Trader Hub

ComfortDelGro Corp Ltd – More Growth Ahead

traderhub8

Publish date: Mon, 04 Mar 2024, 11:19 AM

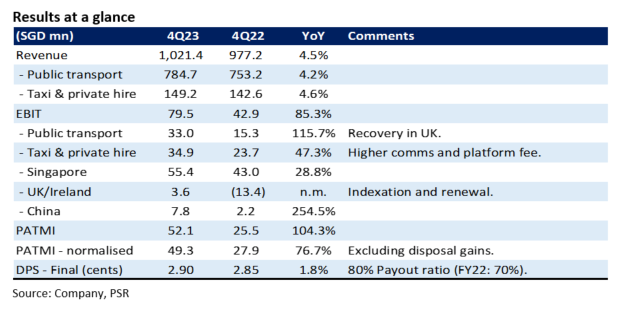

- FY23 earnings beat expectations at 117% of our forecast. Revenue was within our estimates at 98%. 4Q23 PATMI jumped 77% YoY to S$49.3mn.

- The turnaround in UK bus operations and growth in Singapore and China taxi operations were the major drivers of earnings.

- We raised our FY24e earnings by 24% to S$207mn. Our BUY recommendation is maintained and the DCF target price raised to S$1.63 (prev. S$1.57). We expect multiple earnings drivers in 2024; (i) higher platform fees and commission for Singapore taxis; (ii) UK bus indexation and re-contracting; (iii) Increased taxi fleet size in China; (iv) Margin recovery for Singapore rail operations as operating cost stabilises, rail passenger numbers grow and lagged re-pricing of fares.

The Positive

+ Jump in China taxi earnings. Operating profit in China jumped almost 4-fold to S$7.8mn in 4Q23. Earnings recovered as rebates were removed. Demand for vehicles has been strong, and ComfortDelGro is looking to expand its fleet to accommodate the demand.

The Negative

– Meagre rail earnings. We expect Singapore rail operations to be barely profitable. The rise in wages and electricity has impacted margins. We believe margin recovery will occur in FY24e from the lagged 7% rise in fares and slower rise in operating costs, especially electricity.

Source: Phillip Capital Research - 4 Mar 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

CSOP IEdge S-REIT Leaders Index ETF – The Deeper Discounted Singapore REIT ETF

Created by traderhub8 | Jun 12, 2024

Valuetronics Holdings Ltd- Get Paid as Customer Base Is Refreshed

Created by traderhub8 | Jun 03, 2024

Singapore Telecommunications Ltd – Down Under Is Turning Around

Created by traderhub8 | May 27, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments