ComfortDelGro Corp Ltd – Recovery Building Momentum From Repricing

traderhub8

Publish date: Thu, 17 Aug 2023, 11:33 AM

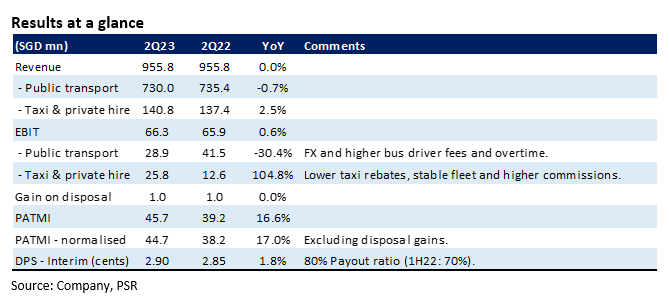

- 2Q23 results were within expectations. 1H23 revenue and PATMI were 45% and 47% of our FY23e forecast. PATMI grew 17% YoY to S$45mn as taxi earnings doubled.

- Public transport remains a drag on earnings from weaker foreign exchange and higher bus driver costs in the UK. We expect a strong rebound in earnings as bus contracts service fees in the UK are repriced higher from inflation indexing and more rational pricing.

- No changes to our FY23e forecast but we raised our FY23e DPS to 6.08 cents (prev. 5.3 cents), as the company increased their minimum payout ratio from 50% to 70%. Our BUY recommendation and DCF target price of S$1.57 is unchanged. The largest driver to earnings in 2H23 will be the repricing of services in the key public transport and taxi operations. We believe the key earnings driver in 2H23 include higher bus service fees in the UK, increased hiring of Australian bus drivers, the introduction of taxi platform fees in Singapore and lower taxi rental rebates in Singapore and China.

The Positives

+ Taxi profits doubled. 2Q23 margins improved with higher booking volumes, additional booking commissions, lower rebates in Singapore (15% to 10% from Apr23) and reduced taxi rebates and costs in China. Another driver to earnings has been a stable taxi fleet in Singapore. Comfort’s taxi fleet grew 0.8% YoY to 8,782, after several years of decline.

+ Cash piling up and returning to shareholders. Comfort continues to generate healthy free-cash-flows (FCF). 1H23 FCF was S$86.4mn (1H22: S$88.5mn), pilling up the net cash to S$565mn. Capital expenditure is now trending at S$350mn p.a. compared to pre-pandemic S$450-500mn. Comfort has raised its minimum dividend payout ratio from 50% to 70%. We estimate S$131mn of dividends to be paid out this year.

The Negative

– Lethargic in margins for public transport. Public transport operating margin has been the weakest spot for Comfort. 2Q23 margins was 4%, an improvement over 3.4% in 1Q23 but far below pre-pandemic 8%. Bus operations across the UK, Australia and Singapore are depressing margins. The worst hit is the UK which reported an operating loss of S$0.5mn. A combination of irrational tendering activity and a spike in bus driver fees has negatively impacted margins. Australia is suffering from higher overtime salaries and other “running time” charges due to the lack of bus drivers.

Source: Phillip Capital Research - 17 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024

Created by traderhub8 | May 27, 2024