NetLink NBN Trust – Stable as Usual

traderhub8

Publish date: Wed, 08 Nov 2023, 11:45 AM

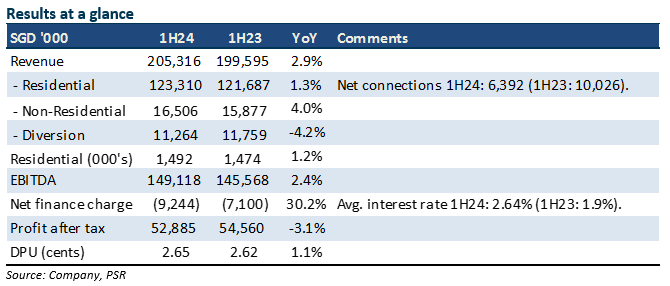

- 1H24 results were within expectations. Revenue and EBITDA were 49%/50% of our FY24e forecast, respectively. DPU increased 1.1% YoY to 2.65 cents.

- 1H24 EBITDA grew 2.4% YoY to S$149mn, in line with the revenue growth of 2.9%. Residential connections during the quarter were 4,023, below our trendline growth of 5,500 per quarter.

- We maintain our FY24e forecast and DCF target price of S$0.87. Our NEUTRAL rating is unchanged. The regulatory review of fibre rates is likely to be announced by this year. We believe the current distribution is sustainable. The repricing of the S$510mn interest rate hedges in 2026 will place some downward pressure on distributions.

The Positive

+ Higher distribution. Interim distribution rose 1.1% YoY 2.65 cents. This is modestly higher than our expectations of unchanged distribution for the year. NetLink is paying out S$103mn in distributions from free-cash flow of around S$80mn. The balance is topped up from cash held in reserves.

The Negatives

– Another weak quarter of residential connections. Residential connections increased by only 2,369 in 2Q24, the weakest in eight quarters. We believe delays or renovation periods before moving into the new homes drove the sluggishness.

– Finance cost rose 30% YoY. The unhedged portion of S$735mn gross debt continued to be a drag on cash-flows. Net finance cost rose 30% to S$9.2mn. Assuming the current interest rate hedged loan of S$510mn is repriced upwards by 300 bps, the distribution could be negatively impacted by around 7.5%.

Source: Phillip Capital Research - 8 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024