HRnetGroup Limited – Expecting Growth to Creep Up

traderhub8

Publish date: Mon, 26 Feb 2024, 11:14 AM

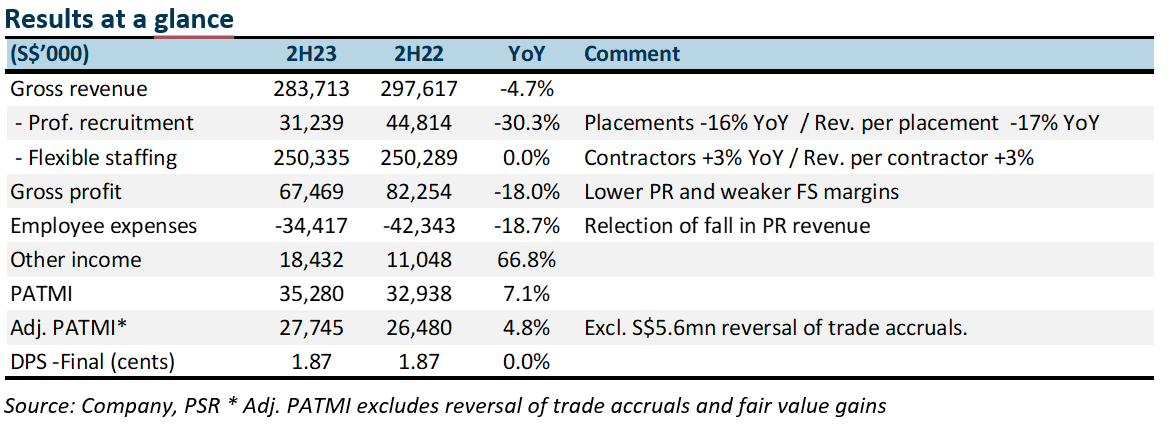

- Results were marginally below expectations. FY23 revenue and adjusted PATMI were 97%/95% of our forecast. 2H23 grew 5% YoY to S$27mn. Professional recruitment revenue was weaker than expected with a decline of 30% YoY. Placements were the lowest since listing.

- Flexible staffing remained resilient. Margins were softer with the absence of pandemic-related roles. Growth was from finance and manufacturing.

- Hiring in technology roles from start-ups to semiconductors has been a growth vertical for HRnet. However, the pace of hiring in this segment has slowed significantly. Growth will now come from capturing a larger share of customer budgets. HRnet office network and sphere of service including solutions in instant pay and claims, can raise the support of client needs in the region. Flexible staffing is benefiting from a rising wage environment, tight supply of local manpower and increased outsourcing. General hiring conditions are weak, particularly in China. We lowered our FY24e earnings by 11% to S$57mn. Our BUY recommendation is maintained. With the more tepid growth, we are reducing our valuation metric to 11x PE ex-cash FY24e (prev. 12x PE). Target price lowered from S$0.88 to S$0.85. It remains at a huge discount to global peers trading at an average PE of 19x.

The Positive

+ Flexible staffing (FS) is the key performer. Around 94% of FS revenue is from Singapore. 2H23 FS revenue in Singapore rose 1.8% YoY. Despite the decline in number of contractors, the rise in wages supported revenue. Government policy to drive up wages of the lower income also pushed income from government subsidies to S$6.6mn in 2H23 (2H22: S$1.2mn).

The Negative

– Professional recruitment (PR) is still the weak spot. The number of PR hirings in 2H23 fell 17% YoY to 2,856, due to hiring freezes and cautious sentiment. Revenue per placement declined 17% YoY as more placements were completed for junior roles.

Outlook

We are forecasting a 5% contraction in volumes for PR. There are limited indications corporates are ramping up their hiring of managerial roles in this region. FS revenue is expected to grow stronger from higher wages and improvement in volumes especially in Taiwan. The FS operations in Taiwan is beginning to hit scale and gain more traction with corporates.

Maintain BUY and lower TP of S$0.85 (prev. S$0.88).

HRnetGroup enjoys net cash of S$303mn with barriers of scale with more than 500 full-time recruitment consultants across 17 cities. There is another S14mn outstanding in their committed share buyback programme.

Source: Phillip Capital Research - 26 Feb 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024