep gearing below 40% and foster organic growth. It will also take CERT closer to its long-term 60:40 target asset class split between light industrial / logistics and well-located Grade A offices. Despite accounting for the loss of income from the divestments, CERT still trades at an attractive FY24e DPU yield of 9.2%. There is no change in our estimates.

The Positives

+ Portfolio occupancy is expected to improve to 95% as recently completed developments are fully leased. It dipped 0.9%pts QoQ to 93.4% in 1Q24 due to these projects being included in the occupancy statistics, though they were not fully leased yet. Logistics/light industrial and office occupancy stood at 94.5% and 89.7% (4Q23: 95.6% and 90.3%), respectively. Additionally, CERT had a strong portfolio rental reversion of +9.2% (FY23: 5.7%), with light industrial/logistics and office reversions coming in at 5% and 10.3%, respectively.

+ Making full use of the cheap 2.125% bond due November 2025. CERT plans to delay refinancing this bond for as long as possible to take advantage of the cheap cost and potential interest rate cuts. Given its strong operating performance, we believe it will be able to refinance this bond without issue in due time. Additionally, more accretive bond buybacks may be possible if its asset sale program stays on track. Aggregate leverage increased 1%pt QoQ to 41.3%, while the all-in cost of debt increased 0.9%pts QoQ to 3.28% in 1Q24. As 86% of debt remains hedged to a fixed rate, we expect the all-in cost of debt to remain around 3.3% in FY24e.

+ Divestments continue. In 1Q24, Grojecka 5, Poland, was sold for €15.8mn, 7.5% above the most recent valuation. In late April, two more assets were divested for €7.2mn at a blended 2.1% premium. CERT has c.€150mn in potential divestments that are earmarked for sale over the next two years, with €60mn in advanced discussions.

The Negative

– nil

Source: Phillip Capital Research - 3 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024