StarHub Limited – Dare+ Investments Ending Soon

traderhub8

Publish date: Fri, 10 Nov 2023, 11:36 AM

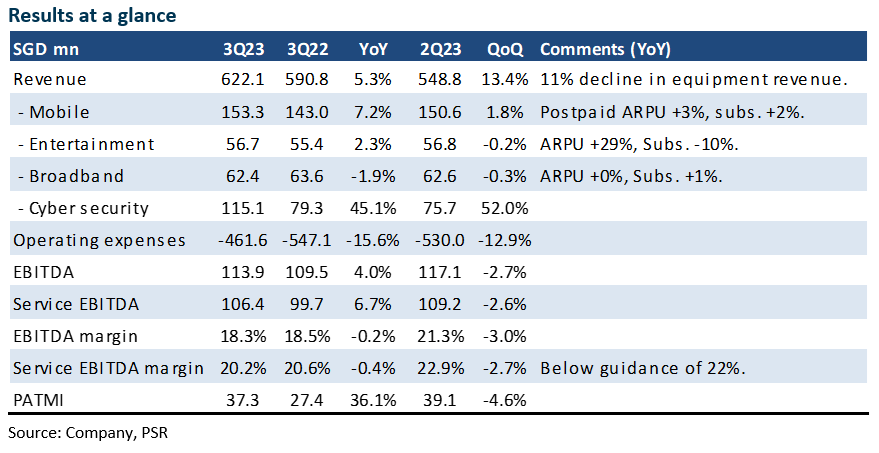

- 3Q23 results were within expectations. 9M23 revenue and EBITDA were 74%/73% of our FY23e estimates. No change in StarHub FY23 guidance.

- Revenue growth of 5% YoY in 3Q23 was led by cybersecurity and mobile. Cybersecurity revenue rose 45% YoY to S$115mn on strong order books and pipeline. Mobile revenue expanded 7% YoY to S$153mn from higher roaming revenues.

- We maintain our FY23e forecast and ACCUMULATE recommendation. Our target price of S$1.21, pegged at 6.5x FY23e EV/EBITDA, is unchanged. With the S$310mn Dare+ investments in operating expense and capital expenditure, we expect an improvement in earnings in FY24e. The revenue opportunities post Dare+ investments remain unclear. The cybersecurity operation continues to build up its franchise and is yet to be fully priced into StarHub valuations as it remains unprofitable.

The Positive

+ Jump in cybersecurity. Cybersecurity registered a record revenue of S$115mn in 3Q23. Project details were not disclosed but the orderbooks and project pipelines remain healthy. There have been new solutions in AI and automation.

The Negative

– Competition pressing down ARPUs. Competition is pressing down ARPU in mobile and broadband. ARPU was flat QoQ in 3Q23. Mobile is facing price competition from MVNOs, whilst broadband operators are pricing down ahead of the Simba.

Outlook

With Dare+ investments near completion this year, we expect an improvement in earnings for FY24e. The trajectory of earnings post Dare+ investment hinges on the new revenue opportunities resulting from the revamp of the IT systems. A wider suite of services with better customisation features are some of the benefits. Capex spending will be replaced with opex, such as the greater use of cloud solutions. Opex should also reduce in FY24 as overlapping legacy systems and costs are decommissioned.

Source: Phillip Capital Research - 10 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024