Far East Hospitality Trust – Mega Events to Drive RevPAR Recovery

traderhub8

Publish date: Thu, 15 Feb 2024, 10:47 AM

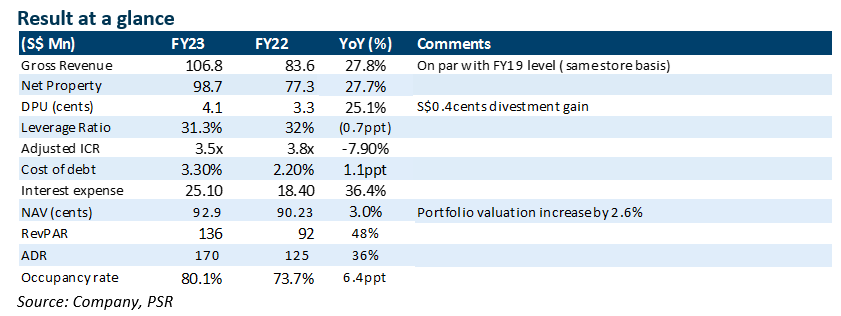

- Gross revenue for FY23 rose by 27.8% YoY to S$8mn on the back of a rebound of hotel revenue of 36%. It was within our expectations. ADR increased by 36.1% YoY to S$170 thanks to rising international visitor arrivals to 71% of pre-COVID level. Occupancy grew 6.3 pp YoY to 80.1%, leading to a 47.8% rise in RevPAR to S$136.

- DPU exceeded our expectation by 7%, surging to 4.09 cents (+25.1% YoY), supported by a higher NPI (+27.7% YoY) and S$8mn distribution of divestment gain of Central Square.

- We reiterate our BUY recommendation with an unchanged DDM-TP of S$0.79 and FY24e-25e DPU forecasts of S$4.35 to S$4.45 cents. As Chinese travelers return supported by 30-day visa-free policy, we expect revenue to rise, backed by the improving occupancy rate. ADR is expected to be maintained due to the line-up of MICE and mega concerts in FY24. FEHT is currently trading at FY24e dividend yields of 6.8% and 0.7x P/NAV

The Positives

+ Recovery on track. ADR exceeded pre-COVID levels, reaching S$170 for FY23, propelled by the recovery in flight capacity. However, RevPAR lags behind, standing at 95% of pre-COVID levels owing to a 9% gap in occupancy rates (FY19: 89.1% vs. FY23: 80.1%). We expect RevPAR to continue trending upward in FY24, with more support from Q2 onwards due to seasonality. Income from variable rental surged by more than six times, surpassing pre-COVID levels by 1% and contributing to 25% of gross revenue amidst the leisure recovery. We expect a decline in contributions from corporate travelers, potentially driving ADR higher in the absence of corporate discounts. Occupancy is forecast to ramp-up in FY24e, thanks to major events such as the Taylor Swift Eras Tour and Singapore Airshow in 2024; current forward bookings appear promising.

+ Potential inorganic growth. FEHT is one of the least geared SREITs with a leverage ratio of 31.3% and debt headroom of c.S$900mn (Gearing at 50%). However, they identify limited growth potential in Singapore due to the tight spread between funding cost and asset yield. There are no near-term plans for acquiring more stake in Sentosa since the ticket size is large and EFR is off the table. The focus remains on low-interest-rate countries such as Japan, with the possibility of acquiring sponsor’s assets in Tokyo and a positive carry of c.2.5%.

The Negative

– Interest rate creeping up. The cost of debt for FY23 was 3.3%, and FEHT expects the rate to increase to c.4% in FY24 when hedges drop off, as only 42.6% of the debt is hedged at a fixed rate.

Source: Phillip Capital Research - 15 Feb 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024

Created by traderhub8 | May 27, 2024