Ascott Residence Trust (SGX:HMN) - What You Need to Know

ljunyuan

Publish date: Tue, 15 Mar 2022, 02:40 PM

Back in 2020, when the Covid-19 pandemic was at its worst, many countries resorted to closing their immigration borders, along with blanketed lockdowns to slow the rate of transmission of the pandemic within the community – this severely impacted the performance of companies in travel-related industries. Ascott Residence Trust (SGX:HMN), with its portfolio comprising of hotels and serviced residences, saw their businesses plummeted.

Fast forward to 2022, many of the countries have once again reopened their immigration borders after vaccinating a majority of their population, and this bodes well for companies in the tourism industry – with Ascott Residence Trust being one of them, with the recovery of occupancy rates of their hotels and serviced residences, along with their revenue per available unit, as people resume their leisure travelling activities once again.

That said, is Ascott Residence Trust a “buy” right now? In today’s post about the Singapore-listed REIT, I’d be sharing with you the essentials you need to know about it – including a brief introduction, its financial performances, revenue per available unit, debt profile, as well as distribution payouts to unitholders over a 10-year period (between FY2012 and FY2021), and finally my outlook for the REIT ahead (where I share the possible head- and tail-winds in the near-term):

Brief Introduction to Ascott Residence Trust

Ascott Residence Trust (SGX:HMN) is the largest hospitality trust in Asia Pacific with an asset value of S$7.7 billion as at 31 December 2021 (i.e. end of financial year 2021.) The REIT is also a constituent of the FTSE EPRA NAREIT Global Real Estate Index Series.

Its portfolio currently comprises a total of 93 properties with about 17,000 units in 43 cities across 15 countries, as follows (you can click on the respective links below to find out more about each of the properties the REIT owns):

- Australia (13 Properties)

- Belgium (2 Properties)

- China (5 Properties)

- France (15 Properties)

- Germany (5 Properties)

- Indonesia (2 Properties)

- Japan (22 Properties)

- Malaysia (1 Property)

- The Philippines (2 Properties)

- Singapore (5 Properties – comprising of Ascott Orchard Singapore, Citadines Mount Sophia Property Singapore, lyf One-North Singapore, Riverside Hotel Robertson Quay, and Somerset Liang Court Property Singapore)

- South Korea (2 Properties)

- Spain (1 Property)

- United Kingdom (4 Properties)

- United States of America (11 Properties)

- Vietnam (4 Properties)

Also, the REIT’s properties are mostly operated under the following brands: Ascott The Residence, Somerset, Quest, and Citadines.

Financial Performance

In this section, let us take a look at the REIT’s financial performance over a 10-year period – between FY2012 and FY2021:

| FY2012 | FY2013 | FY2014 | FY2015 | |

| Gross Revenue (S$’mil) | $303.8m | $316.6m | $357.2m | $421.1m |

| Net Property Income (S$’mil) | $159.1m | $161.2m | $180.2m | $204.6m |

| Distributable Income to Unitholders (S$’mil) | $99.7m | $114.8m | $125.6m | $123.3m |

| FY2016 | FY2017 | FY2018 | FY2019 | |

| Gross Revenue (S$’mil) | $475.6m | $496.3m | $514.3m | $515.0m |

| Net Property Income (S$’mil) | $222.4m | $226.9m | $239.4m | $252.6m |

| Distributable Income to Unitholders (S$’mil) | $135.0m | $152.2m | $154.8m | $165.6m |

| FY2020 | FY2021 | |||

| Gross Revenue (S$’mil) | $296.8m | $302.0m | ||

| Net Property Income (S$’mil) | $130.1m | $145.1m | ||

| Distributable Income to Unitholders (S$’mil) | $94.2m | $137.3m |

Looking at the table and chart above, I’m sure you’d agree with me that the hospitality REIT’s financial performance over years have been pretty decent – with its gross revenue and net property income declining only in FY2020 (and quite a severe one due to border closures as a result of the Covid-19 pandemic), while its distributable income to unitholders saw declines in just 2 out of the 10 years I have looked at (in FY2015, due to a lack of one-off items of approximately $9.1m distributed in the previous financial year, as well as in FY2020, due to Covid-19.)

Another thing to highlight is that, no doubt its top- and bottom-line recovered in FY2021 (as borders start to reopen up for tourism to resume), but they are still a distance away from pre-Covid levels (i.e. in FY2019) – which in my opinion, will take another year or two before its eventual recovery.

Revenue Per Available Unit

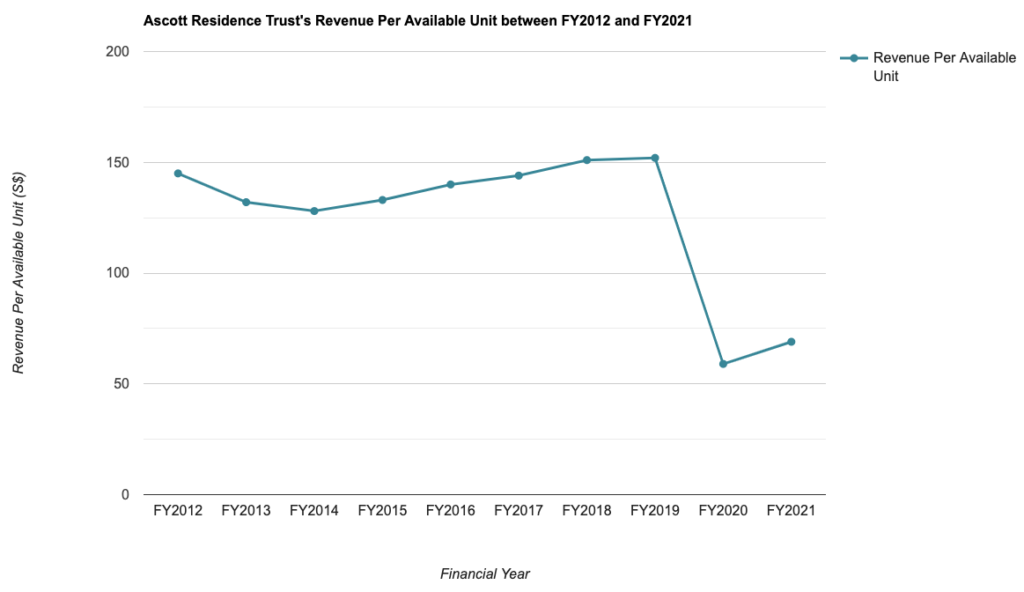

In this section, I’d be looking at the hospitality REIT’s revenue per available unit (which is abbreviated as RevPAU) for its properties recorded over the past 10 years (between FY2012 and FY2021):

| FY2012 | FY2013 | FY2014 | FY2015 | |

| Revenue Per Available Unit (S$) | $145 | $132 | $128 | $133 |

| FY2016 | FY2017 | FY2018 | FY2019 | |

| Revenue Per Available Unit (S$) | $140 | $144 | $151 | $152 |

| FY2020 | FY2021 | |||

| Revenue Per Available Unit (S$) | $59 | $69 |

The REIT’s RevPAU have fluctuated over the years, and tumbled in FY2020 (due to Covid-19), before recovering the year after – however, it is still about 55% away from pre-Covid levels (of $152 recorded in FY2019) – and just like for its financial performance, it’ll take another year or two before the REIT’s RevPAU recovers to pre-Covid levels in my opinion.

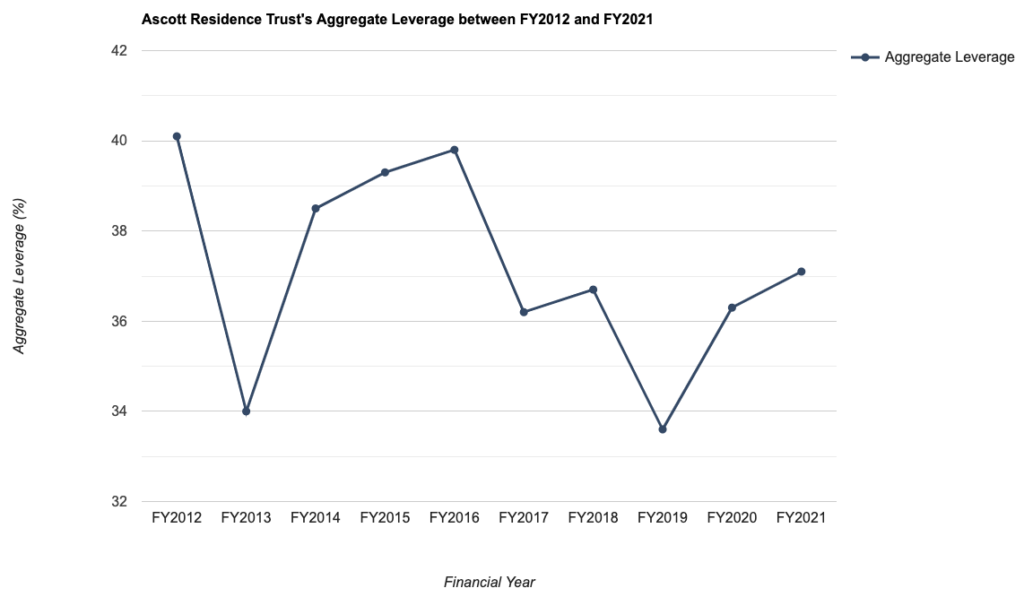

Debt Profile

When it comes to evaluating a REIT’s debt profile – my focus tends to be on 2 areas: its aggregate leverage (or gearing level, as some REITs would like to call it), and its interest coverage ratio – where my preference for the former is below 40.0%, and for the latter at 5x.

Did Ascott Residence Trust’s debt profile over the years fulfil my requirements? Let us take a look in the table below:

| FY2012 | FY2013 | FY2014 | FY2015 | |

| Aggregate Leverage (%) | 40.1% | 34.0% | 38.5% | 39.3% |

| Interest Coverage Ratio (times) | 3.9x | 4.0x | 4.3x | 4.1x |

| Average Term to Debt Maturity (years) | 3.0 years | 4.2 years | 4.4 years | 4.6 years |

| Average Cost of Debt (%) | 3.3% | 3.2% | 3.0% | 2.8% |

| FY2016 | FY2017 | FY2018 | FY2019 | |

| Aggregate Leverage (%) | 39.8% | 36.2% | 36.7% | 33.6% |

| Interest Coverage Ratio (times) | 4.3x | 4.7x | 4.8x | 5.6x |

| Average Term to Debt Maturity (years) | 4.7 years | 4.1 years | 3.9 years | 3.4 years |

| Average Cost of Debt (%) | 2.4% | 2.4% | 2.3% | 2.0% |

| FY2020 | FY2021 | |||

| Aggregate Leverage (%) | 36.3% | 37.1% | ||

| Interest Coverage Ratio (times) | 2.2x | 3.7x | ||

| Average Term to Debt Maturity (years) | 2.9 years | 2.7 years | ||

| Average Cost of Debt (%) | 1.8% | 1.6% |

The hospitality REIT’s aggregate leverage have fulfilled my requirements, where it has been maintained at under 40.0% in all the years I have looked at – particularly, in FY2021, its aggregate leverage, at 37.1%, is a conservative one (where it still has a pretty good debt headroom to go before the regulatory limit of 50.0% is reached, allowing the REIT to embark on further yield-accretive acquisitions as an when an opportunity to do so arises.)

Its average cost of debt have also been on a downward moving trend over the years – from a high of 3.3% in FY2012, it has slid to just 1.6% in FY2021. The only thing which did not quite meet my requirement is its interest coverage ratio, where it fell slightly under 5.0x (the only year where its interest coverage ratio went above 5.0x was in FY2019.)

Another thing to note here as far as its borrowings is concerned is that, slightly more than half of its borrowings will be expiring in the coming FY2022 (28%, or $765m), as well as in FY2023 (25%, or $698m) ahead.

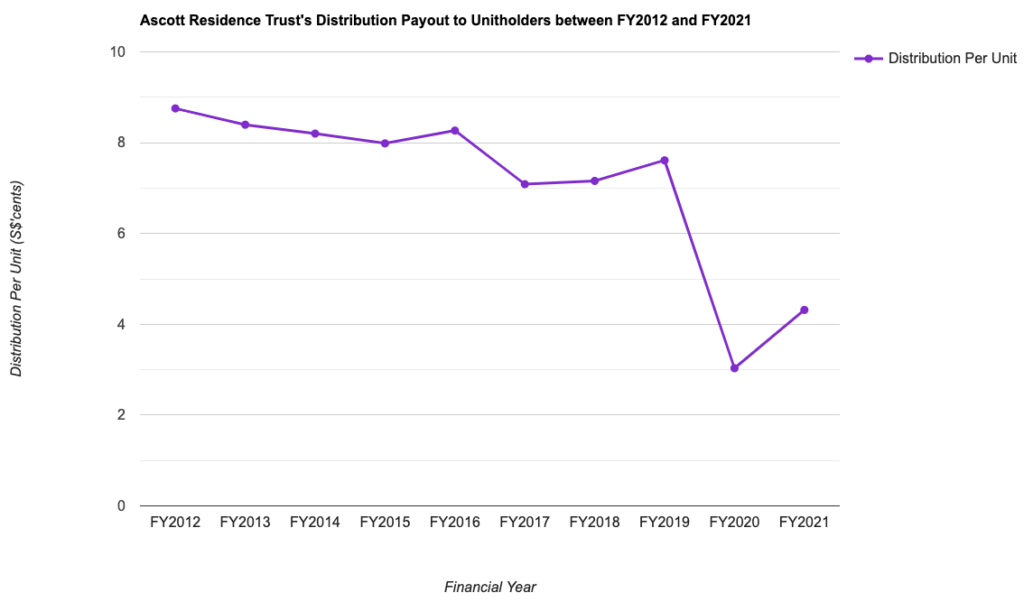

Distribution Payout to Unitholders

The management of Ascott Residence Trust declares a distribution payout to its unitholders on a semi-annual basis (once when it releases its results for the first half of the financial year, and once when it releases its results for the second half of the financial year.)

Over a 10-year period, its distribution payout to unitholders is as follows:

| FY2012 | FY2013 | FY2014 | FY2015 | |

| Distribution Per Unit (S$’cents) | 8.755 cents | 8.396 cents | 8.201 cents | 7.985 cents |

| FY2016 | FY2017 | FY2018 | FY2019 | |

| Distribution Per Unit (S$’cents) | 8.267 cents | 7.086 cents | 7.158 cents | 7.611 cents |

| FY2020 | FY2021 | |||

| Distribution Per Unit (S$’cents) | 3.033 cents | 4.316 cents |

One thing to note is that, the REIT’s distribution payout over the years have fluctuated – in particular, the huge decline in its payout for FY2020 was due to Covid-19, where its revenue has been massively impacted as a result of border closures in many countries to slow down the rate of transmission of the pandemic.

Closing Thoughts

While I like the REIT’s financial performance over the years, along with its conservative debt profile (where its aggregate leverage has a healthy debt headroom before the regulatory limit is reached), but as a retail investor, I’m more into REITs that can offer a steadily rising distribution payout over the years (but in the case of Ascott Residence Trust, its payout have fluctuated over the years.) Another thing to note is that slightly more than 50% of its borrowings will be due in the coming year, as well as the next.

Looking ahead, one of the major tailwind for the REIT will be the further reopening of the immigration borders, along with simpler pre-departure and on-arrival testing requirements (or even eliminating it altogether) in countries that it has properties in – this will definitely facilitate tourist movements, and as a result, see its hospitality properties reporting further improvements in terms of revenue contribution.

On the other hand, the current situation in Ukraine may see fewer tourists visiting European countries, and the REIT’s properties in those locations (Belgium, France, Germany, Spain, as well as the United Kingdom) being affected to some extent – which may in turn impact the REIT’s financial performance in the near-term.

With that, I have come to the end of my review of Ascott Residence Trust. I hope you’ve found the contents presented in this post useful, and that they have given you a better understanding of the Singapore-listed hospitality REIT. However, do take note that the information shared above is purely for educational purposes only, and they do not represent any buy or sell calls for units of the REIT. As always, you’re strongly encouraged to do your own due diligence before making any investment decisions.

Disclaimer: At the time of writing, I am not a unitholder of Ascott Residence Trust.

More articles on THE SINGAPOREAN INVESTOR

Created by ljunyuan | Aug 12, 2024