Singapore Telecommunications Ltd – Currency Down, Margins Under

traderhub8

Publish date: Thu, 24 Aug 2023, 11:35 AM

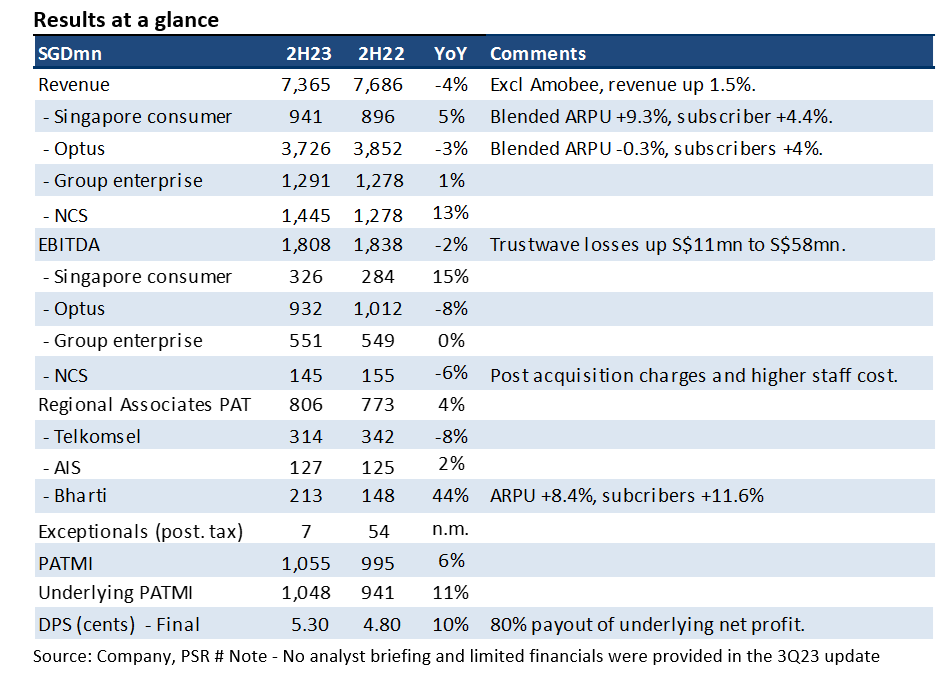

- 1Q24 revenue and EBITDA were within expectations at both 23% of our FY24e forecast. The 9% decline in the Australian dollar and drop in Optus margins were the drag on earnings.

- Maiden disclosure of the Digital infraco (data centre, submarine cable, satellite), reflected an 11% YoY growth in EBITDA from higher pricing and satellite deployment services. Meanwhile, Bharti registered a 34% YoY growth in earnings to S$112mn.

- Optus remains the weakest spot for the group with EBIT declining 28% YoY in local currency terms to S$56mn. Despite the larger revenue and market size, Optus EBIT is only 23% of Singapore operations. We incorporated a modest decline in our FY24e revenue and EBITDA estimates by 2% to account for the weakness in the Australian dollar. The SOTP TP is lowered to S$2.80 (prev. S$2.84). We upgrade to BUY from ACCUMULATE due to recent price weakness. Valuations are attractive but any re-rating for Singtel will come from its S$6bn asset monetization efforts, better cost controls at Optus, mobile price restoration and broadband growth.

The Positives

+ Stellar performance for Bharti. Bharti registered a 33% rise in profit after tax to S$112mn. The key driver to earnings was the 9% YoY increase in mobile ARPU in India to Rp200. Customers are looking to premiumize their mobile pricing plans to 4G smartphones and from prepaid to postpaid. The earnings growth at Bharti was before the exceptional loss of S$114mn from a devaluation of the Nigerian Naira (14 June) and fair value loss from its foreign currency convertible bonds.

+ Digital infraco, the new source of growth. The newly disclosed digital infraco reported an 11% rise in EBITDA to S$62mn. Earnings were driven by higher prices in the data centre and satellite deployment services.

The Negative

– No respite at Optus. Optus EBITDA was hurt by a 9% decline in the Australian dollar. EBITDA margin was down 1.8% points from higher wages and electricity costs. Competitive pricing and a weakening in consumer sentiment are also placing pressure on mobile ARPU.

Source: Phillip Capital Research - 24 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024