Keppel DC REIT – DXC Settlement Offers Partial Relief From Uncollected Rents

traderhub8

Publish date: Mon, 22 Apr 2024, 10:57 AM

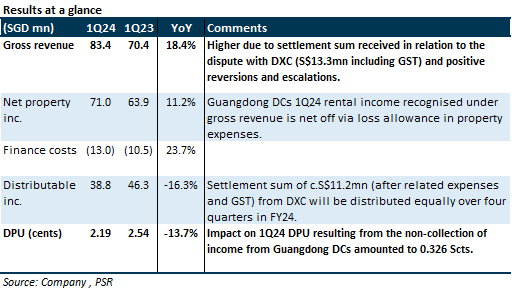

- 1Q24 DPU of 2.192 Singapore cents (-13.7% YoY) was in line with our expectations at 25.5% of FY24e forecast.

- The settlement sum of S$13.3mn related to the dispute with DXC has been received in full. After deducting related expenses and GST, the remaining S$11.2mn will be distributed equally across four quarters in FY24. This will partially offset the loss from the non-collection of three months of rent at the Guangdong DCs, which amounted to c.S$5.3mn in 1Q24.

- Maintain ACCUMULATE with an unchanged DDM-derived target price of S$1.86. Organic growth will stem from renewals in FY24e (26.7% of leases expire in 2024); we expect portfolio rental reversions of c.4% for FY24e. Our FY24e forecast already assumes no rental contribution from the Guangdong DCs, so further bad debts will not affect our forecast. Potential catalysts include accretive acquisitions and the collection of rental in arrears from Bluesea. The current share price implies FY24e/25e DPU yields of 5.2%/5.8%. There is no change in estimates.

The Positives

+ Maintained high portfolio occupancy of 98.3% (unchanged QoQ), with a portfolio WALE of 7.4 years. 26.7% of leases by rental income will expire in 2024. Leases signed in 1Q24 were at positive rental reversions.

+ Steady capital management, with 1Q24 average cost of debt declining 0.1ppts QoQ to 3.5% and a healthy ICR at 4.7x. 73% of debt is on a fixed rate, and only 4% of debt is up for refinancing in 2024, with most of the debt expiring from 2026 and beyond. Gearing increased 20bps QoQ to 37.6%, still below KDCREIT’s internal cap of 40%. The majority of foreign-sourced income is also hedged until December 2024.

The Negative

– Rentals are owed by the master lessee at Guangdong DCs. Currently, Bluesea owes c.8.5 months of rents totalling c.S$15.8mn.We are waiting to see how long before management decides to pull the plug and take over the property. KDCREIT reserves its rights to terminate the acquisition of GDC 3; there is currently a RMB100mn deposit on GDC 3. Additionally, there might be a risk of asset devaluations for the Guangdong DCs if KDCREIT cannot recover the overdue rent.

Source: Phillip Capital Research - 22 Apr 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024