Updates on Ascendas REIT's Proposed New Management Agreements

ljunyuan

Publish date: Tue, 05 Jul 2022, 02:09 PM

Not sure if fellow unitholders are aware of this, but Ascendas REIT will be holding an EGM tomorrow afternoon (Wednesday, 06 July 2022) to seek unitholders’ approval on “the proposed entry into the New Management Agreements” to replace the existing Management Agreements – which was approved by unitholders during the EGM held on 28 June 2012, and will be expiring on 30 September 2022.

As I did not receive any mailing in my letterbox regarding this (despite my unitholdings in my CDP account), and only learned about this yesterday evening (04 July 2022) when I did my routine checks on any possible corporate actions that companies in my investment portfolio may be engaged in, I missed the deadline to register for the EGM.

However, I have gone through the published documents and for simplicity sake, highlighted some of the key differences (as best as I can) between the “Existing Management Agreements” and the “Proposed New Management Agreements” in this post, together with opinions by by the Independent Financial Advisor, along with recommendation by the Independent Directors and Audit Risk Committee on this.

Let’s begin:

Key Differences in the Existing and Proposed New Management Agreements

Singapore Property Management Agreement:

i. Adjusted Gross Revenue:

The adjusted gross revenue (with its fees still remaining at 2.0% per annum) will be expanded to include income derived from car park income, and additional property tax recovered from tenants.

To elaborate, under the existing management, Ascendas REIT is paying the Singapore Property Manager a carpark management fee (which consists of a base fee of S$2.16m, as well as 40.0% of the hourly carpark income) – in turn, it is responsible for all car park management site staff costs, operating as well as capital expenditures.

Under the proposed new management, Ascendas REIT will be responsible for all car park management site staff costs, operating as well as capital expenditures. In turn, it will no longer need to pay a separate carpark management fee, and they will be retaining 100.0% of the hourly carpark income.

Savings in the proposed new management agreement is highlighted in the table below:

ii. Marketing & Leasing:

One minor change is that the REIT will no longer be entitled to a 50.0% refund on the commissions paid to a third-party agent paid by the Singapore Property Manger when tenancy is prematurely terminated within 6 months – the change was made to align with market practice.

iii. Project Management:

For projects exceeding S$100m, fees payable to the Singapore Property Manager in the existing agreement is based on mutual agreement. However, for the proposed new agreement, fees will be capped at 1.35% of the cost of the construction projects.

Also, the scope of these projects in the proposed new agreement comprises the following – routine refurbishment, retrofitting, renovation and reinstatement works, along with routine maintenance where expenses are being classified as “capital expenditure” under the Singapore Financial Reporting Standards.

iv. Energy Audit Services:

As all Singapore properties have completed their relevant energy audits, the energy audit services of the Singapore Property Manager will no longer be required – and hence it will not be entitled to any fees in relation to it in the proposed new agreement.

Australia Property Management Agreement:

No material changes to note.

United States Property Management Agreement (for its Master Asset and Lease Agreement):

i. Asset Management Fee:

The fee payable has been adjusted from 0.4% per annum of the total value of the US Adjusted Deposited Property (including right-of-use assets) to 0.3% of the total value of the US Adjusted Deposited Property (and also excluding right-of-use assets.)

The change will have no financial impact to Ascendas REIT.

European Property Management Agreement (for its Master Asset and Lease Agreement):

i. Asset Management Fee:

Just like the fee payable for its United States Property Management Agreement (for its Master Asset and Lease Agreement), fee payment has been adjusted down to 0.3% of the total value of the Europe Adjusted Deposited Property, and excluding right-of-use assets.

The change will have no financial impact to Ascendas REIT.

ii. Project Management Fees:

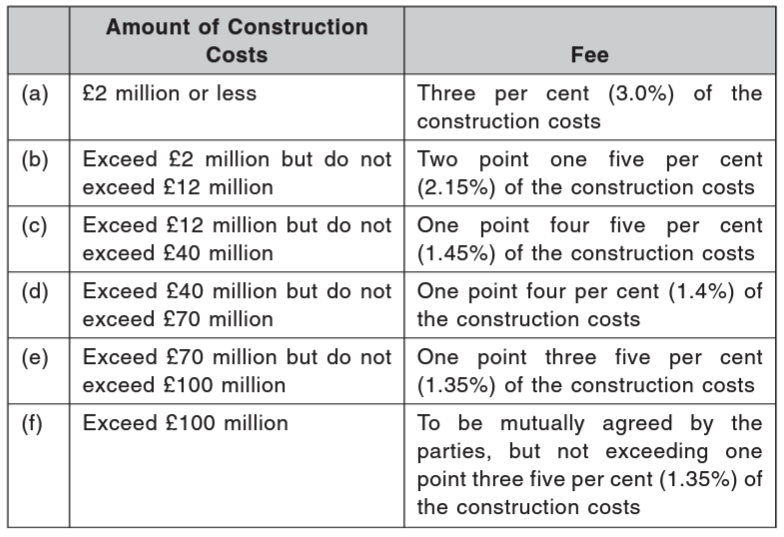

In-line with the Project Management Fees for the REIT’s Singapore properties (outlined above), fees in the proposed new agreement for its European properties will be capped at 1.35% of the construction costs for projects exceeding £100m (from fees being based on mutual agreement in the existing agreement) – the change is consistent with the current practice.

Another thing to note here is that, while the fees are quoted in Pound Sterling (which is UK’s lawful currency), for construction works done in its European properties, costs will be converted from the relevant currency to Pound Sterling, and fees will be calculated according to the fee table below:

Opinion of Independent Financial Advisor and Recommendation of the Independent Directors and Audit Risk Committee

The Independent Financial Advisor (Deloitte & Touche Corporate Finance Pte Ltd) opined that the New Management Agreements are based on normal commercial terms and not prejudicial to the interests of Ascendas REIT and its unitholders. Accordingly, it has advised Independent Directors and the Audit and Risk Committee to recommend that unitholders vote in favour of the resolution during the EGM.

The Independent Directors and Audit Risk Committee have also deemed that the proposed New Management Agreements are based on normal commercial terms and not prejudicial to the interests of Ascendas REIT and its minority unitholders, and recommend that unitholders vote in favour of the resolution.

Related Documents

- Presentation Slides

- Circular to Unitholders

- Notice of EGM

- EGM Announcement

- Proxy Form

- Responses to Substantial Questions

Disclaimer: At the time of writing, I am a unitholder of Ascendas REIT.

More articles on THE SINGAPOREAN INVESTOR

Created by ljunyuan | Aug 12, 2024