Pan-United Corporation Ltd – Volume Catches Up; Surprise Margin Improvement

traderhub8

Publish date: Mon, 14 Aug 2023, 11:28 AM

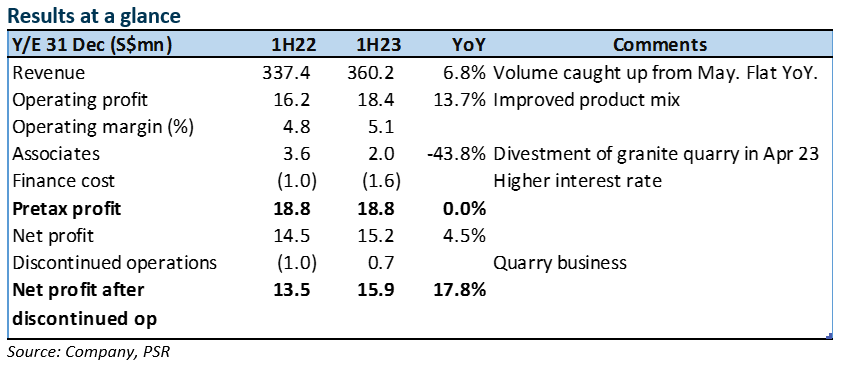

- 1H23 earnings beat our expectations, at 63% of FY23e, due to widening gross margins to 21.3% (+1.6% pt YoY) on improved product mix. Construction activities picked up from May, and PanU’s volume in 1H23 caught up to level that of 1H22.

- The company expects volume to rise in 2H23, with buoyant demand from public and private housing developments and infrastructure projects. We think the higher gross margin is sustainable, due to: 1) a higher mix of products which offer low-carbon solutions to the customers; and 2) higher fees from batching services offer to HDB construction work. Credit risks have risen with some construction companies facing distress. However, the impact on PanU is manageable as it supports mainly government projects.

- We raised our FY23e net earnings estimates by 36% to account for the higher margin. Maintain BUY with unchanged TP of S$0.50. The business generates strong operating cash flow, underpinning a dividend yield of 5%.

The Positives

+ Volume picked up from May despite the lull in the first four months, with the clampdown on construction work for safety checks. 1H23 volume was flat YoY.

+ Gross margin rose 1.6ppt to 21.3%. We think the improvement was derived from a better product mix as it sold more differentiated products such as those which offer low-carbon solutions, and higher fee income from batching services.

+ Net cash increased to S$18mn (Dec 22: S$10mn). Cash generation remains strong, with free cash flow of S$0.03/share. Receivable days have risen to 85 days (Dec22: 72 days) mainly due to the higher volume ramp-up at quarter end. While credit risk of the construction industry has risen, we think the impact on PanU is small as it supplies mainly to infrastructure projects.

The Negative

– Malaysia and Vietnam markets remained weak.

Source: Phillip Capital Research - 14 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024

Created by traderhub8 | May 27, 2024