SASSEUR REIT – Growth Drivers Intact

traderhub8

Publish date: Mon, 02 Oct 2023, 11:39 AM

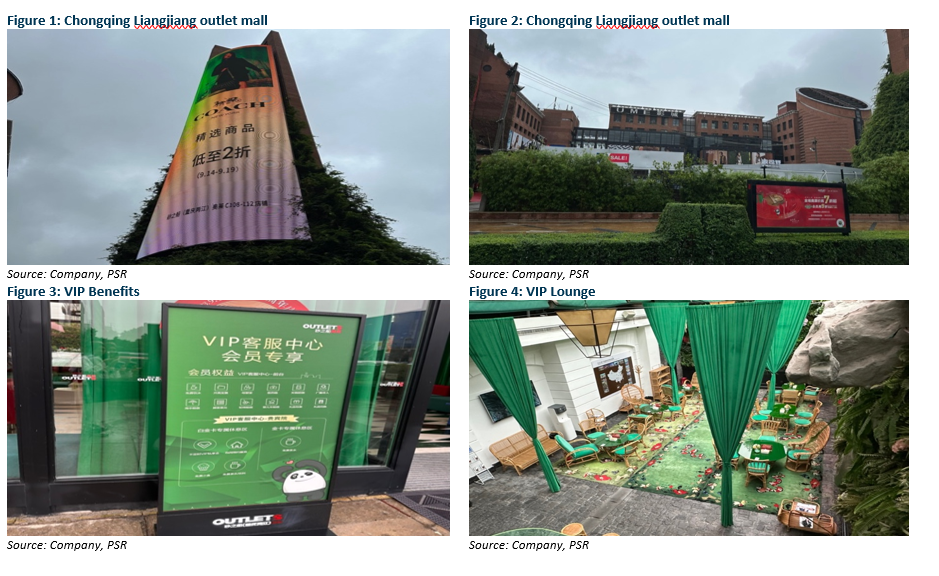

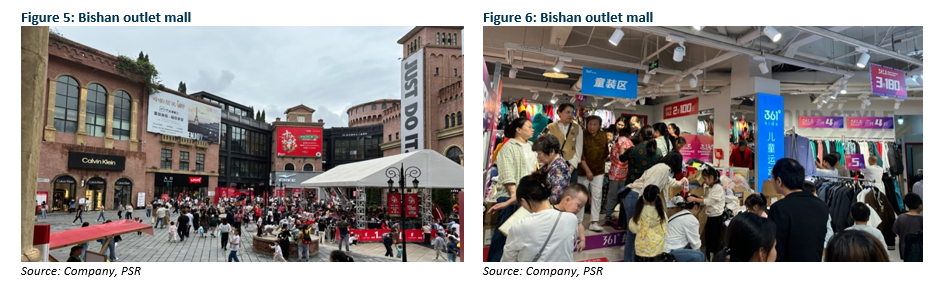

- We visited the outlet malls in Chongqing Liangjiang, Chongqing Bishan and Xi’an (ROFR asset) during SASSR’s Anniversary Sales. Outlet sales at the Sponsor Group level increase 39% YTD as of Sept 22, 2023. Sales for the past nine months have outperformed the entire year of FY23 due to the pent up demand and clear value proposition for its products.

- We expect VIP membership at the REIT level to continue increasing after the Anniversary sales (3.2 million as of 1H23), as the average spending per customer tends to be higher during this period, resulting in a higher conversion rate to VIP status. Additionally, we project that VIP members will contribute to more than 60% of the total sales in FY23.

- Potential accretive acquisition of Xi’an asset to raise DPU by c.4% in FY24 as the gearing is currently 26.2% with debt headroom of c. S$811 mn.

- We maintain our BUY recommendation with unchanged DDM-TP of S$0.90 and FY23-24e dividend yield of 9.6% – 9.9%.

Site Visit Highlights

- Outlet sales at the Sponsor Group level robust. Sales for the past nine months have outperformed the entire year of FY23, with the Chongqing Liangjiang outlet mall being the top contributor, and domestic brands accounting for c.70% of sales. Nike, Adidas, and +39 Space are usually the top three best-performing tenants for Chongqing Liangjiang and Xi’an outlet. New brands, including Teenie Weenie (for teenagers), Le Coq Sportif (sports), and AIMER (lingerie), have also gained popularity among middle-income Chinese customers. We anticipate a 29% YoY increase in FY23 sales, driven by SASSR’s clear value proposition, which capitalises on the trend of consumption downgrade in China.

- VIP membership at the Sponsor Group level is expected to increase by 20% to 20 million by the end of FY23, contributing to c.70-80% of total sales. At the portfolio level, VIP membership reached 3.2 mn as of 1H23, with a 3-year CAGR of 22.6%. SASSR has also adjusted its business model to adapt to several paradigm shifts post-COVID. To enhance customer conversion rates and engagement, SASSR has launched an online WeChat mini-program as part of its omnichannel strategy. We believe that the proportion of online sales has significant growth potential, as products have higher exposure with greater convenience to shop (currently accounting for low-single digit of total sales). Meanwhile, SASSR is also extending operating hours during the Anniversary Sales event to attract more customers and is launching various events such as the upcoming National Day sales event for domestic Chinese brands.

- Xi’an outlet mall is a sponsor pipeline asset and the second largest outlet mall in terms of sales revenue. The valuation of the Xi’an asset is estimated to be c.S$500mn-600mn as it is comparable to the largest asset in the portfolio (Chongqing Liangjiang) ,with a stable cap rate of c.7%. We believe such an acquisition is DPU accretive with a positive carry of 1.5% and would raise DPU by 4% given that EMA rental income would increase by 45%. However, given the current capital market condition, we believe acquisition is unlikely to be done in FY23. Leverage ratio as of 1H23 was 26.2% which is one of the lowest among S-REITs, as such SASSR has no intention to divest any asset.

- We maintain our BUY recommendation with unchanged DDM-TP of S$0.90. At the current share price, our FY23-24e DPUs of S$6.45 – 6.61 cents would translate into 9.6% – 9.9% dividend yield.

Description of the Chongqing Liangjiang asset

Sasseur (Chongqing) Outlets stands out as the star asset with the highest valuation (Dec 22: RMB 3,129 mn) and the most significant foot traffic. It is a retail outlet mall strategically targeting middle and upper-class consumers. As of Dec22, VIP members reached 967k with 3 different tiers and own set of benefits (Figure 3 and 4).

Description of the Chongqing Bishan asset

Sasseur (Bishan) Outlets is a comprehensive shopping destination that seamlessly combines retail shopping with entertainment, dining, education, and leisure experiences. It offers various amenities, including UME cinema (Figure 12), Counter-Strike game area (Figure 8), a VIP lounge (Figure 11), and a super farm for strawberry picking (Figure 7). The recent Asset Enhancement Initiative (AEI) involves AI assistance to guide customers and provide the latest offers and promotions (Figure 10).

Source: Phillip Capital Research - 2 Oct 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024