Singapore Banking Monthly – Interest Rates Decline Halted

traderhub8

Publish date: Fri, 05 Apr 2024, 10:09 AM

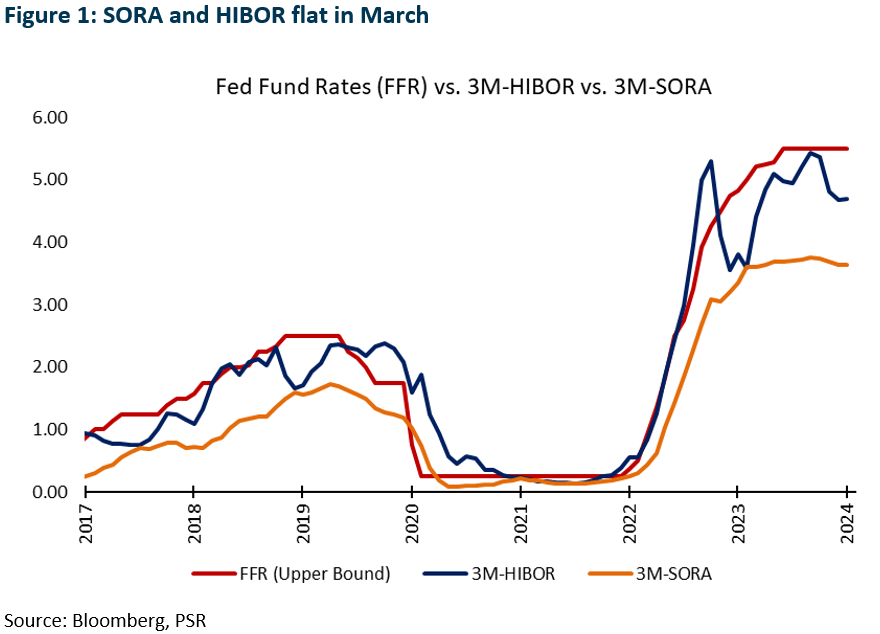

- March’s 3M-SORA was flat MoM at 3.64% but was 2bps lower than the 1Q24 average. Nonetheless, the 3M-SORA rose by 29bps YoY. 3M-HIBOR was up 2bps MoM to 4.70%, slightly reversing the decline of 14bps in February.

- Singapore domestic loans dipped 0.3% YoY in February, below our estimates. This was the smallest loan decline recorded in 15 months. The CASA balance rose slightly to 18.2% (Jan24: 18.1%).

- Maintain OVERWEIGHT. The banks had a positive March performance. The best performer continued to be DBS, with a 7.4% increase, while OCBC and UOB improved by 3.8% and 4%, respectively. We remain positive on banks. NIMs may stay flat despite the higher-for-longer interest rate environment, but a recovery in loan growth and fee income will uplift profits. Bank dividend yields are also attractive, with upside surprises due to excess capital ratios and a push towards higher ROEs.

3M-SORA and 3M-HIBOR flat in March

Singapore interest rates were flat in March, halting the 5bps decline in the previous two months. The 3M-SORA was flat MoM at 3.64%. Nonetheless, March’s 3M-SORA rose by 29bps YoY but was 2bps lower than the 1Q24 3M-SORA average of 3.66% (4Q23: 3.74%).

Hong Kong interest rates increased slightly in March. The 3M-HIBOR was up 2bps MoM to 4.70%, slightly reversing the decline of 14bps in February. Furthermore, March’s 3M-HIBOR improved by 89bps YoY but was 3bps lower than 1Q24 3M-HIBOR average of 4.73% (Figure 1).

Singapore loan growth declined to the lowest in 15 months

Overall loans to Singapore residents – which captured lending in all currencies to residents in Singapore – fell by 0.3% YoY in February to S$801bn. Notably, this is the smallest decline in 15 months. Still, we expect a low-single-digit growth for 2024 as loan growth is expected to turn positive in 2H24.

Business loans fell by 0.7% YoY in February. Loans to the building and construction segment, the single largest business segment, fell 0.7% YoY to S$170bn, while loans to the manufacturing segment fell 5.9% YoY in February to S$21bn.

Consumer loans grew 0.4% YoY in February to S$312bn, the second YoY increase recorded since December 2022. Housing loans, which comprise ~70% of consumer lending, grew 1.4% YoY in February to S$225bn.

Total deposits and balances—which include deposits in all currencies made by non-bank customers—grew by 4.2% YoY in February to S$1,815bn. In the Current Account and Savings Account, or CASA, the proportion rose slightly to 18.2% (Jan 24: 18.1%) of total deposits or S$330bn.

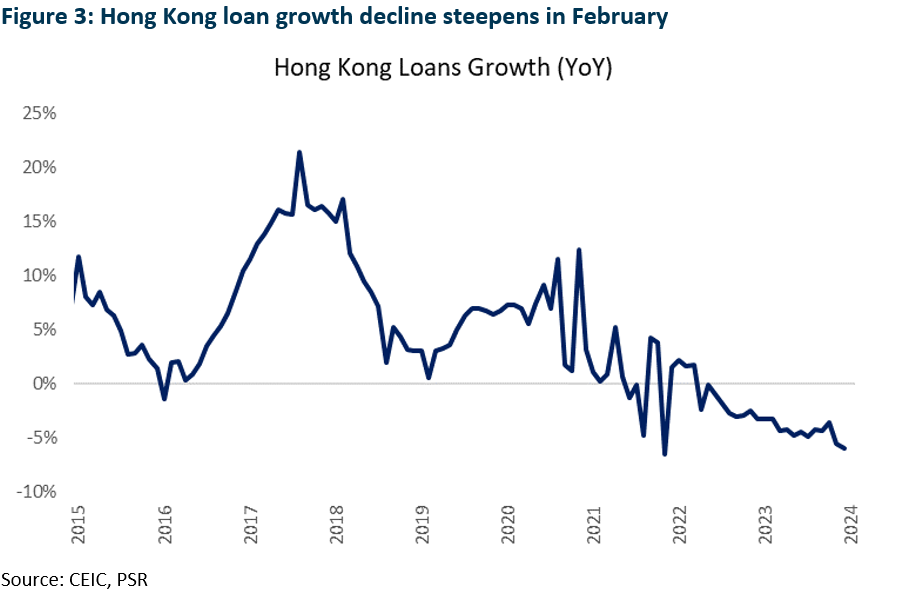

Hong Kong loan growth decline steepens

Hong Kong’s domestic loan growth declined 5.9% YoY and 1% MoM in February. The decline was sharper than January’s fall of 5.6% YoY and 0.8% MoM.

Volatility fell as the market stabilised

SDAV dipped 3% YoY to S$1,178mn in March (Figure 4), while the DDAV grew 24% YoY and 11% MoM in February. The VIX, a market index that measures the implied volatility of the S&P 500 Index, averaged 13.8 in March, down from 14 in the previous month.

The top four equity index futures turnover fell 9% YoY in March to 11mn contracts (Figure 5) due to the lower trading volumes of its Nikkei 225 Index Futures and FTSE China A50 Index Futures. Notably, the Nikkei 225 Index Futures increased 51% MoM, while the FTSE China A50 Index Futures fell 15% MoM in March.

Source: Phillip Capital Research - 5 Apr 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024