Trader Hub

CapitaLand Ascott Trust – Further Upside From Occupancy Growth

traderhub8

Publish date: Fri, 09 Feb 2024, 05:21 PM

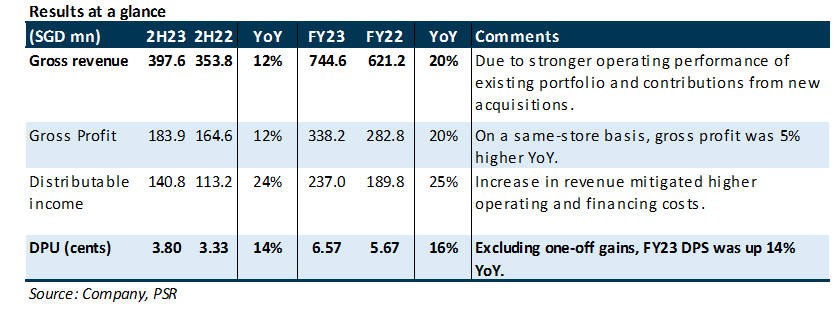

- FY23 DPU of 6.57 cents (+16% YoY) exceeded our expectations by 11.7% due to a one-off realised exchange gain. Excluding one-off items, adjusted DPU increased 14% YoY to 5.44 cents, which was 93% of our forecast.

- 4Q23 portfolio RevPAU rose 4% YoY to S$161, reaching 103% of pre-COVID 4Q19 levels mainly due to higher average daily rates (ADR). Average portfolio occupancy was stable QoQ at 77% (4Q22: 78%), and it was at 92% of pre-COIVD levels.

- Downgrade from BUY to ACCUMULATE with an unchanged DDM-TP of S$1.04 as we roll forward our forecasts. FY24e/FY25e DPU is raised by 3%/6% after lowering our interest costs assumptions. CLAS remains our top pick in the sector owing to its mix of stable and growth income sources and geographical diversification. Growth in RevPAU going forward will come from higher portfolio occupancy, as ADR growth would slow from the high base. The current share price implies an FY24e/25e dividend yield of 6.5/6.8%.

The Positives

- 4Q23 RevPAU grew 4% YoY to S$161, reaching 103% of pre-pandemic 4Q19 pro-forma RevPAU mainly due to higher ADRs. Average portfolio occupancy was stable QoQ at 77% (4Q22: 78%). RevPAU in Australia, Japan, Singapore, UK and USA continued to exceed pre-COVID 4Q19 levels on a same-store basis. Japan saw a spike in RevPAU by 90% YoY after its re-opening to independent leisure travellers in Oct 2022. Performance in China and Vietnam continued to improve, with RevPAU at 86% and 88% of 4Q19 levels respectively.

- Proactive capital management. Gearing and interest cover remained healthy at 37.9% and 4x, respectively. CLAS’s effective borrowing cost remained unchanged at 2.4% QoQ, with 81% of debt on a fixed rate. We expect the FY24 cost of debt to increase to c.2.9% after refinancing 18% of its total debt (c.S$563mn) due in FY24. A 50bps increase in CLAS’s borrowing cost will impact full-year DPU by 0.08 Singapore cents.

- Higher portfolio valuation. CLAS’s portfolio valuation rose 2% as stronger operating performance and outlook mitigated the impact of higher discount and cap rates across all markets (except for Japan). Markets with valuation gains include Australia, Europe, Japan, Singapore, and UK. Separately, CLAS is divesting Citadines Mount Sophia Singapore for S$148mn, 19.4% above book value. The exit yield for this transaction is 3.2%, and CLAS will recognise a net gain of c.S$14.6mn. The divestment is expected to be completed in 1Q24.

The Negatives

- Nil

Source: Phillip Capital Research - 9 Feb 2024

More articles on Trader Hub

CSOP IEdge S-REIT Leaders Index ETF – The Deeper Discounted Singapore REIT ETF

Created by traderhub8 | Jun 12, 2024

Valuetronics Holdings Ltd- Get Paid as Customer Base Is Refreshed

Created by traderhub8 | Jun 03, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments