Does Crocs Inc. Make a Good Investment?

ljunyuan

Publish date: Wed, 20 Oct 2021, 01:30 PM

The name “Crocs” needs no further introduction – you can find its retail shops in many of the bigger malls in Singapore. Some of you even have their shoes in your cabinet.

Incorporated since 2002, the US-listed Crocs Inc. (NASDAQ:CROX) is a world leader in innovative casual footwear (where its products are currently sold in more than 90 countries – with Singapore being one of them; however, the company is focused on 5 core markets – US, Japan, China, South Korea, and Germany, where it believes the greatest opportunities for growth exist.

Apart from their iconic clog silhouette (which you can see from the image above), Crocs Inc. have, over the years, have expanded its product offerings to include wide variety of casual footwear products including sandals (wedges, flips, and sides) that meet the needs of the entire family (I know of some families who all wear the same design and colour of Crocs clog whenever they head out.) On top of that, the company have secured licensing partnerships with Disney (including Marvel and Lucasfilm), Universal Studios, Nintendo, and Warner Bros., to allow them to bring popular global franchises and characters to life on their catalogue of products in a fun and exciting way.

In my post today about the NASDAQ-listed company, I will be sharing with you the company’s financial performance and debt profile for the most recent 2 financial years (i.e. FY2019 and FY2020, reason being in the years prior, the company is in a net loss position), along with its current year results so far (compared against the same time period last year.)

Let’s begin…

Financial Performance

The following table is Crocs Inc.’s financial performance between FY2019 and FY2020 (it has a financial year ending every 31 December):

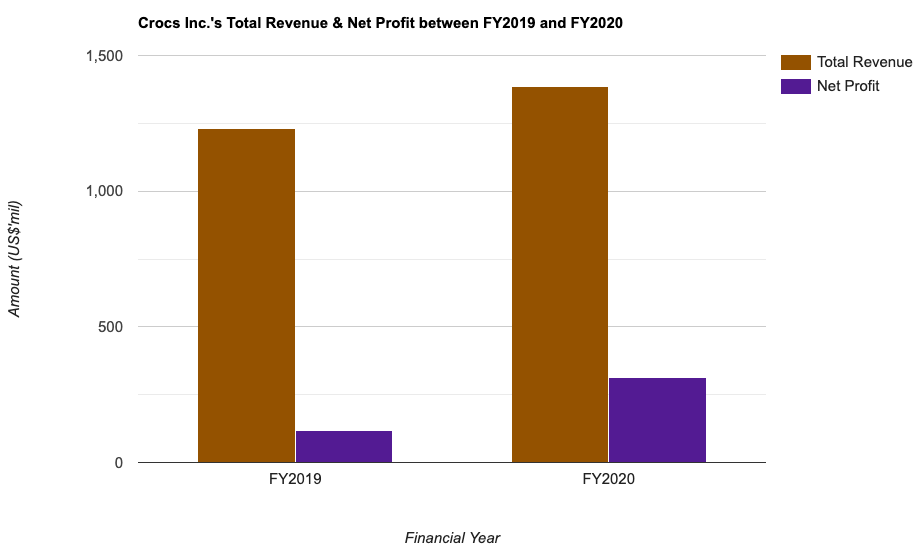

Total Revenue & Net Profit (US$’mil):

| FY2019 | FY2020 | |

| Total Revenue (US$’mil) | $1,231m | $1,386m |

| Net Profit (US$’mil) | $119m | $313m |

In FY2020, Crocs’ total revenue saw a 12.6% improvement compared to last year, with growth seen across all its business segments – where its e-commerce revenue jumped by 58.2%, wholesale revenue rose 5.6%, and its retail comparable store sales grew 21.2%.

Its net profit in the same time period doubled to $313m.

Gross & Net Profit Margin (%):

The following table is the company’s gross and net profit margin I’ve computed:

| FY2019 | FY2020 | |

| Gross Profit Margin (%) | 50.1% | 54.1% |

| Net Profit Margin (%) | 9.7% | 22.6% |

As its cost of sales went up by only 3.6% (compared to a 12.6% growth in its total revenue), its gross profit margin saw a 4.0 percentage point (pp) improvement to 54.1% in FY2020. Also, due to a huge jump in terms of its net profit, its net profit margin also leaped to 22.6% (a huge improvement compared to just 9.7% recorded in FY2019.)

Return on Equity (%):

One of the things I look at when I study about a company is its Return on Equity (or RoE) – where in layman terms, it is the amount of profits (in percentage terms) the company is able to generate for every dollar of shareholders’ money it uses in its businesses. Personally, anything above 15.0%, along with the company being able to grow this statistic over the years, is considered ideal.

With that, let us take a look at Crocs’ RoE which I have computed:

| FY2019 | FY2020 | |

| Return on Equity (%) | 90.2% | 107.6% |

Personally, I am impressed with the company’s RoE over the most recent 2 financial years I have looked at.

Debt Profile

Apart from its financial performance, another area I focus my attention on whenever I study about a company is its debt profile – where my preference is towards those with minimal or no debt, along with the company being in a net cash position.

The following table highlights Crocs’ debt profile for FY2019 and FY2020:

| FY2019 | FY2020 | |

| Cash & Cash Equivalents (US$’mil) | $112m | $139m |

| Total Borrowings (US$’mil) | $205m | $180m |

| Net Cash/Debt (US$’mil) | -$93m | -$41m |

No doubt the company is in a net debt position in the 2 financial years I have looked at (a slight negative here), but compared to the previous year, its total borrowings have come down; along with its cash and cash equivalents improving by 24.1% (compared to the previous year), while the company is still in a net debt position, but it has improved.

Current Year Financial Performance (1H FY2020 vs. 1H FY2021)

On 22 July, Crocs released its financial results for the second half of the financial year 2021 ended 30 June 2021. In this section, you’ll find some of the key statistics that I look at (whenever I study a company’s quarterly results) recorded for the current quarter under review, and compare them against that recorded in the same time period last year (i.e. Q2 FY2020 ended 30 June 2020):

| 1H FY2020 | 1H FY2021 | % Variance | |

| Total Revenue (US$’mil) | $613m | $1,101m | +79.6% |

| Net Profit (US$’mil) | $68m | $417m | > +100.0% |

| Gross Profit Margin (%) | 51.2% | 58.9% | +7.7pp |

| Net Profit Margin (%) | 11.1% | 37.9% | +26.8pp |

| Cash & Cash Equivalents (US$’mil) | $155m | $203m | +31.0% |

| Total Borrowings (US$’mil) | $275m | $386m | +40.4% |

| Net Cash/Debt (US$’mil) | -$120m | -$183m | N.M. |

On the whole, its latest set of y-o-y results (in terms of its total revenue and net profit) is an impressive one (in my personal opinion) – the improvements can be attributed to growth recorded in all its business segments. If there’s a slight negative in its current year results, it will be its debt profile, where it sank slightly deeper in a net debt position (due to a smaller growth in its cash and cash equivalents compared to its total borrowings.)

Looking ahead, the company expects its revenue growth in the third quarter ahead (its results will be out this Thursday, 21 October) to be between 60% and 70% compared to the same time period last year, and its revenue growth for the full year to be between 60% and 65% compared to the previous year.

Closing Thoughts

Crocs Inc.’s financial results have improved rather significantly since going back to a net profit position once again in FY2019. Also, its current year results (in terms of growth in its total revenue and net profit) is also pretty impressive.

If there’s one slight negative, it will be that the company is in a net debt position.

Another thing you may want to take note is that the company does not pay out any dividend currently (and as such, if you are those who are looking to invest in a company that pays out a regular dividend, then this one is not for you.) Also, for those who may have concerns on whether the company may sink back into a net loss position once again, one suggestion – you may want to wait for its full year results for another year or two before making any investment decision (and if the company can continue to record improvements in its revenue and net profit, coupled with their debt profile turning into a net cash position, then in my opinion, it is definitely one you can consider adding into your investment “shopping list”.)

However, despite having said all of that, do take note that all the opinions are purely my own, which I’m sharing for educational purposes only. You should always do your own due diligence before you make any investment decisions.

Disclaimer: At the time of writing, I am not a shareholder of Crocs Inc.

More articles on THE SINGAPOREAN INVESTOR

Created by ljunyuan | Nov 18, 2024

Created by ljunyuan | Nov 11, 2024

Created by ljunyuan | Nov 08, 2024

Created by ljunyuan | Nov 05, 2024