8 Things to Note about the New UOBAM Ping An ChiNext ETF

ljunyuan

Publish date: Mon, 31 Oct 2022, 10:29 AM

Disclaimer: This article is written in partnership with UOB Asset Management (UOBAM), where The Singaporean Investor has received a small amount of money for the contents within.

Headwinds faced by China of late, including their insistence on ‘Zero Covid’, issues surrounding the Chinese properties, crackdown on the technology companies, and most importantly, deterioration of relations between them and the United States have seen the Chinese stock market falling into a bear market (a market is considered to be in a ‘bear market’ if it falls by more than 20% from its high.)

Despite of that, we cannot ignore the fact that the country is still the ‘second largest economy in the world’, Additionally, there are long-term structural opportunities in China given the current macro situation and the new Chinese government economic policies. Hence, I have every confidence that the Chinese economy will eventually recover in time to come (I’m sure many of you share the same thoughts as well), and so too will their stock market (not only that, chances are high that they will also form new highs.)

So, for those of you who are looking to diversify your investment portfolio to invest in the Chinese market, and at the same time, not well-versed in Chinese to study the annual reports of individual companies, the new UOBAM Ping An ChiNext ETF is one you can consider. This is the first ETF to be launched under the Memorandum of Understanding (MOU) which the Singapore Exchange (SGX) and the Shenzhen Stock Exchange (also referred to 'SZSE' in short) signed in December 2021 which allows Singaporean and Chinese investors to access feeder ETFs listed locally on each other's exchanges, and you can read more about it here.

As the name ‘ChiNext’ suggests, this ETF mirrors the performance of the ChiNext Index (before fees, costs, and expenses – including any taxes and withholding taxes) – the benchmark and flagship index of the ChiNext market. The index comprises 100 of the largest and most liquid A-shares listed on the ChiNext market of Shenzhen Stock Exchange (also referred to as ‘SZSE’ in short.)

In this post, you’ll find 8 things to note about the Chinese ETF:

1. The Role of ‘Ping An’ in UOBAM Ping An ChiNext ETF

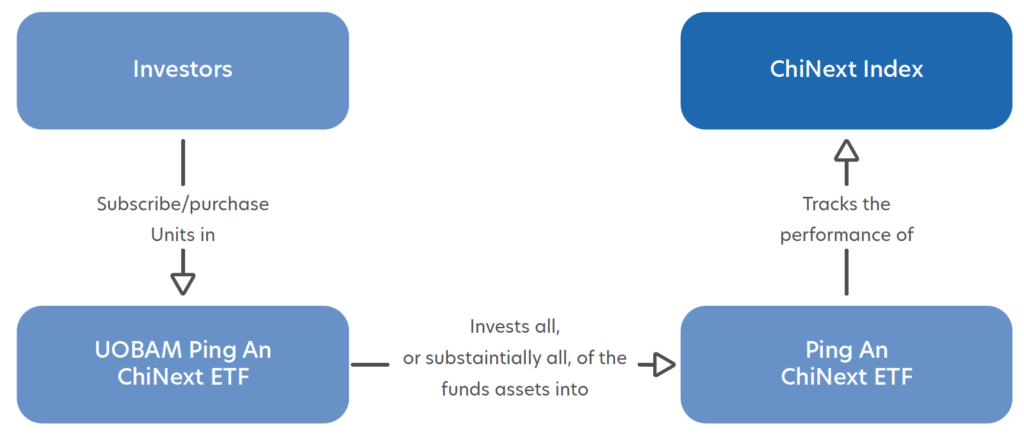

Some of you may be wondering why ‘Ping An’ is in the picture – the reason is because, when you subscribe/purchase units in this ETF, the Fund Manager will invest all (or substantially all) of the funds assets into the Ping An ChiNext ETF (listed on the Shenzhen Stock Exchange, and managed by Ping An Fund Management Company Limited) – which tracks the performance of the ChiNext Index.

The relationship can be found in the image below:

For those of you who may be wondering about the credibility of Ping An Fund Management Company Limited, the company, it has more than 11 years of fund and asset management service experience (since its establishment in 2011), with over RMB800bn of assets under management currently (which is about S$158bn in Singapore dollar terms, based on the exchange rate on 14 October 2022.)

2. Key Benefits of Investing in the UOBAM Ping An ChiNext ETF

The following are some of the key benefits of investing in this new Chinese ETF:

i. Diversification: By investing in the ETF, you will be investing in 100 of the top companies listed on the ChiNext market – just like when you invest in Singapore’s benchmark Straits Times Index, where immediately, you will be an investor of 30 of the top companies (by market capitalisation) in the Singapore market.

ii. Instant Access to the ChiNext Market: With the UOBAM Ping An ChiNext ETF, you can get instant access to the ChiNext Market, which is less accessible to foreign retail investors.

iii. Potential Capital Appreciation Opportunities: The Index has a heavy weightage on companies with business activities in growing industries (such as production of batteries for electric vehicles, along with equipment in the renewable energy sector) – in the years to come, demand for products by these companies is only going to increase (as more and more countries are pushing for the use of electric vehicles, along with using renewable energy), leading to further growth in the companies’ financial performance and hence, an rise in their share prices – this will result in the ETF’s share price going up as well, allowing you to enjoy capital appreciation for your investment.

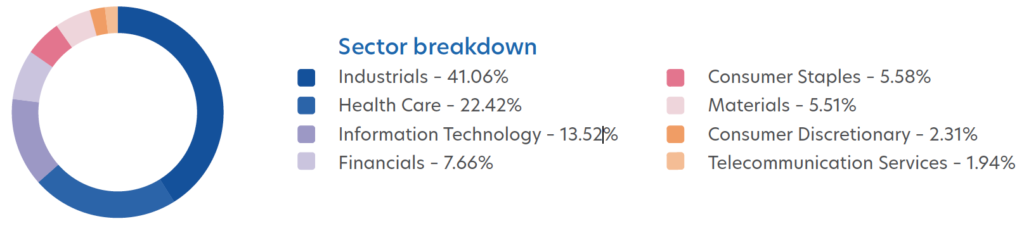

3. Sector Breakdown of Companies in the ChiNext Index

The following are sectors of the companies in the ChiNext Index (as at 14 September 2022):

As you can see, 2 industries – in industrials [where companies comprises of ion-lithium battery manufacturers for electric vehicles, and renewable energy equipment manufacturer – both of them very much up and coming industries], and healthcare technologies [where companies comprises of those manufacturing life support systems, ultrasound machines, and Covid-19 vaccines – all of them in defensive businesses that will do well regardless of the economic condition] comprises 63.48% of the whole ChiNext Index.

Another thing to note is that 4 out of the top 10 index constituents are companies in the industrials sector, and another 4 are in the healthcare sector, which we will have a more in-depth look at in my next pointer.

4. Top 10 Index Constituents

The following are the top 10 index constituents, where you’ll find their weightage (in percentage terms) in the index, sector they are in (information correct as at 14 September 2022), along with a brief introduction about the company (so that you know what it does):

1. Contemporary Amperex Technology Co. Ltd (17.05% Weightage, under Industrials Sector)

Commonly known as CATL, the company is the biggest lithium battery manufacturer in the world and controls 50% of the market share in this sector (Source: Fitch Ratings, August 2022.) Some of the clients and partnership include Tesla, Mercedes Benz, BMW, Volkswagen, Toyota, Honda, and Hyundai.

2. East Money Information Co. Ltd. (7.40% Weightage, under Financials Sector)

Founded in 2004, and formerly known as Shanghai Dong Can Information Technology Co. Ltd, it is a China-based company that provides paid financial data services, financial e-commerce services, and Internet advertisement services through its website EastMoney.com.

3. Shenzhen Mindray Bio-Medical Electronics (4.28% Weightage, under Healthcare Sector)

The company is a global medical instrumentation developer, manufacturer, and marketer which designs and produces medical equipment and accessories for both human and veterinary use. Its products can be found in healthcare facilities in over 190 countries and regions.

4. Sungrow Power Supply Co. Ltd. (3.74% Weightage, under Industrials Sector)

A leader in innovation in the solar industry with a strong 25-year track record in the PV (an abbreviation for Photovoltaic System, which is composed of one or more solar panels combined with an inverter and other electrical and mechanical hardware that uses energy from the sun to generate electricity) system, the company’s broad range of products (for both residential and commercial) is used in over 150 countries worldwide.

5. Eve Energy Co. Ltd. (3.64% Weightage, under Industrials Sector)

A global lithium battery company in the business of developing, manufacturing, and distributing battery products, including lithium primary batteries, lithium ion batteries, and electronic cigarettes. Of note, the company is nominated as the supplier of BMW Group in 2022.

6. Wens Foodstuffs Group Co. Ltd. (3.45% Weightage, under Consumer Staples Sector)

Established since 1993 and based in Guangdong, China, the company in the business of breeding and distribution of meat products, including that of chicken, duck, swines, and other related products. It also manufactures and markets cooked and frozen meat.

7. Shenzhen Inovance Technology Co. Ltd. (3.41% Weightage, under Industrials Sector)

The company is a leading provider of industrial automation solutions, where they deliver complete solutions for the following sectors: Elevators and escalators (its business unit, Monarch, is one of the world’s largest suppliers of elevator and escalator control solutions), plastic injection machinery, textile machinery, air compressors, cranes and hoists, printing and packaging, robotics, electric vehicles, and light rail transit. In 2019, it was one of the 23 companies to be selected for the Best Managed Companies (China) award from Deloitte.

8. Aier Eye Hospital Group Co. Ltd. (2.80% Weightage, under Healthcare Sector)

As the name suggests, the company operates eye hospitals that offer medical services for the various eye conditions including refractive correction, glaucoma, corneal diseases, and cataract. Apart from China (where they are the largest eye hospital chain), their eye hospitals are also located in Europe, the United States, and Southeast Asia. To add, in 2019, the company have also offered to acquire 35% of Singapore-listed ISEC Healthcare for S$67.1m.

9. Chongqing Zhifei-Biological Products Co. Ltd. (2.14% Weightage, under Healthcare Sector)

Known as ‘Zhifei’ for short, the company is the first privately-run vaccine enterprise listed on ChiNext. Its business is in the area of production of vaccines for prevention and control of infectious diseases – such as in the prevention of Covid-19, tuberculosis, rotavirus gastroenteritis in infants, and diseases caused by HPV (including cervical cancer.)

10. Walvax Biotechnology Co. Ltd. (2.10% Weightage, under Healthcare Sector)

A leading vaccine producer engaged in the research and development, along with the manufacturing and distribution of safe and efficacious quality vaccines. Currently, it has successfully developed 9 licensed vaccines, including SARS-CoV-2 mRNA Vaccine, 13-valent Pneumococcal Polysaccharide Conjugate Vaccine (PCV13) and Recombinant Human Papillomavirus Bivalent (Types 16,18) Vaccine (HPV2).

In total, these 10 companies above have a total of 50.01% weightage on the ChiNext Index – as such, any movements (positive or negative) in these companies will have a certain level of influence in how the Index moves.

5. Launch of the UOBAM Ping An ChiNext ETF

The IOP (Initial Offering Period) period for the ETF will be between 21 October 2022 (Friday) and 07 November 2022 (Monday) – both dates inclusive. If you are interested in investing in the ETF (whether using cash, and/or through the Supplementary Retirement Scheme), you can do so just like you subscribe for shares of newly listed companies, which you can do so via platforms of the participating banks, including UOB ATMs, along with its internet banking platform and TMRW app, DBS ATMs, along with its internet banking platform and mobile app, OCBC ATMs, along with its internet banking platform (where the period of subscription is between 21 October 2022, at 9.00am and 03 November 2022, at 12.00pm.) Participating dealers include CGS-CIMB Securities, DBS Vickers Securities, iFast Financial, MooMoo SG, Phillip Securities, and Tiger Brokers (if you are subscribing to the IOP via these platforms, please check with them on their subscription closing dates.)

Each unit of the ETF is priced at S$1 (with the ticker symbol being SGX:CXS)

The ETF will be listed on the Singapore Exchange on 14 November 2022 (Monday), and you can trade it just like you trade shares of any Singapore-listed companies.

6. Trading Size

Just like all other ETFs listed on the Singapore Exchange, the minimum number of shares per lot is one (1).

7. Fees of the UOBAM Ping An ChiNext ETF

The following are some of the fees of the ETF:

- Management Fee: Currently at 0.50% per annum

- Trustee Fee: Currently not more than 0.05% per annum

- Expense Ratio: Maximum 1.25% per annum

8. Distribution Payout Policy

At the time of writing, the Fund Manager has not declared any distributions for the ETF.

Closing Thoughts

One of the key advantages (in my personal opinion) is the ease to invest in the Chinese market (and tap onto its future growth.)

However, do take note that the fund manager has not declared any distributions currently – meaning you will not receive any dividends. So, the main focus is achieving capital gains with exposure to the ChiNext Market.

With that, I've come to the end of today's post to share about the new UOBAM Ping An ChiNext ETF. If you would like to learn more about the ETF, you can do so on UOBAM's website here, or join the upcoming SGX webinars to hear more from UOBAM, Ping An, and SZSE - there will be one session in English (to be held on Tuesday, 01 November 2022), as well as one session in Chinese (to be held on Thursday, 03 November 2022), and you can sign up here.

Important notes and disclaimers:

This document is for general information only. It does not constitute an offer or solicitation to deal in units ("Units") in the UOBAM Ping An ChiNext ETF (the "Fund") or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information contained in this document, including any data, projections and underlying assumptions, are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and the views of UOB Asset Management Ltd ("UOBAM") as of the date of this document, all of which are subject to change at any time without notice. In preparing this document, UOBAM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was otherwise reviewed by UOBAM. While the information provided herein is believed to be reliable, UOBAM makes no representation or warranty whether express or implied, and accepts no responsibility or liability for its completeness or accuracy. Nothing in this document shall, under any circumstances constitute a continuing representation or give rise to any implication that there has not been or there will not be any change affecting the Fund. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOBAM and any past performance or prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited ("UOB"), UOBAM, or any of their subsidiary, associate or affiliate ("UOB Group") or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should note that the Fund is not like a conventional unit trust in that an investor cannot redeem his Units directly with UOBAM and can only do so through the participating dealers, either directly or through a stockbroker if his redemption amount satisfies a prescribed minimum that will be comparatively larger than that required for redemptions of units in a conventional unit trust. The list of participating dealers can be found at www.uobam.com.sg.

An investor may therefore only be able to realise the value of his Units by selling the Units on the Singapore Exchange Limited ("SGX"). Investors should also note that any listing and quotation of Units on the SGX does not guarantee a liquid market for the Units. An investment in unit trusts is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should read the Fund's prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before deciding whether to subscribe for or purchase any Units. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. The Fund is not in any way sponsored, endorsed, sold or promoted by and/or its affiliates and SGX and/or its affiliates make no warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the ChiNext Index (the "Index") and/or the figure at which the Index stands at any particular time on any particular day or otherwise, The Index is administered, calculated and published by SGX. SGX shall not be liable (whether in negligence or otherwise) to any person for any error in the Fund and the Index and shall not be under any obligation to advise any person of any error therein. "SGX" is a trademark of SGX and is used by the Index under license. All intellectual property rights in the Index vest in SGX. Please note that, where relevant, the general disclaimers and jurisdiction specific disclaimers found on SGX's website at http://www.sgx.com/terms-use are also incorporated into and applicable to this document/material.

This publication has not been reviewed by the Monetary Authority of Singapore.

More articles on THE SINGAPOREAN INVESTOR

Created by ljunyuan | Aug 12, 2024