BRC Asia – 3Q23 in Line, Construction Progress Still Muted

traderhub8

Publish date: Thu, 10 Aug 2023, 11:20 AM

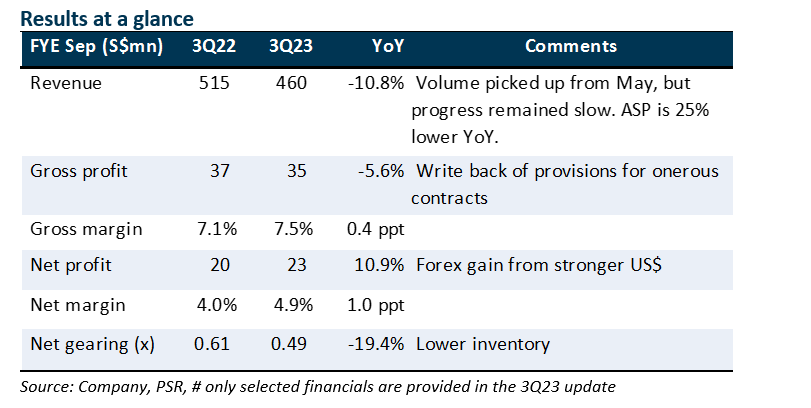

- 3Q23 net profit was in line. The marginal 10.9% gain was driven by forex gain from a stronger US dollar, and writeback in provisions for onerous contracts with a fall in steel price (about -25% YTD). Volume remains below pre-COVID though safety controls at worksites were lifted in May.

- Demand remains robust, though construction progress is still inhibited by shortage of manpower and new enforcement measures by the authorities. BRC’s orderbook is S$1.34bn at end June.

- Maintain BUY with unchanged target price of $1.99.

The Positives

+ Volume and construction activities picked up from May (>2x higher MoM), though they are still below pre-COVID levels. Construction progress is hampered by the shortage of dormitory beds, workers and step-up in safety enforcement on worksites and construction personnel. Demand, however, remains robust, underpinned by public housing, record government land sales for private housing, and infrastructure projects. BRC has an orders on hand of S$1.34bn.

+ BRC is largely insulated from potential bad debts through credit insurance. Some construction companies are facing financial stress due to lower-margin legacy projects, project delays and rising costs. For BRC, the impact is non-delivery/cancellation of outstanding orders, but there is no collection risk for jobs that have been delivered.

The Negative

– Net margin remains low at 4.9%. We think margins might not return to FY22’s 5.3% due to higher share of trading business which are lower-margin, and large-scale infrastructure projects.

Source: Phillip Capital Research - 10 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024

Created by traderhub8 | May 27, 2024