PropNex Ltd – Challenging But Bottomed

traderhub8

Publish date: Mon, 04 Mar 2024, 11:19 AM

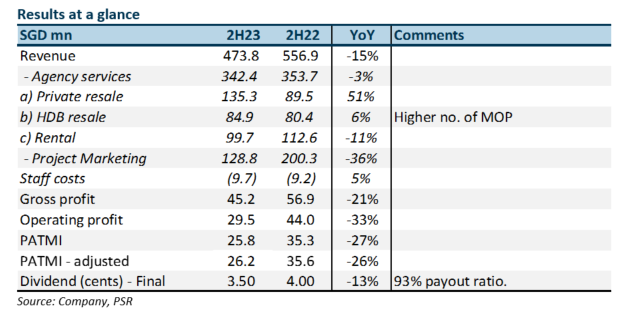

- 2023 results were below expectations. Revenue and PATMI were 83%/76% of our estimates. 2H23 adjusted PATMI declined 26% YoY to S$26.2mn, dragged down by weakness in new launch transactions. The dividend for FY23 dropped 11% to 6 cents or 6.9% yield.

- Transaction volumes in 2023 disappointed. Consumer sentiment was weak and hesitant with April’s rising interest rates and cooling measures. Despite new launches rising by 66% in 2023 to 7,551 units, weakness persisted.

- We lower our FY24e earnings by 16% to S$56mn. Our DCF target price was lowered to S$0.97 (prev. S$1.16) and ACCUMULATE recommendation maintained. We expect a recovery in transactions in FY24e. Driving transactions are recovering sentiment post-cooling measures, a higher number of new launches, a surge in residential completions, resilient HDB prices for upgraders, and lower mortgage interest. PropNex remains the largest real estate agency in Singapore, with 62.5% market share in private residential and HDB resale transactions. The company pays an attractive yield of 6.9% (or S$44mn) backed by S$148mn net cash.

The Positive

+ Market share gains and rising cash pile. PropNex shared that in 2023, its market share in new launches crept up 0.5% to 47.9%. Meanwhile, the share in resale rose a larger 6.8% points to 65.8%. HDB resale declined by 0.4% to 64.7%. It remains the largest real estate agency in Singapore, with 12,233 agents (or 66%). Cash continues to pile up in 2023 with a free cash flow of S$55mn (2022: S$49mn). The dividend payout ratio continues to rise to a record 93% in FY23.

The Negative

– Weakness in new launch revenue. Revenue in new launches declined by 36% YoY to S$128mn. The fall in sentiment post-cooling measure and the larger number of units available for resale affected demand. Gross margins contracted as new launches generate higher margins with the additional 0.5% commission paid to the agency.

Source: Phillip Capital Research - 4 Mar 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024