SATS LTD – Acquisition Costs Weighed on 1Q24 Earnings

traderhub8

Publish date: Thu, 17 Aug 2023, 11:33 AM

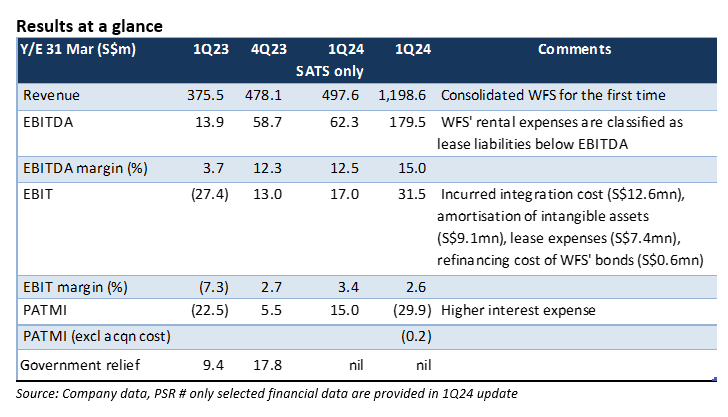

- SATS slipped into net loss in 1Q24, after booking S$29.7mn integration costs and amortization expenses relating to the acquisition of WFS. Excluding these, net loss was S$0.2mn, which was in line with our expectations. Operating gains were cancelled out by higher interest expense.

- SATS’ core operations turned in a profit, even with the expiry of government relief, though EBIT margin of 3.4% is still a far cry from pre-COVID level of 16%-17%. WFS’ volume declined in line with softer cargo demand, but yields are holding up.

- Maintain NEUTRAL recommendation and TP of $2.51. We lowered FY24e earnings forecast by 49% to take into account the integration costs.

The Negatives

– Acquisition-related costs weighed on earnings. WFS was consolidated for the first time. It incurred a one-off integration cost (S$12.6mn), amortization of intangible assets (S$9.1mn), lease expenses (S$7.4mn) and cost for refinancing of WFS’ bonds (S$0.6mn). The final amount of intangible assets will be determined in 2H24e. The annual amortization could change.

– Net debt rose to S$2.2bn (Mar 23: S$0.77bn). Higher interest expense cancelled out all the operating gains. Free cash flow was negative S$10.7mn in 1Q24.

– Volume handled by WFS has declined in tandem with the decline in global air cargo demand. However, the industry decline is moderating (Jun 23: -3.4% YoY, YTD: -8.1%).

The Positive

+ SATS-only operations were profitable, though it no longer enjoy government relief.

Outlook

The outlook is mixed. Aviation-related profits could improve with 1) inflight meals restoring to pre-COVID levels; 2) reduction in double-catering; and 3) increase in number of flights. On the other hand, air cargo volume might remain sluggish from lower manufacturing output and trade activities. The higher interest expense is a drag on earnings.

Source: Phillip Capital Research - 17 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024