Q & M Dental Group Ltd – Data-driven Treatments Can Commence

traderhub8

Publish date: Mon, 18 Mar 2024, 11:07 AM

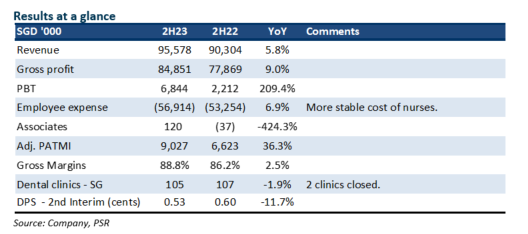

- 2023 adjusted PATMI exceeded our expectations at 121% of forecasts. Operating margins recovered from higher revenue per patient and more stable employee expenses. Associates also turned around from losses the prior year.

- Q&M is rationalising their network of clinics and closing poor performing clinics. Revenue intensity per patient is raised by utilising its EM2AI software. Data is drawn from dental scans, medical notes and records to ascertain the necessary level and timeliness of the treatments for patients. We view EM2AI as a critical tool for efficiency and differentiation.

- We upgraded from ACCUMULATE to BUY and raised our target price to S$0.36 (prev. S$0.34). We value the company at 20x PE FY24e earnings, in line with industry peers. Listed associate, Aoxin Q & M Dental (S$0.051, Not Rated) is valued at market price with a 20% discount. We expect Q&M to return to growth in FY24e. The key drivers are higher revenue per patient, more stable employee cost (as staffing levels for nurses normalise), deconsolidation of EM2AI R&D expenses and turnaround in associates.

The Positive

+ Recover in revenue and margins. 2H23 revenue growth is the fastest over the past two years. Despite fewer clinics, revenue expanded from higher revenue per patient. Using data driven treatment, Q&M can ascertain and provide a more intensive treatment for patients. Margins recovered from operating leverage and a stable number of staff or nurses.

The Negative

– Declining number of clinics. 2023 saw the first decline in the number of clinics in six years. Q&M closed two clinics in Singapore. The restructuring was to close loss-making clinics. Q&M is still looking to expand its clinics but for larger sites.

Source: Phillip Capital Research - 18 Mar 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024