Singapore Telecommunications Ltd – Down Under Is Turning Around

traderhub8

Publish date: Mon, 27 May 2024, 10:00 AM

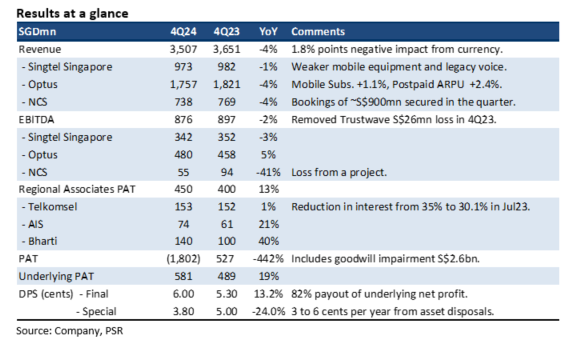

- 4Q24 revenue was within expectations, with FY24 revenue at 97% of our EBITDA exceeded 105% of forecasts due to higher other income and Optus margins. The final dividend was raised by 13% to 6 cents and an inaugural “value realisation dividend” (or recurrent special) of 3.8 cents.

- Optus managed to expand 4Q24 EBITDA margins to the highest in six quarters. Headcount at Optus declined by 12% over the past twelve months. Mobile price repair is also underway with postpaid ARPU rising 2.4% YoY.

- We maintain BUY with a higher target price of S$3.00 (prev. S$2.80). We raised our FY25e EBITDA by 5% and the market valuations of associates are higher. We see multiple earnings and share price drivers for Singtel. These include (i) S$200mn p.a. cost down in Australia and Singapore. FY24 combined headcount is down almost 7% YoY; (ii) S$300-400mn EBITDA opportunity in GPU-as-a-Service; (iii) planned asset disposals of S$6bn; (iv) recovery in associate earnings post current de-valuation in Airtel Africa, growth in home broadband and higher mobile prices. The dividend yield is now 6.2%.

The Positive

+ Margin recovery in Optus. Optus 4Q24 EBITDA margin of 27% was the highest in six quarters. The recovery was due to aggressive cost management. Headcount was lowered by 12% YoY to 6,313. The lower cost structure will carry into the FY25e. Another driver to earnings has been the growth in mobile service revenue of 5% YoY in 4Q24 as postpaid ARPU and subscribers creep up.

The Negative

– Weakness in Singapore and NCS. Singapore’s profitability was negatively impacted by lower equipment sales and constant drag from legacy voice services. Weakness in margin was due to higher staff, selling, and administrative costs. NCS’s drop in earnings was due to a loss from an undisclosed project. Earnings would have grown, excluding this impact.

Source: Phillip Capital Research - 27 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024