CapitaLand Investment Limited – Targeting to Double FUM in 5 Years

traderhub8

Publish date: Mon, 04 Mar 2024, 11:17 AM

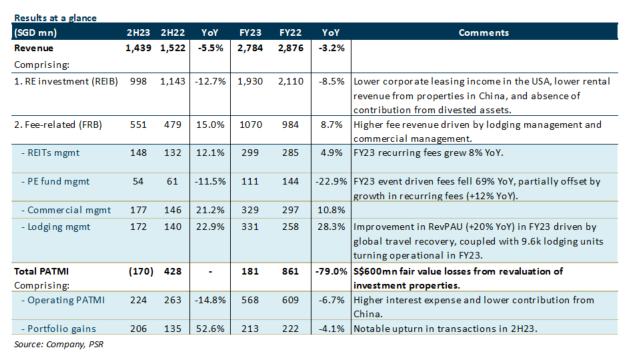

- FY23 revenue of S$2.784bn (-3.2% YoY) formed 92% of our FY23e forecast while PATMI of S$181mn (-79% YoY) was below our estimate due to revaluation losses of S$600mn and lower contribution from China.

- FY23 fee-related revenue (FRB) rose 8.7% YoY, driven by higher recurring fund management fees (+9% YoY), lodging management fees (+28% YoY), and commercial management fees (+11% YoY). However, this was offset by a significant decrease of 52% in event-driven fees. Including S$10bn of funds pending deployment, CLI has reached its FY24 FUM target of S$100bn and has now set a new target to reach S$200bn in five years.

- Maintain BUY with a lower SOTP TP of S$3.38 from S$3.68. We cut our FY24e PATMI by 15% after factoring in a weaker contribution from China. Our SOTP-derived TP of S$3.38 represents an upside of 29.2% and a forward P/E of 15x. We like CLI for its robust recurring fee income stream and asset-light model. We expect the FRB to continue to improve, boosted by the lodging business with higher RevPAU (FY23: +20%) and more lodging units turning operational.

The Positives

+ FY23 FRB revenue grew 8.7% YoY, boosted by lodging management fees (+28.3%), recurring fund management fees (+9.3%), and commercial management fees (+10.8%). This is partially offset by lower event-driven fees (-52% YoY) in a market that is less conducive to deal-making. Including S$10bn in committed equity pending deployment, CLI currently has S$100bn in FUM and is targeting to reach S$200bn in five years.

The Negative

– FY23 REIB revenue fell 8.5% YoY due to lower corporate leasing income in the USA and lower rental revenue from properties in China. Rental reversions in China remain negative across all operating segments.

– Significant fair value losses of S$600mn, which came mainly from China (-S$511mn) due to weaker rents and market outlook, as well as USA (-S$231mn) due to cap rate expansion. This is partially offset by gains in Singapore (+165mn) and India (+S$44mn).

Source: Phillip Capital Research - 4 Mar 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024

Created by traderhub8 | May 27, 2024