Venture Corporation Limited – as Weak as During the Pandemic

traderhub8

Publish date: Mon, 06 Nov 2023, 11:45 AM

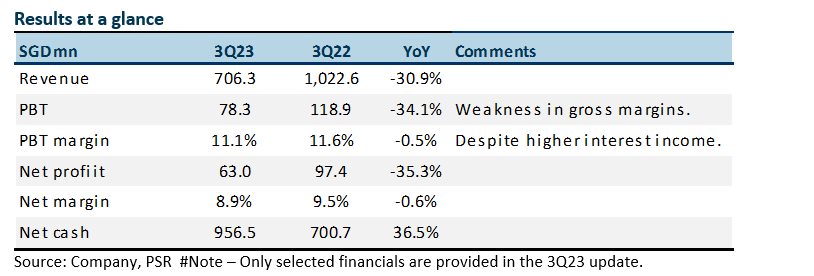

- 3Q23 PAT was down 35% YoY to S$63mn. The results were below expectations. 9M23 revenue and PAT were 70%/69% of our FY23e forecast. Soft demand and inventory adjustment continue to weigh down on revenue and earnings.

- The pace of decline should narrow in 4Q23e as contributions from new product introductions and supply chains transition from China to SE Asia.

- We cut our FY23e revenue and PATMI by 7% and 8%, respectively. We maintain our NEUTRAL recommendation. Our target price is lowered to S$12.50 (prev. S$15.20) due to our cut in earnings and a reduction in our PE ratio to 13x (prev. 15x). Venture’s valuation continued to de-rate as growth has stuttered over the past five years. The dividend yield of 6% is attractive and sustainable with its cash hoard of S$956mn.

The Positive

+ Recovery in net cash. Net cash recovered by S$255mn YoY in 3Q23 to S$956mn. Inventory declined by S$304mn YoY to a still elevated S$949mn. Inventory is high compared to pre-pandemic levels of around S$700mn.

The Negatives

– Weakness in margins. There was no disclosure of gross margins this quarter. But assuming interest income was similar to prior quarters, operating margins declined by at least 1% point. This was despite staff costs declining around 9% YoY.

– Revenue slump. Revenue growth remains problematic for Venture. 3Q23 revenue of S$706mn is trending around supply chain pandemic levels.

Source: Phillip Capital Research - 6 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | May 20, 2024

Created by traderhub8 | May 15, 2024

Created by traderhub8 | May 14, 2024