PRIME US REIT – No Breach, But Refinancing Risks Persist

traderhub8

Publish date: Mon, 26 Feb 2024, 11:16 AM

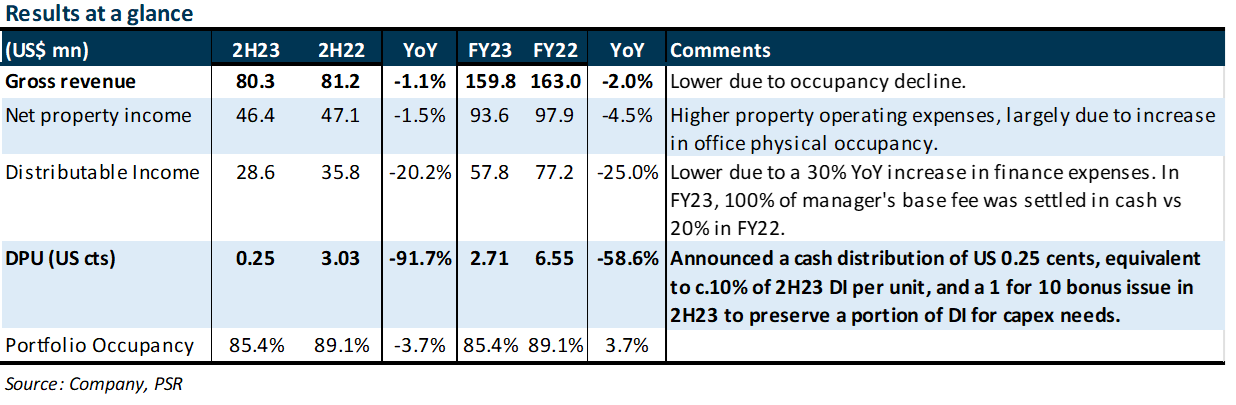

- FY23 DPU of 2.71 US cts (-58.6% YoY) was below our estimates due to Prime paying only 0.25 US cts in 2H23 (c.10% of 2H23 distribution) to preserve capital for capex needs. Assuming a 100% payout ratio, FY23 DPU of 4.86 US cts would have aligned with our FY23e forecast at 99%. Prime also announced a 1-for-10 bonus issue (c.43% of 2H23 DI), translating to a value of 1.03 US cts, based on a unit price of US$0.103.

- The YoY decline in FY23 distributable income (-25%) was due to Prime increasing management fees paid in cash from 20% to 100%, higher interest expense, and lower portfolio occupancy. Excluding the change in management fees paid in cash, distributable income is down 18.9% YoY. Portfolio valuations fell 8.7%, taking gearing to 48.4%, just under the MAS limit of 50%.

- Maintain BUY, DDM-TP lowered from US$0.37 to US$0.30 as we roll over our forecasts. FY24e DPU estimate lowered by 77% after factoring in the enlarged share base from the bonus issue, a lower portfolio occupancy, and a payout ratio of 25%. The key risk entails refinancing US$478mn (68% of total) debt under its main credit facility expiring in July 24, though management has expressed confidence in their ability to do so. Prime is now focusing on deleveraging and has set a target to execute US$100mn of deleveraging in 2024. Assuming a 25% payout ratio in FY24e, the current share price implies an FY24e DPU yield of 8%. Prime is currently trading at 0.22x P/NAV.

The Positive

+ Leasing activities picked up in 4Q23. Prime signed 304.1k sq ft of leases in 4Q23, more than the previous three quarters combined (9M23: 276.8k sq ft), at 9.6% positive rental reversion. Portfolio occupancy improved 0.4% QoQ to 85.4%, but it will dip in 2024 due to Sodexo (5.4% of income) vacating c.166k sq ft of space (c.3.8% of portfolio occupancy) at One Washingtonian Center (OWC). Management indicated strong leasing momentum at some of its properties, with notable leasing discussions underway at OWC and Park Tower, albeit with relatively longer lead times.

The Negatives

– Portfolio valuation fell US$134.3mn or 8.7% YoY, due to an average 54bps expansion in cap rates across the portfolio. The decline in valuation was lower than we anticipated. As a result, there was no breach in financial covenants as gearing increased to 48.4%, just under MAS limit of 50% if ICR is above 2.5x; Prime’s ICR is 3.1x. Prime is now working on deleveraging alternatives and is targeting up to US$100mn of deleveraging in 2024 to pare down gearing.

– Yet to refinance US$600mn in credit facilities (US$478 outstanding) due July 24. Management indicated they are actively discussing refinancing this loan with lenders, which constitutes 68% of Prime’s total debt. The cost of debt for the quarter was flat QoQ at 4%, with 79% of debt either on fixed rate or hedged, with 62% of debt hedged or fixed through to 2026 or beyond.

Outlook

Prime has not committed to future distributions going forward and will evaluate the situation dynamically, depending on capital requirements. Management continues to prioritize net effective rents with lower capex deals over headline rents in a challenging US office environment. In-place rents are c.6.5% below asking rents, and the potential for favourable rental reversions going forward remains promising. Prime US Reit has no exposure to WeWork, which filed for Chapter 11 bankruptcy.

Maintain BUY, DDM TP lowered from US$0.37 to US$0.30. FY24e DPU estimate lowered by 77% after factoring in the enlarged share base from the bonus issue, a lower portfolio occupancy, and a payout ratio of 25%. Assuming a 25% payout ratio, the current share price implies an FY24e DPU yield of 8%.

Source: Phillip Capital Research - 26 Feb 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024

Created by traderhub8 | May 27, 2024