Valuetronics Holdings Ltd – Turning Around After Five Years

traderhub8

Publish date: Fri, 22 Sep 2023, 11:39 AM

- After five years of revenue decline, we expect a turnaround for Valuetronics after securing four new customers for FY24e/FY25e.

- The new factory in Vietnam will allow customers to de-risk from a China supply chain faced with high US tariffs and escalating geopolitical tension.

- Valuations are attractive at 1.1x EV/EBITDA with a dividend yield of 5%. Valuetronics carries a net cash of HK$1bn (S$177mn) on its balance sheet, or 80% of the market cap. We initiate coverage with a BUY recommendation and target prices of S$0.61. We peg our target price to industry valuations of 11x PE 1-year forward earnings. Valuetronics has an existing share buy-back plan to purchase an estimated 60mn shares (or S$32m) at the current price.

Company Background

Valuetronics Holdings Ltd (VALUE) was established in 1992 and listed on SGX Mainboard in 2007. VALUE is an electronics manufacturing services (EMS) provider with 80% of revenue from industrial and commercial electronics (ICE), and 20% from consumer electronics (CE). EMS services that VALUE provides include design, printed circuit board assembly (PCBA), full box build or module assembly and manufacturing of plastic and metal components. ICE products include industrial and commercial printers, industrial cold chain temperature monitors, automobile data and media connectivity modules and IP phones. Meanwhile, consumer products are largely PCBA work on smart lighting, electronic toothbrushes, and shavers. VALUE gross margins of 13% are ahead of the industry’s 8% due to the larger contribution of low-volume and high-mix ICE products. VALUE has two manufacturing facilities – 110,000 sqm in Huizhou City, Guangdong, China and a 52,541 sqm plant in Vinh Phuc Province, Vietnam.

Investment Highlights

- Multiple headwinds over the past five years. After a peak in 2018, VALUE suffered a revenue decline of 29% in the past five years. Faced with tariffs of as much as 25%, major US customers had shifted production out of their China factories into Indonesia or Mexico. VALUE then had to spend HK$200mn for a new factory in Vietnam. Subsequent challenges included pandemic-related component shortages, customers exiting the Russian market and business development activities disrupted by travel restrictions. We believe the major headwinds are behind VALUE and the company is poised for growth in the coming years. We expect margins to improve from higher ICE contribution, weaker renminbi and more stable component prices and depreciation.

- New plant, new customers. With the new plant set up in 2022, VALUE has been able to secure four new customers that will contribute to revenue in FY24e and FY25e. Customers are not willing to keep manufacturing solely in China. This is because of higher tariffs in the US, and customers wanting to de-risk due to the escalating geopolitical tensions. The four new customers are for electronic price tags at retail outlets, liquid cooling solutions for gaming computers, electronic souvenirs in entertainment facilities and network access products.

- Attractive valuations backed by 60mn outstanding share buybacks. We find VALUE valuations attractive at 9.6x PE and a net cash balance sheet of HK$1bn (S$177mn). In February 2022, VALUE announced an aggressive share buy-back programme worth HK$250mn (S$45mn). The company has since utilized HK$68mn to repurchase 22.5mn shares. Another HK$182mn (or S$32mn) is available to purchase another 60mn shares at the current price levels.

We initiate coverage with a BUY rating and a target price of S$0.61. Our target price is based on 11x PE FY24e, in-line with industry valuations.

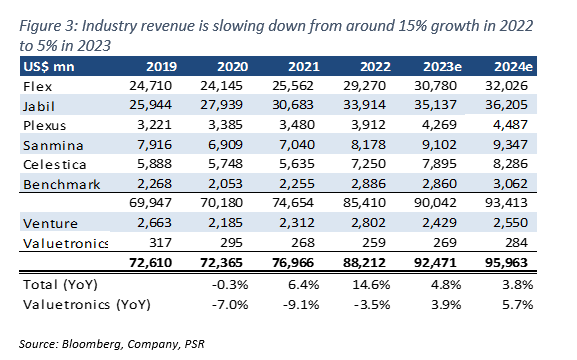

REVENUE

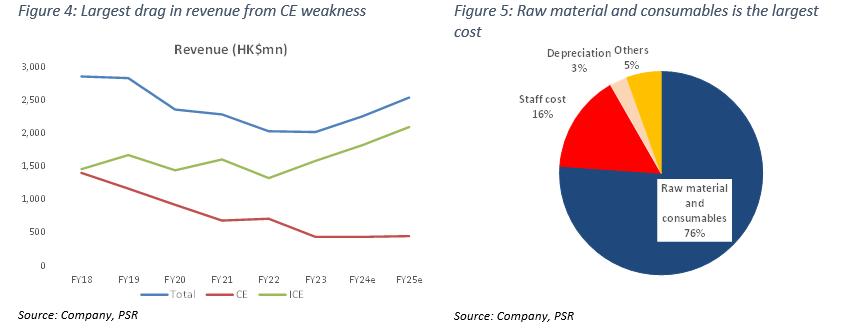

VALUE revenue peaked in FY18 at HK$2.85bn. Since then, the revenue has declined by 29% over five years to HK$2bn in FY23 (Figure 4). Revenue suffered from multiple factors namely customers de-risking out of China’s supply chain following the Trump administration’s imposition of trade tariffs. Other drivers of the weakness were the pandemic causing component shortages and travel restrictions affecting business development activities with potential customers. To meet customer demand for a new location, VALUE started construction of its new Vietnam factory in July 2020. The factory was completed in 2022.

Revenue is split into two product categories:

- Industrial and Commercial (ICE): ICE comprises low volume high mix products. Key products include industrial-use printers (for slots, point of sale, teller stations), thermal label printers, cold chain temperature monitors, network agriculture chemical dispensers and data and media connectivity modules in automobiles.

- Consumer Electronics (CE): CE products are PCBA for Shavers and electric toothbrushes and box build of smart lighting products. From 2018 to 2023, CE revenue collapsed a massive 69% to HK$446mn. The imposition of higher tariffs caused a major smart lighting customer to shift its production base from China to Mexico, to supply the US market. Meanwhile, VALUE will supply to the rest of the world.

EXPENSES

VALUE expenses are largely raw material and consumables (76%), staff cost (16%), depreciation (3%) and others (5%) – Figure 5. As a percentage of sales, staff cost has been climbing since 2018, from 12.3% to 14.9% currently. Rising wage pressures in China have been the major driver. Labour cost in China is expected to be stable with the general weakness in the export sector. Depreciation as a percentage of revenue has doubled from 1.4% to 2.8%, following the expansion of the plant in Vietnam.

Source: Phillip Capital Research - 22 Sep 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024