Singapore Banking Monthly – Higher NII Hampered by Allowances

traderhub8

Publish date: Mon, 13 Nov 2023, 11:23 AM

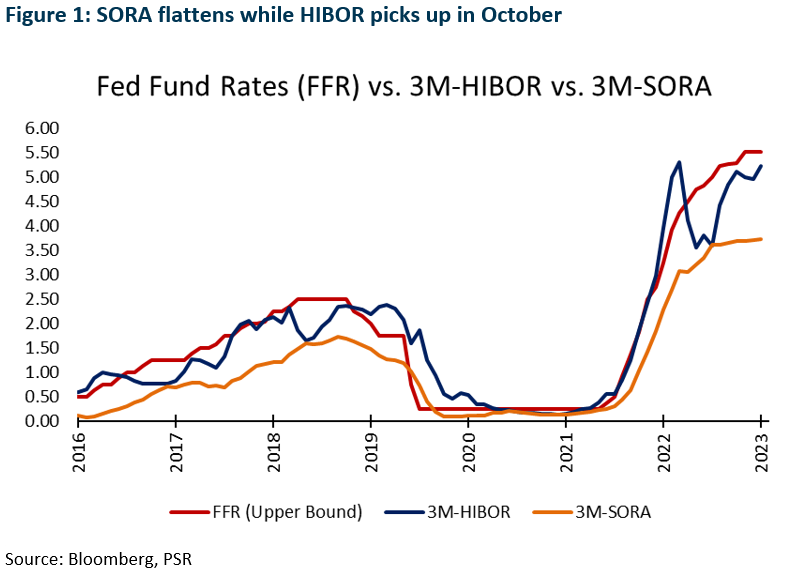

- October’s 3M-SORA was up 2bps MoM to 3.72% and was 3bps higher than the 3Q23 average of 3.69%. 3M-HIBOR was up 27bps MoM to 5.22%.

- 3Q23 bank earnings were slightly above expectations. PATMI rose 15%, supported by NII growth of 14% YoY. Guidance for FY23e remains unchanged with NIMs stable QoQ at around 2.10-2.25% and loans growth maintained at low to mid-single digit.

- Singapore domestic loans dipped 6.1% YoY in September, below our estimates. The loan decline was lower than in the previous month. The CASA balance rose slightly to 18.9% (Aug23: 18.8%).

- Maintain OVERWEIGHT. We remain positive on banks. Bank dividend yields are attractive at 5.7% with upside surprise in dividends due to excess capital ratios and push towards higher ROEs. SGX is another major beneficiary of higher interest rates (SGX SP, BUY, TP S$11.71).

3M-SORA growth flat; 3M-HIBOR picked up in October

Singapore interest rates continued their gradual incline in October. The 3M-SORA was up 2bps MoM to 3.72%. October’s 3M-SORA surged by 144bps YoY and was 3bps higher than 3Q23 3M-SORA average of 3.69% (2Q23: 3.62%).

Hong Kong interest rates picked back up and more than reversed the previous two months’ decline. The 3M-HIBOR was up 27bps MoM to 5.22%, reversing the total decline of 15bps in August and September. This is the highest level that the 3M-HIBOR has reached in 2023. September’s 3M-HIBOR improved by 126bps YoY and was 21bps higher than 3Q23 3M-HIBOR average of 5.01% (Figure 1).

3Q23 RESULTS HIGHLIGHTS

- Continued NII and NIM growth boost earnings

DBS’ 3Q23 adjusted earnings of S$2.63bn were above our estimates, and 9M23 adjusted PATMI was 78% of our FY23e forecast. 3Q23 DPS is raised 14% YoY to 48 cents. NII rose 16% YoY on NIM expansion of 29bps despite loan growth dipping slightly. Fee income rose 9% YoY, while other non-interest income grew 21% YoY. DBS has maintained its FY23e guidance. It provided FY24e guidance of double-digit fee income growth (from wealth management and credit card fees), stable NII as higher NIMs from higher-for-longer rates will be offset by lower loan growth and total allowances to normalise to 17-20bps of loans. FY24e PATMI to be maintained at around the current levels in FY23.

OCBC’s 3Q23 earnings of S$1.81bn were slightly above our estimates. It came from higher net interest income and higher fee income offset by lower insurance income and higher allowances. 9M23 PATMI was 77% of our FY23e forecast. NII grew 17% YoY led by NIM improvement of 21bps YoY to 2.27% despite loan growth dipping 2% YoY. NIM expansion was mainly driven by higher margins across the Group’s key markets. OCBC has increased their NIM guidance for FY23e from above 2.20% to around 2.25%.

UOB’s 3Q23 adjusted earnings of S$1.48bn were slightly above our estimates, and 9M23 adjusted PATMI was 77% of our FY23e forecast. NII grew 9% YoY and fee income rose 14% YoY, while other non-interest income growth was flat, and allowances increased 12% YoY. Management has maintained its FY23e guidance, while providing FY24e guidance of mid-single digit loan growth from a growing customer franchise and focus on high-quality customers. Also, NIM to remain at current levels as funding costs have stabilised and expectations for rates to maintain till 2H24; double-digit fee income growth expected from the Citi acquisition; and there are expectations of stable cost-to-income ratio and credit cost at around 25-30bps.

- Allowances higher across the board

DBS’ 3Q23 total allowances were higher 21% YoY due to higher SP of S$197mn (3Q22: S$25mn). As a result, 3Q23 credit costs rose to 18bps, with 9M23 credit costs at 11bps. The rise in SP was due to allowances being prudently taken for exposures linked to the recent money laundering case in Singapore. The NPL ratio rose slightly to 1.2% (3Q22: 1.1%), while GP reserves were stable YoY at S$3.91bn.

OCBC’s 3Q23 total allowances rose 19% YoY to S$184mn as SPs grew to S$220mn (2Q23: S$78mn) partially offset by a GP write-back of S$36mn (2Q23: GP of S$76mn). The higher SP was from corporate accounts in various sectors and geographies all over ASEAN, and not due to any specific account. OCBC said that it does not see any systemic risk. As a result, credit costs increased by 4bps YoY to 17bps.

UOB’s total allowances rose by 12% YoY to S$151mn mainly due to specific allowance increasing by 80% YoY to S$229mn despite a general allowance write-back of S$78mn for the quarter. The increase in specific allowance was a pre-emptive move to rebalance collateral value in US and Hong Kong/China. Management said that the accounts were not distressed or non-performing. This resulted in credit costs increasing by 2bps YoY to 19bps.

Source: Phillip Capital Research - 13 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | May 20, 2024

Created by traderhub8 | May 15, 2024

Created by traderhub8 | May 14, 2024