Thai Beverage PLC – the Beer Is Still Flat

traderhub8

Publish date: Mon, 14 Aug 2023, 11:28 AM

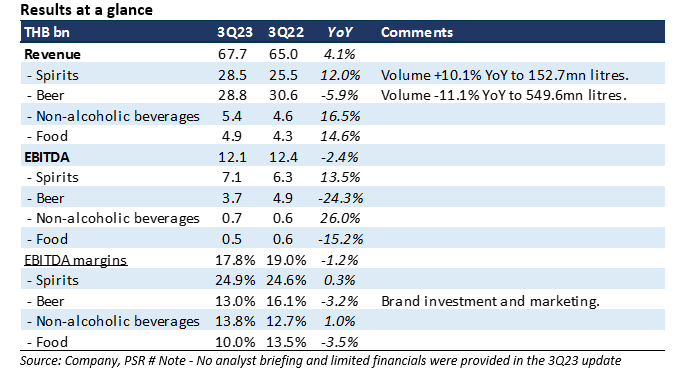

- Results were below expectations. 9M23 revenue and PATMI at 71%/65% of our FY23e forecasts. Weakness in beer sales was steeper than expected.

- Spirits revenue climbed 12% YoY to THB28.5bn in 3Q23, largely on 10% volume jump and improvement in selling price from better mix of brown spirits and price adjustment. 3Q23 spirits volume was a record 152.7mn litres.

- We lower our FY23e revenue by 10% and PATMI 7%. Beer contribution to group PATMI around 8% due to the large minority interest. The weakness in beer volumes was steeper than expected. Sabeco is facing major volume contraction due to weak macro conditions in Vietnam affecting discretionary spending such as alcohol. Our BUY recommendation is maintained but target price is lowered from S$0.80 to S$0.75. We peg 18x FY23e earnings for the core operations, its historical average. And listed associates are valued at market valuations.

The Positive

+ Rebound in spirits volume, revenue and margins. Spirits volume continue to pick up momentum, rising 10% YoY in 3Q23 to an estimated 152.7mn litres. Revenue rose a faster 12% YoY from higher selling price and better product mix of brown spirits.

The Negative

– Beer earnings collapsed. EBITDA for beer operations was down 24%, largely from the drag in Sabeco operations. Margins contracted from weaker volumes, high raw material inventory and higher marketing spend in events to promote the brands.

Outlook

We expect beer volumes for Sabeco to remain weak for the rest of the year. Any recovery is only expected early next year from economic uplift and lower raw material cost. Spirit volume may soften as festivities post-election wind down and farm incomes have been trending down.

Source: Phillip Capital Research - 14 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024