Is Li Ning Company Limited (SEHK:2331) a Buy?

ljunyuan

Publish date: Mon, 05 Dec 2022, 11:37 AM

When it comes to shortlisting for companies to invest, one of the very first things I look out for is whether or not its business is simple to understand – in that regard, Hong Kong-listed Li Ning Company Limited (SEHK:2331) is – if you are the “sporty” type of person, you have probably come across the company’s brand of products in the retail stores, or online.

In fact, Li Ning is one of the leading sports brand companies in China, where they retail footwear, apparel, equipment, and accessories (with their focus on running, badminton, along with leisure wear) under their namesake brand. On top of that, they also retail other sports products which are self-owned by or licensed by the Group, including Double Happiness (which retails table tennis products), AIGLE (outdoor sports), Danskin (fashionable fitness products for dance and yoga), as well as Kason (badminton) – to me, it passes my investment criteria as the company has a simple to understand business.

Next, I’ll study whether or not the company is worthy of a place in my “shopping list” by studying its historical financial performance, debt profile, and dividend payout – in this post, you’ll find my review of the company’s historical performance between FY2017 and FY2021 (a period of 5-years; it has a financial year ending every 31 December), whether or not at its current traded price, it is considered to be ‘cheap’ or ‘expensive’ based on its current vs. its historical valuations, and finally, my thoughts about it.

Let’s begin…

Financial Performance (between FY2017 & FY2021)

In this section, let us take a look at its historical financial performance in terms of its total revenue and net profit attributable to its shareholders, gross and net profit margin, as well as its return on equity:

Total Revenue & Net Profit Attributable to Shareholders (RMB’mil):

| FY2017 | FY2018 | FY2019 | FY2020 | FY2021 | |

| Total Revenue (RMB’mil) | RMB 8,874m | RMB 10,511m | RMB 13,870m | RMB 14,457m | RMB 25,572m |

| Net Profit Attributable to Shareholders (RMB’mil) | RMB 515m | RMB 715m | RMB 1,499m | RMB 1,698m | RMB 4,011m |

Over the last 5 years, both its top- as well as bottom-line saw year-on-year (y-o-y) improvements every single year.

In terms of their compound annual growth rate (CAGR), in my opinion, it has been impressive as well, with its total revenue growing at a CAGR of 23.6%, and its net profit attributable to shareholders growing at a CAGR of 50.8%.

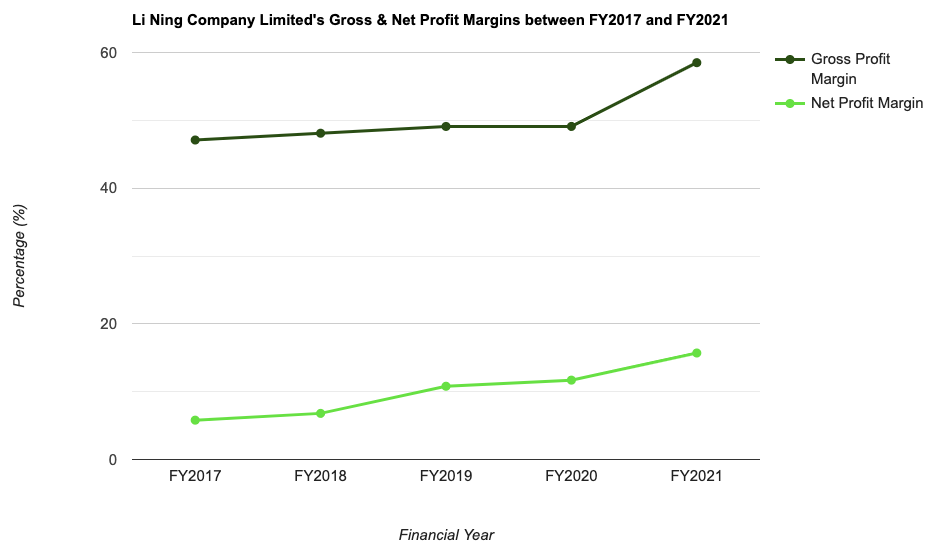

Gross & Net Profit Margins (%):

The following table is Li Ning’s gross and net profit margins over the last 5 years I’ve computed:

| FY2017 | FY2018 | FY2019 | FY2020 | FY2021 | |

| Gross Profit Margin (%) | 47.1% | 48.1% | 49.1% | 49.1% | 58.5% |

| Net Profit Margin (%) | 5.8% | 6.8% | 10.8% | 11.7% | 15.7% |

The company’s gross and net profit margins over the years have also been on a steady rise as well, which is good to note.

Return on Equity (%):

In layman terms, Return on Equity, or RoE for short, is the amount of profits (in percentage terms) the company is able to able to generate for every dollar of shareholders’ money it uses in its business. Personally, my preference is towards companies that are able to generate an RoE of 15.0% and above.

Here’s Li Ning Company Limited’s RoE I have computed over the last 5 years:

| FY2017 | FY2018 | FY2019 | FY2020 | FY2021 | |

| Return on Equity (%) | 10.2% | 12.3% | 21.0% | 19.5% | 19.0% |

Since peaking at 21.0% in FY2019, it has declined in the years thereafter – however, at 19.0% in FY2021, it is still very good (in my opinion.)

Debt Profile (between FY2017 and FY2021)

Especially in the current rising interest rate environment, companies with increasing amount of borrowings could see their net profit being impacted from higher financing costs. Hence, it becomes all the more important that we invest in companies with minimal or no debt (of course the latter is preferred), as their bottom-lines is less likely to be impacted by the current high interest rate environment (which I foresee it to remain that way in the next 1-2 years.)

In that regard, does Li Ning’s debt profile fulfil this investment criteria of mine? Let us find out in the table below:

| FY2017 | FY2018 | FY2019 | FY2020 | FY2021 | |

| Cash & Cash Equivalent (RMB’mil) | RMB 2,529m | RMB 3,672m | RMB 5,961m | RMB 7,187m | RMB 14,745m |

| Total Borrowings (RMB’mil) | – | – | – | – | – |

| Net Cash/ Debt (RMB’mil) | RMB +2,529m | RMB +3,672m | RMB +5,961m | RMB +7,187m | RMB +14,745m |

One thing I like about Li Ning is that, not only does it have any borrowings, but its net cash position over the years is also on the rise.

Dividend Payout to Shareholders (between FY2017 & FY2021)

Since FY2018, the management of Li Ning have been declaring a dividend payout to its shareholders on an annual basis – with its ex-date around mid-June and payout around end-June.

The following table is Li Ning’s dividend payout between FY2017 and FY2021, along with its payout ratio:

| FY2017 | FY2018 | FY2019 | FY2020 | FY2021 | |

| Dividend Per Share (HKD/share) | – | HKD 0.10 | HKD 0.18 | HKD 0.23 | HKD 0.53 |

| Dividend Payout Ratio (%) | – | 30.3% | 25.3% | 27.9% | 27.3% |

Between FY2018 and FY2021 (a period of 4 financial years), the company’s dividend payout have grown at a CAGR of 51.7% – which in my opinion is very impressive.

Dividend payout ratio-wise, it seems that the company is keeping a huge percentage of its profits (about 70.0%) for its businesses – in terms of whether or not the company is able to increase its dividend payouts, I’m of the opinion that if its bottom-line continues to improve, then its dividend payout should increase in-line.

Is the Current Traded Price of Li Ning Considered ‘Cheap’ or ‘Expensive’?

At the time of writing, Li Ning is trading at HKD64.45, and based on this price point, its current valuations, compared against its 5-year average is as follows:

| Current | 5-Year Average | |

| P/E Ratio | 32.7 | 38.3 |

| P/B Ratio | 6.5 | 6.6 |

| Dividend Yield (%) | 0.8% ** | 0.6% |

Comparing the current vs. the 5-year average valuations, Li Ning is considered to be trading at a discount – due to its current P/E and P/B ratios being lower than its average, and its current dividend yield higher than its average.

Closing Thoughts

A steady rise in Li Ning’s financial performance (particularly its total revenue and net profit attributable to shareholders, along with its gross and net profit margin), along with the company being in a improving net cash position, and rising dividend payout over the last 5 years I have looked at, are reasons why the Hong Kong-listed company caught my investing eye.

If there is a slight negative to note about the company’s historical performance, it will be its RoE, which have went down slightly after peaking in FY2019.

Finally, when it comes to investing in Hong Kong-listed companies, do take note that different companies have different lot sizes – for Li Ning, the minimum lot size is 500 (meaning you have to buy shares in multiples of 500); at its current traded price of HKD64.45, your minimum investment for the company will be about HKD32,225 (which is about S$5,583.62 based on the exchange rate of HKD1.00 to S$0.17 at the time of writing of this post. Also, the price is excluding brokerage fees.

With that, I have come to the end of my review of Li Ning Company Limited. As always, I do hope you’ve found the contents above useful. Do note that all the opinions above are solely mine which I’m sharing for educational purposes only. They do not represent any buy or sell calls for the company’s shares. You should always do your own due diligence before making any investment decisions.

Disclaimer: At the time of writing, I am not a shareholder of Li Ning Company Limited.

More articles on THE SINGAPOREAN INVESTOR

Created by ljunyuan | Aug 12, 2024