Lendlease Global Commercial REIT – High Rental Reversion and Rental Upside From Sky Complex

traderhub8

Publish date: Mon, 05 Feb 2024, 10:01 AM

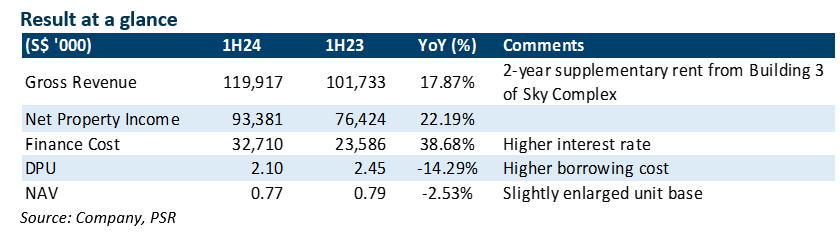

- Gross revenue increased by 17.9% to S$9mn with the 2-year supplementary rental from Building 3 of Sky Complex and form 55% of our FY24e forecast.

- NPI increased 22.2% YoY while DPU slid 14.5% YoY to 2.1 cents, and were 54%/52% of our FY24e estimates. High rental reversion was sustained with 313@somerset at c.20%, and Jem provided a stable contribution at c.10%.

- We reiterate our BUY recommendation with lower DDM-TP of S$0.83 and FY24e-25e DPU forecast of 4.16-4.59 Singapore cents. Erosion of DPU brought by higher-for-longer interest rates will still be apparent. We expect FY24e earnings will be supported by strong rental reversion.

The Positives

+ Resilient rental reversion of 15.7%, with 313@somerset contributing c.20%, and Jem delivering stable support of c.10%. Due to the lingering effects of COVID-19 base rents, we expect a rental reversion in the high teens for 313@somerset and in the low teens for Jem in 2025, as 20.3% of the lease by GRI is set to expire.

+ Stable operating metrics. Tenant sales continue to trend above pre-COVID levels and increased 0.6% YoY in 1H24. F&B, entertainment, and necessities outperformed. Despite lower contributions from GTO, we expect sales to benefit the top line with the influx of Chinese tourists, facilitated by the 30-day visa-free policy.

The Negative

– Borrowing cost inched up. There was no indication of a near-term reversal in the interest rate trajectory. LREIT having hedged 61% of its borrowings, will not experience much benefit from a potential interest rate cut in the future. With the implementation of the new rate, the expected interest rate for FY24e is c.3.5% (1H24: 3.37%).

Source: Phillip Capital Research - 5 Feb 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024

Created by traderhub8 | May 27, 2024