Suntec REIT – Deeply Discounted Assets

traderhub8

Publish date: Thu, 25 Jan 2024, 10:43 AM

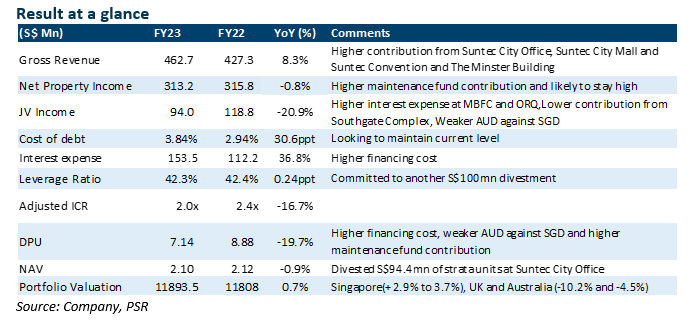

- Gross revenue for FY23 surged by 8.3% to S$462.7mn, surpassing our expectations by 7.8%. NPI slided 0.8% YoY to S$2mn and was in line with expectation at 104.2% of our forecast.Revenue were supported by a rental reversion of 12.3% for Singapore office spaces and a 21.8% rental reversion for Suntec City Mall. Suntec Convention has fully resumed its operations, with revenue surpassing pre-COVID levels by 3.9%.

- DPU decreased by 19.7% YoY but exceeded our estimates(S$307.9mn) by 6.7%, primarily due to higher maintenance fund contribution and weaker Australia performance, ending the full year at 7.135 cents. Another S$100mn divestment plan has been set, following the S$94.4mn of strata offices sold in FY23.

- We reiterate our BUY recommendation with an unchanged DDM-TP of S$1.47 and FY24e-25e DPU forecasts of S$7.30 to S$7.89 cents. We have factored in the effects of leasing downtime and a better-than-expected recovery of the Suntec Convention Center in FY24e. Rental reversions for retail spaces will continue to trend strong in the mid-teens, while office spaces are expected to be in the mid-single digits. The stock is trading at 42% discount to book value of S$2.1.

The Positives

+ Resilient balance sheet upon completion of divestment goal. SUN divested S$94.4mn at Suntec City Office Towers in FY23 at,31% above the book value. Post-divestment, gearing stood at 42.3% (-0.24ppt YoY). SUN is committed to another S$100mn disposal plan, with a priority on strata units in Suntec Office due to better visibility of end-user demand. The proceeds generated will be used for debt repayment, aiming to lower gearing to 40%. The S$200mn strata units contribute to c.5% of the total revenue, thus compressing DPU by 3% after factoring in interest savings from debt repayment.

+ Singapore valuation rose. Tenant sales surpassed the pre-COVID level by 14%, while shopper traffic lagged behind by c.10%. Singapore retail achieved a rental reversion of 21.8% in FY23 despite cautious domestic consumption. Meanwhile, rental reversion for offices remains resilient at 12.3%, with high tenant retention of 71% in Suntec. Occupancy costs continue to trend down to 21%, compared to the pre-COVID level of 23%, leaving room for further rental reversion. Singapore assets valuation rose by 3.1% in FY23. The overseas portfolio fell due to cap rate expansion, ranging from 25 bps to 63 bps, resulting in a total portfolio valuation uplift of 0.7%.

+ Better-than-expected recovery for Suntec Converntion Center. While MBS expansion faced some delays, Suntec Convention rebounded strongly in 2023 with the return of larger international events, driving revenue to grow 58%YoY to S$63.9 (+3.9% FY19). The growth is set to continue in FY24, driven by MICE and consumer events. We expect them to contribute to c.20% of total revenue.

The Negative

– Fading recovery tailwind. The retail occupancy rate saw a 2.3% YoY decline to 95.2%, mainly due to the departure of anchor tenants in both Singapore and overseas assets. The occupancy rate for 55 Currie Street was at 56.2% and is expected to improve by 1Q24. Minster Building occupancy stood at 87.3%. Portfolio occupancy for Offices segment also dropped by 3.4% YoY to 94.9%.

Source: Phillip Capital Research - 25 Jan 2024

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024