Keppel DC REIT – Uncollected Rents Impact DPU

traderhub8

Publish date: Fri, 09 Feb 2024, 10:43 AM

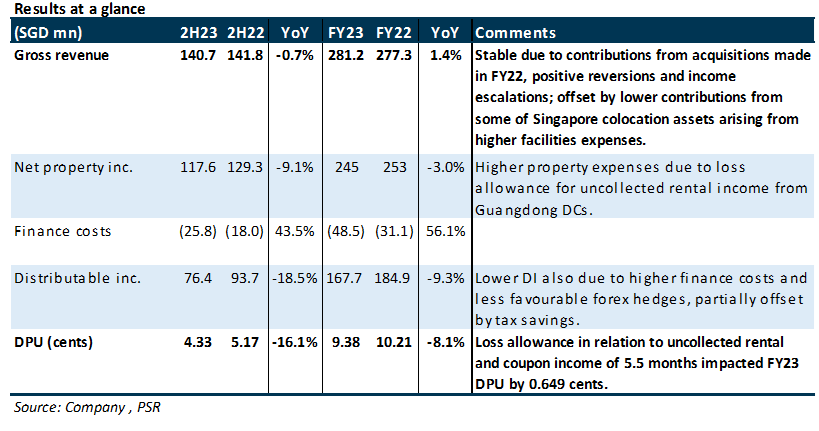

- FY23 DPU of 9.383 Singapore cents (-8.1% YoY) fell short of our expectations at 94.7% of our FY23e forecast, mainly due to the uncollected rental and coupon income of c.5.5 months amounting to S$10.5mn at the Guangdong DCs.

- To date, Guangdong Bluesea Data Development (Bluesea), the tenant at Guangdong Data Centre (GDC) 1, 2 & 3, has only settled RMB0.5mn of the RMB48.3mn in arrears. Therefore, we think that Bluesea will likely be unable to meet its rental obligations, and KDCREIT will have to eventually replace the tenant.

- Downgrade from BUY to ACCUMULATE with a lower DDM-derived target price of S$1.86 from S$2.26. FY24e, FY25e, and FY26e DPU estimates are cut by 14%, 11%, and 8%, respectively, after we factor in the default and eventual replacement of Bluesea. Organic growth will stem from renewals in FY24e (27.5% of leases expire in 2024); we expect portfolio rental reversions of c.4% for FY24e. Potential catalysts include accretive acquisitions and the collection of rental in arrears from Bluesea. The current share price implies FY24e/25e DPU yields of 5.4%/5.8%.

The Positives

+ Maintained high portfolio occupancy of 98.3% (unchanged QoQ), with a portfolio WALE of 7.6 years. 27.5% of leases by rental income will expire in 2024. Leases signed in FY23 were at positive rental reversions. Additionally, some of the leases signed were restructured into power pass-through leases, which should improve NPI margins.

+ Prudent capital management, with 74% of debt on a fixed rate. The average cost of debt increased 0.1ppts QoQ to 3.6% in 4Q23, and ICR remains healthy at 4.7x. Only 4% of debt is up for refinancing in 2024 with the majority of debt expiring from 2026 and beyond. Gearing increased 20bps QoQ to 37.4%, still below KDCREIT’s internal cap of 40%. Forecast foreign-sourced income is also substantially hedged till Dec 2024.

+ Stable portfolio valuations (+0.4% yoy), with no write-down for China assets yet. In local currency terms, higher valuations were achieved in Singapore, Australia, Ireland, Italy, and the Netherlands. KDCREIT has not written-down valuations for the China assets, but we see a risk of impairment should they be unable to recover the rental arrears.

+ Positive outcome for DXC litigation, as the high court ruled in favour of KDCREIT on its intepretation of contractual rights. KDCREIT is claiming S$3mn from DXC as the sum outstanding from Apr 21 to Dec 21, as well as loss suffered as a result of DXC’s refusal to pay for the space it unilaterally gave up from Apr 21 to Mar 25. The dispute is set for trial in February 24 to determine the actual quantum to be paid by DXC to KDCREIT.

The Negatives

– Rentals owed by master lessee at Guangdong DCs. To date, Bluesea has only settled RMB0.5mn of the RMB48.3mn in arrears, and that excludes the top-up of RMB32.2mn of security deposits that KDCREIT requested. We therefore expect further loss provisions in FY24e. Management is working with Bluesea on a recovery roadmap and is also reserving its rights to terminate the acquisition of GDC 3. There is currently a RMB100mn deposit on GDC 3.

Source: Phillip Capital Research - 9 Feb 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024