Prime US REIT – Navigating Through the Storm

traderhub8

Publish date: Mon, 14 Aug 2023, 11:27 AM

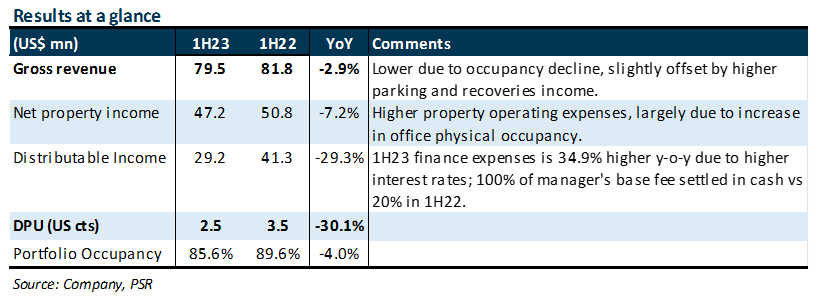

- 1H23 DPU of 2.46 US cts (-30.1% YoY) was in line with our estimates at 50% of FY23e forecast. The decline of was due to Prime increasing management fees paid in cash from 20% to 100%, higher interest expense, lower occupancy, and higher operating expenses. Excluding the change in management fees paid in cash, DPU is still down c.24% YoY.

- Portfolio occupancy dropped to 85.6% from 88.6% in 1Q23, with overall rental reversions of +9.5%.

- Maintain BUY, DDM-TP lowered from US$0.46 to US$0.39. Our cost of equity increased from 13.75% to 15.95% due to the inherent weakness of the US office sector. Catalysts include improved leasing and a greater return to the office. Prime is currently trading at 0.25x P/NAV, and we believe that most of the negatives are already priced in. The current share price implies FY23e/FY24e DPU yield of 25/27%.

The Positive

+ Extension of debt maturities. During the quarter, Prime extended the maturity of its term loan and revolver under its main credit facility (c.34% of total loans) by one year to July 2024. As a result, Prime has no refinancing obligations till July 2024. This gives Prime more time to secure refinancing and some respite amid the credit crunch situation in the US.

+ Gearing decreased 0.9ppts QoQ to 42.8%. 80% of debt is either on fixed rate or hedged (79% in 1Q23), with 63% of debt hedged or fixed through to 2026 or beyond. Prime’s effective interest cost for the quarter increased marginally QoQ from 3.7% to 3.8%, and its interest coverage ratio is at 3.4x. Prime has a buffer of c.5.1% and c.15% from 2022 year-end asset valuations before gearing hits 45% and 50% respectively.

The Negatives

– Portfolio occupancy decreased to 85.6% from 88.6% in 1Q23. The biggest contributors to the decline were 171 17th Street (-14.5ppts QoQ to 80.5%) and Park Towers (-11.4ppts QoQ to 74.3%).

Source: Phillip Capital Research - 14 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024