Keppel DC REIT – Waiting for Acquisitions

traderhub8

Publish date: Wed, 18 Oct 2023, 11:40 AM

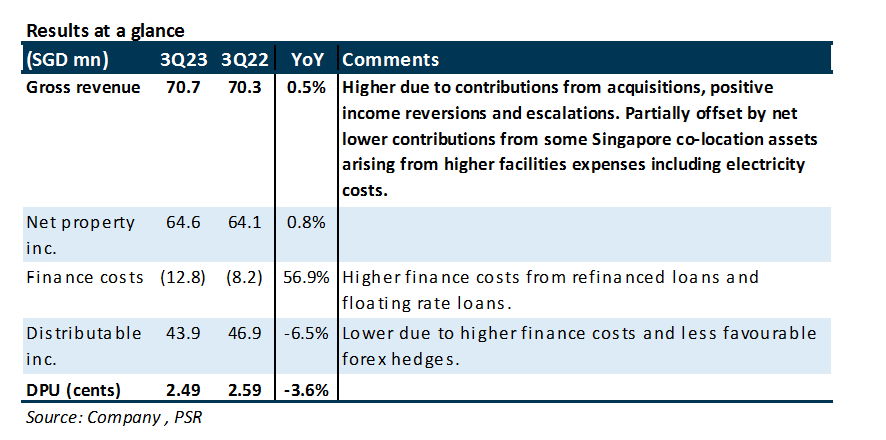

- 3Q23 DPU of 2.492 Singapore cents (-3.6% YoY) was in line with our expectations. It formed 25.1% of our FY23e forecast.

- 3Q23 revenue/NPI growth of 0.5%/0.8% YoY, driven by contributions from acquisitions and positive income reversions and escalations, was more than offset by higher finance costs (+56.9% YoY) and less favourable forex hedges.

- Upgrade from NEUTRAL to BUY with an unchanged DDM-derived target price of S$2.26 due to the recent share price performance. DPU growth catalysts include more accretive acquisitions and lower-than-expected interest costs. Organic growth will stem from renewals in FY24e (27.7% of leases expire in 2024). We expect revenue growth of c.4% for FY24e, barring contributions from potential acquisitions. The current share price implies FY23e/24e DPU yields of 5.2%/5.4%. No change to our forecasts.

The Positives

+ Maintained high portfolio occupancy of 98.3% (dipped by 0.2% QoQ), with a portfolio WALE of 7.8 years. 27.7% of leases by rental income will expire in 2024, with only 1% expiring for the rest of 2023. Leases signed in 3Q23 were in Singapore, Australia, Ireland and the Netherlands, and were at positive rental reversions. Additionally, some of the leases signed were restructured into power pass-through leases, which should improve NPI margins.

+ Prudent capital management, with 72% of debt on fixed rate. Average cost of debt increased 0.2ppts QoQ to 3.5% in 3Q23, and ICR remains healthy at 5.4x. Only 4.2% of debt is up for refinancing in 2024 with the majority of debt expiring from 2026 and beyond. However, gearing increased 90bps QoQ to 37.2%. A 100bps increase in interest rates would lower DPU by c.2.4%. Forecast foreign sourced income is also substantially hedged till June 2024.

The Negatives

– Nil

Source: Phillip Capital Research - 18 Oct 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024