Alibaba Health Information Technology Limited - What You Need to Know about This HK-Listed Company

ljunyuan

Publish date: Wed, 28 Dec 2022, 09:47 AM

While many are familiar with the business operations of Alibaba Group Holdings (if not, you can check out a review post I have done about this HK- and US-listed company on Instagram here), but the same cannot be said for the Hong Kong-listed Alibaba Health Information Technology Limited (SEHK:0241), or Alibaba Health for short.

Prior to Alibaba Group Holdings’ acquisition of a major ownership in the company in 2015, it was known as CITIC 21 CN Company Limited. As the name “Alibaba Health” implies, it is in the healthcare business where it offers a range of pharmaceutical and over-the-counter (or OTC for short) drugs, nutritional supplements, medical devices, contact lenses, along with other health-related products through its online shopping site Tmall, and offline pharmacy outlets to individual and corporate customers in China and Hong Kong. On top of that, the company also provides medical and healthcare services, including medical checkups, neuleic acid testing, medical consultation, registration, vaccination, and traditional Chinese medicine (or TCM for short) through various channels.

In the rest of today’s post, you’ll learn more about the HK-listed company – particularly how it generates its revenue, its financial performance and debt profile over the last 5 financial years (between FY2017/18 and FY2021/22; the company has a financial year ending every 31 March), along with its performance for the first half of the current financial year compared against the same time period last year.

Let’s begin:

How Alibaba Health Generates its Revenue

Alibaba Health reports its revenue in 3 business segments, along with its percentage contribution for the latest full year under review (i.e. FY2021/22):

i. Pharmaceutical Direct Sales Business – This business segment deals with the sale of pharmaceutical and healthcare products to individual and merchant customers through its online stores on Tmall and its offline pharmacy outlets. This is on top of fees generated from pharmaceutical brands placing ads on the company’s various online platform and mobile apps. In FY2021/22, this business segment contributed 87% towards the company’s total revenue;

ii. Pharmaceutical E-commerce Platform Business – This business segment includes the provision of business development for merchants, customer services on behalf of merchants, marketing event planning for merchants, along with technical support and assistance to Tmall Entities’ business team. On top of that, this business segment is also involved in providing to the merchants on Tmall’s e-commerce platform maintenance related software services in respect of merchant admission, product quality control, and maintenance support in return for a 3% commission from merchants based on the transaction amounts of the merchandises being sold on Tmall by them. In FY2021/22, this business segment contributed 10% towards the company’s total revenue;

iii. Healthcare & Digital Services Business – This business segment encompasses the selling of health checkups, genetic testing and vaccine inoculation to individual and corporate customers. In FY2021/22, this business segment contributed the remaining 3% towards the company’s total revenue.

Alibaba Health’s Financial Performances between FY2017/18 and FY2021/22

In this section, let us take a look at the healthcare company’s financial performance over the last 5 financial years – between FY2017/18 and FY2021/22:

Total Revenue & Gross Profit Margin:

| FY 2017/18 | FY 2018/19 | FY 2019/20 | FY 2020/21 | FY 2021/22 | |

| Total Revenue (HKD’mil) | HKD 2,443m | HKD 5,096m | HKD 9,596m | HKD 15,518m | HKD 20,578m |

| Net Profit Attributable to Unitholders (HKD’mil) | HKD -107m | HKD -82m | HKD -7m | HKD +349m | HKD -266m |

My Observations: Alibaba Health’s total revenue saw year-on-year (y-o-y) increment every single year, and over a 5-year period, it saw a compound annual growth rate of an impressive 53.1%.

However, do take note that the company is in a net loss position in 4 out of 5 years (with the only financial year the company being in a net profit position in FY2020/21.)

The reason why the company fell into a net loss position once again in FY2021/22, after reversing into a net profit position the year before, was due to an increase in fulfilment expenses (due to growth in revenue of pharmaceutical direct sales business), sales marketing expenses (due to group’s increasing investment in building the brand awareness of Tmall’s Pharmaceutical Platform and Alibaba Health Pharmacy, increase in deployment of corresponding market resources to increase its market share of online B2C drug sales, and accelerate business deployment of prescription drug business, as well as increase in headcount of its sales and operation functions), administrative expenses (mainly attributable to business growth which led to an increase in relevant management personnel costs, back-end supporting costs, shared service costs, and professional costs), product development expenses (due to the Group’s continuous investment in the personnel of the company’s research and development function), share of losses of associates (attributable to the delayed progress of projects of certain associates of the Group providing services to hospitals due to impact of Covid-19.)

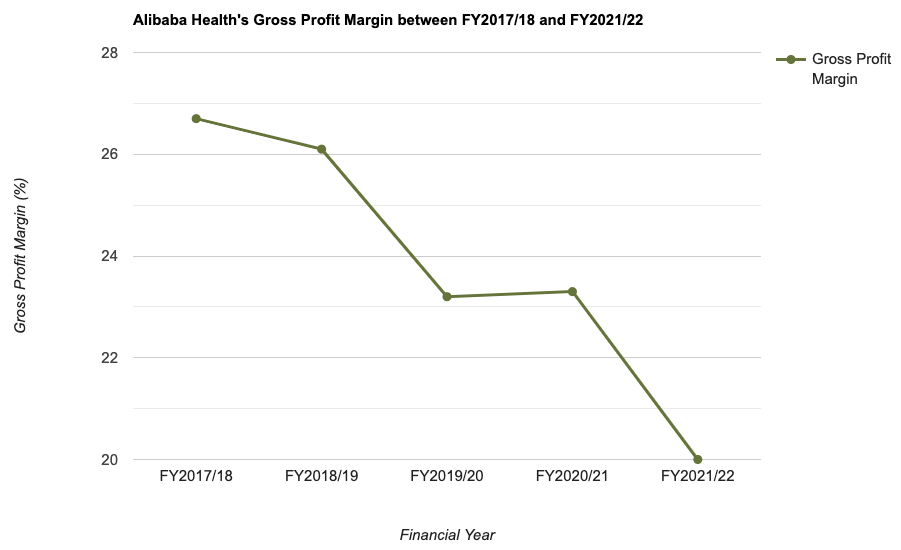

Gross Profit Margin:

| FY 2017/18 | FY 2018/19 | FY 2019/20 | FY 2020/21 | FY 2021/22 | |

| Gross Profit Margin (%) | 26.7% | 26.1% | 23.2% | 23.3% | 20.0% |

My Observations: As you can see from the chart above, Alibaba Health’s gross profit margin have been on a downward decline over the years.

The reason why I did not share statistics of the company’s net profit margin is because it is in a net loss position in 4 out of 5 years.

Alibaba Health’s Debt Profile between FY2017/18 and FY2021/22

Apart from its financial performances, another aspect I will look at when I study a company’s historical performances is its debt profile – where my preference is towards those with minimal or no debt, along with one that is in a net cash position.

Did Alibaba Health’s debt profile over the last 5 years fulfil this requirement of mine? Let us take a look at it below:

| FY 2017/18 | FY 2018/19 | FY 2019/20 | FY 2020/21 | FY 2021/22 | |

| Cash & Cash Equivalents (HKD’mil) | HKD 508m | HKD 280m | HKD 2,595m | HKD 7,252m | HKD 9,341m |

| Total Borrowings (HKD’mil) | – | HKD 1,700m | – | – | – |

| Net Cash/ Debt (HKD’mil) | HKD +508m | HKD -1,420m | HKD +2,595m | HKD +7,252m | HKD +9,341m |

My Observations: Apart from in FY2018/19, the company have no borrowings (which is good to note), and the company is also in a net cash position in 4 out of 5 years (the only year it fell into a net debt position was in FY2018/19.)

Another thing to note is the company’s net cash position have been on a rise since FY2019/20.

Comparison of Alibaba Health’s Performance between 1H FY2021/22 and 1H FY2022/23

The following table is a comparison of Alibaba Health’s performance recorded in the first half of the current financial year 2022/23, against that recorded in the same period last year:

| 1H FY2021/22 | 1H FY2022/23 | % Variance | |

| Total Revenue (HKD’mil) | HKD 9,358m | HKD 11,501m | +22.9% |

| Net Profit Attributable to Shareholders (HKD’mil) | HKD -232m | HKD +161m | N.M. |

| Gross Profit Margin (%) | 20.0% | 20.0% | – |

| Cash & Cash Equivalent (HKD’mil) | HKD 9,046m | HKD 9,403m | +3.9% |

| Total Borrowings (HKD’mil) | – | – | – |

| Net Cash/ Debt (HKD’mil) | HKD +9,046m | HKD +9.403m | +3.9% |

My Observations: Compared to last year, it is a much better one for Alibaba Health on many counts – a 22.9% increase in its total revenue, company reversing into a net profit position once again (which can be attributed to the rapid growth of the Pharmaceutical Direct Sales business, along with its Healthcare and Digital Services business), along with its net cash position further improving.

Closing Thoughts

Just like all the company reviews I have done in the past, Alibaba Health also have its fair share of plus and minus points:

The plus points include the steady growth in its total revenue over the years, along with it being in a net cash position in 4 out of the 5 years I have looked at (on top of that, its net cash position have been on a upward climb since FY2019/20.)

On the other hand, the minus points include the company’s gross profit on a downward decline over the years, along with the fact that it is in a net loss position in 4 out of 5 years I have looked at.

Finally, as far as its results for the first half of the current financial year 2022/23 is concerned, it is much improved – and personally, I’m encouraged by that.

With that, I have come to the end of my review of Alibaba Health’s historical as well as current year performance. As always, do note that the contents above, particularly the opinions, are purely mine which I am sharing for educational purposes only. This post does not represent any buy or sell calls for the company’s shares. Please do your own due diligence before you make any investment decisions.

Disclaimer: At the time of writing, I am not a shareholder of Alibaba Health Information Technology Limited.

More articles on THE SINGAPOREAN INVESTOR

Created by ljunyuan | Aug 12, 2024