Trader Hub

Phillip Macro Update – Key Points for Mar FOMC Meeting

traderhub8

Publish date: Thu, 21 Mar 2024, 05:28 PM

Event

The U.S. Federal Open Market Committee (FOMC) concluded its two-day meeting on the 20th of March 2024. The meeting discussed the Fed’s monetary policy stance and economic projection.

Key points to note from this meeting

- Forthcoming but not appropriate yet – In this FOMC meeting, the committee mentioned economic activities are aligned with their dual mandate, which they have set out to achieve as job gains remained strong while the unemployment rate remained low. It was also observed that inflationary data, such as CPI and PCE, have moderated over the past years but are still elevated. Therefore, for the 5th consecutive meeting, the Federal Reserve Committee has chosen to keep its rates steady at a level of 5.25-5.5%.

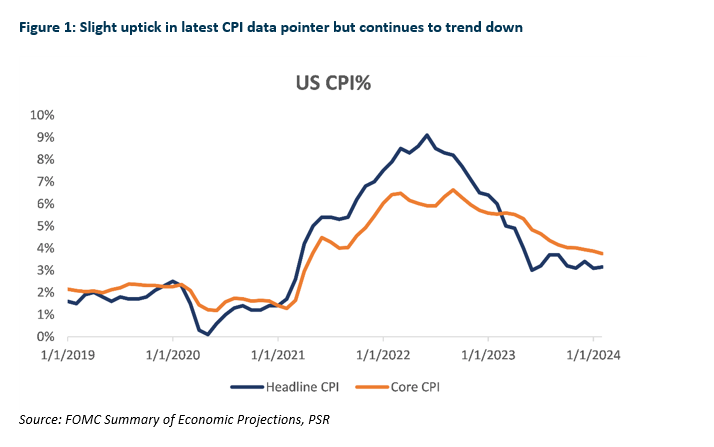

- Bumps along the way before reaching the targeted range of 2% – In the latest inflationary data releases, the Consumer Price Index (CPI) saw a slight uptick. Figures for February showed that headline CPI came in slightly higher at 3.15% (above market expectation of 3.1%), which was contributed by higher shelter costs and gasoline, while Core CPI was at 3.75% YoY, respectively (Figure 1). For January’s Personal Consumption Expenditure (PCE), total PCE and Core PCE also reflected lower numbers at 2.4% YoY and 2.85% YoY, respectively, compared with December’s figures of 2.6% and 2.93%. The path towards the Fed’s 2% target range isn’t all that smooth sailing, but it is surely moving towards the right direction.

- Federal Reserve Projection/Guidance – In this month’s meeting, a Summary of Economic Projection (SEP) was released, and a dot plot graph was provided (Figure 2). The projected rate for 2024 remained as per the SEP that was released back in December’s meeting last year at 4.6% (equating to 3 probable 25bps cuts this year, and a further 3 cuts each in 2025 and 2026). Chairman Powell’s comments saying that it would be appropriate to start rate cuts this year noting that inflation has eased notably further bolsters and solidifies the clarity of the probable rate cuts happening this year. However, for any rate cuts to take place. It would most likely be taking place in the 2H24. As mentioned previously, the committee is still garnering the confidence that inflation is moving sustainably towards their goal before any decision of rate cuts could take place.

- Directional clarity sets the tone within the Market – With the long-awaited clarity on rate cuts, due to mixed inflationary results in recent months, investors are happy. All three major indices pushed higher, with the Dow Jones Industrial Average +1.03% to 39,512.13, S&P500 +0.89% to 5,224.62, and lastly NASDAQ +1.25% to 16,369.41.

- Soaking in while there are still opportunities – Fixed-income investors seeking to secure advantageous yields before potential rate adjustments in the latter half of the year may find the current market environment particularly opportune. New bond issuances currently offer attractive coupon rates. However, with the Federal Reserve anticipating rate cuts, future issuances might not provide the same level of yield. One instance would be the newly issued 5.25% USD bond by Singapore Airlines just last week. The order book for this issuance was 9 times oversubscribed on the issuance date and currently, it is trading on the secondary market at an Ask price of 100.334 giving a yield of 5.20%. If interested, at Phillip, we do offer bond trading and it is available on our POEMS platform. For more information please visit https://www.poems.com.sg/bonds/.

Source: Phillip Capital Research - 21 Mar 2024

More articles on Trader Hub

CSOP IEdge S-REIT Leaders Index ETF – The Deeper Discounted Singapore REIT ETF

Created by traderhub8 | Jun 12, 2024

Valuetronics Holdings Ltd- Get Paid as Customer Base Is Refreshed

Created by traderhub8 | Jun 03, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments