Oiltek International Ltd – Riding Major Capex Cycles

traderhub8

Publish date: Mon, 10 Jun 2024, 11:09 AM

- The order book for Oiltek has been growing at a 50% CAGR over the past four years.

FY24e is poised to be a fifth straight year of record orders. Oiltek secured new orders

last week, which boosted its order book by around 30%, currently RM400mn or two

times FY23 revenue. - FY23 net profit jumped 51% to RM19.1mn on the back of strong order wins of RM322mn

(FY22: RM196mn). We believe the company is riding multiple capex cycles. These

include growth in biodiesel capacity in Malaysia and Indonesia, higher value-added

products downstream, and expansion of customer base in Africa and Latin America. The

largest growth opportunity will be the increasing use of sustainable aviation fuel oil

using palm oil effluents in SE Asia. - Oiltek has an enviable 31% ROE business that is asset-light and backed by net cash of

RM132mn (~70% market cap). Its high returns stem from selling proprietary know-how

and successfully designing, operating, and commissioning customer plants with a 45-

year track record of project completions. We initiate coverage with a target price of

S$0.70, or 15x PE FY24e. There are no direct comparables. We peg Oiltek at a discount

to the engineering sector, which trades at 24x forward PE. FY24e EV/EBITDA is 1x.

Background

Established in 1980, Oiltek is a design and engineering specialist for vegetable oil refineries

and processing plants for major agricultural commodities, including palm (80-90%), soybean,

and rapeseed. Core production processes or products include palm oil refining,

fractionalization, specialty fats, biodiesel, and potentially hydrogenated vegetable oil (HVO)

for sustainable aviation fuel (SAF). The company is based in Malaysia and was listed on the

Catalist in March 2022. Oiltek has customers in more than 34 countries, including major

listed plantation companies. Indonesia accounted for 78% of its FY23 revenue.

Highlights

• Riding multiple capex cycles. Oiltek is dependent on customers’ capex plans, especially

in the palm oil sector. Its growth drivers include: i) higher in biodiesel blending in

Malaysia from B10 (or 10% palm oil) to B20. This will increase the expected biodiesel

tonnage to 1.8mn tonnes. The typical size of a biodiesel plant is 400k tonnes, implying

additional four to five new plants; (ii) an increase in Indonesia biodiesel blend from B35

(since Aug23) to B40; iii) new biodiesel facilities nationwide in Indonesia and Malaysia

for more comprehensive logistics coverage; iv) further downstream integration into

higher value-added products, including specialty fast, animal feed, Rumen fats, cocoa

butter equivalent and phytonutrients; v) Expansion of palm oil refining facilities and

downstream diversification globally such as in Latin America.

• The SAF bounty. There is a growing demand for SAF. IATA projects SAF production will

triple to 1.5mn tonnes in 2024. This would still be only 0.5% of aviation fuels in 2024.

Announced SAF projects could reach 51mn tonnes by 2030. Many countries have

mandated flights to use 3-10% of SAF by 2030. Oiltek has the solutions to treat palm oil

mill effluent (POME) and used cooking oil as feedstock for the production of HVO. HVO

is, in turn, the feedstock to produce SAF.

• Asset-light, strong ROE and cash flow. Oiltek’s key assets are its proprietary process

technologies and a 45-year record of completing projects. It outsources plant fabrication

and installation work to third-party plants, which minimises minimizing capex needs.

Oiltek generates an ROE of 31% despite net cash of RM132mn. The dividend yield was

5% in FY23. We expect dividends to grow by 13% in FY24e.

Background

Oiltek is a design and engineering specialist for vegetable oil refineries and processing

systems for major agricultural commodities, including palm, soybean, and rapeseed. These

refineries produce edible and non-edible oil, related downstream products, and renewable

energy such as biodiesel and biogas. Its key customers are major listed plantation companies.

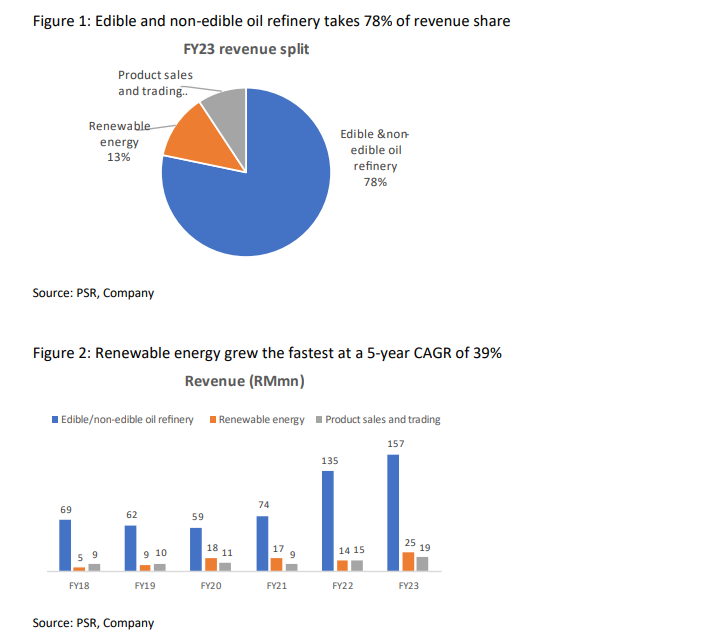

Edible and non-edible oil refinery construction and upgrade accounted for 78% of revenue

share in FY23 (Figure 1). Still, renewable energy, comprising biodiesel and biogas plants, grew

at a faster rate of 83% YoY (Figure 2).

Oiltek has the technology solution to process waste fats/oil, such as palm oil mill effluent

(POME) and used cooking oil (UCO), as well as other vegetable oil-based raw materials, into

the feedstock for production of hydrogenated vegetable oil (HVO), which is used as

sustainable aviation fuel. Its process technology complies with the International

Sustainability and Carbon Certification (ISCC). Oiltek has delivered its first HVO feedstock

treatment plant that uses POME to a customer in Malaysia.

Some of its notable customers include Wilmar International Limited, Sarawak Oil Palms Bhd,

Bunge Loders Croklaan, FGV Holding

Source: Phillip Capital Research - 10 Jun 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024