PropNex Ltd – Expecting a Stronger 2H23

traderhub8

Publish date: Mon, 14 Aug 2023, 11:30 AM

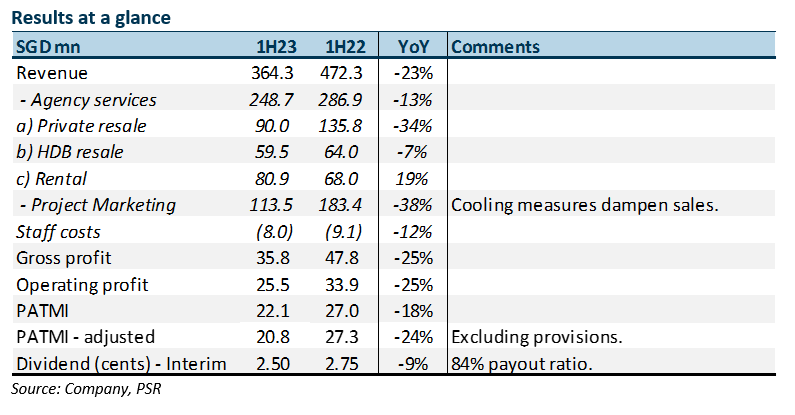

- 1H23 results were below expectations. Revenue and PATMI were 33%/30% of our FY23e forecast. Adjusted PATMI declined 24% YoY to S$20.8mn. Cooling measures and a dearth of new launches pushed revenue lower.

- We expect the pick-up in new launches and market share to drive a stronger performance in 2H23. We expect 8,100 units to be launched in 2H23 compared with 1H23’s 3,400. Market share from the recent launches has been around 43%.

- We lower our FY23e earnings by 9% to S$62.1mn and reduce the DCF target price to S$1.16 (prev. S$1.20). Our recommendation is downgraded from BUY to ACCUMULATE. The dividend yield is attractive at 6.3%, well supported by FCF and S$140mn net cash on balance sheet. We expected a rebound in 2H23 as it will benefit from larger number of new launches and market share gains. Meanwhile, private resale support will come from its large price discounts compared to new launches and surge in completions. HDB resale will be resilient from attractive grants and more units reaching their minimum occupancy period.

The Positive

+ Returning the surge in cash-flow. The highly cash generative model was evident despite the weakness in earnings. FCF generated in 1H23 improved to S$30.0mn (1H22: S$23mn). Capital expenditure remained minimal at S$0.5mn. The net cash was generally stable at S$139.6mn (1H22: S$133.9mn). PropNex announced an interim dividend of 2.5 cents by raising the payout ratio from 75% to 84%. Our forecast dividends of 6.5 cents or S$48mn is well sustained by FCF and strong net cash balance sheet.

The Negative

– Weakness in revenue. Revenue contraction has been larger than expected. Weakness was especially in private new launches and resale. Lack of new launches over the six months 4Q22 till 1Q23 and softness in sentiment post cooling measures drove volumes down.

Source: Phillip Capital Research - 14 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024