Singapore Banking Monthly – Dividends Jumped 39% With NIM Boost

traderhub8

Publish date: Fri, 11 Aug 2023, 11:46 AM

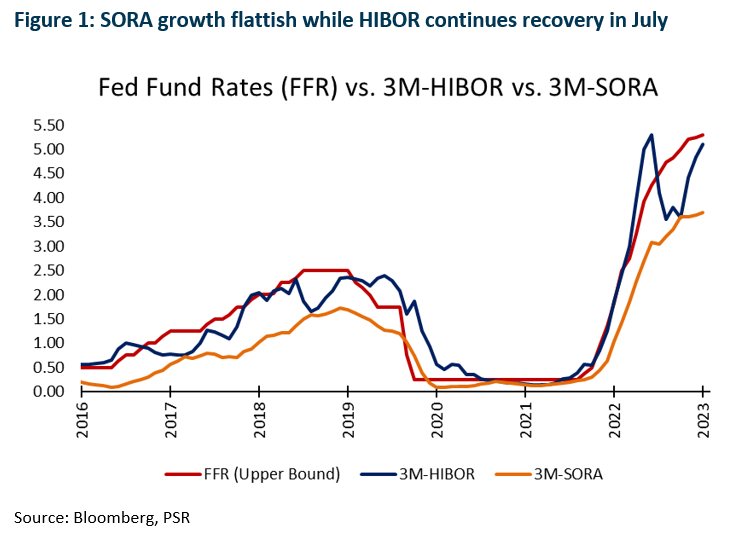

- July’s 3M-SORA was up 5bps MoM to 3.69% and 3M-HIBOR was up 26bps MoM to 5.10%.

- 2Q23 bank earnings were slightly above expectations. PATMI rose 35%, supported by NII growth of 37% YoY. Guidance for FY23e NIMs (from 2.05-2.20% to 2.10-2.20%) and loans growth (maintained at low to mid-single digit). Interim dividend jumped 39% YoY in 1H23.

- Singapore domestic loans dipped 5.02% YoY in June, below our estimates. Loans were stable MoM, for the second time in 10 months. CASA balance grew to 18.9% (May23: 18.8%), the first MoM growth in 16 months.

- Maintain OVERWEIGHT. We remain positive on banks. Bank dividend yields are attractive at ~6.0% with upside surprise in dividends due to excess capital ratios and push towards higher ROEs. SGX is another major beneficiary of higher interest rates (SGX SP, BUY, TP S$11.71).

3M-SORA growth flattish; 3M-HIBOR rebounds in July

Singapore interest rates picked up slightly in July. The 3M-SORA was up 5bps MoM to 3.69%. July’s 3M-SORA surged by 265bps YoY, the smallest YoY growth in eight months. July’s 3M-SORA is 7bps higher than the 2Q23 3M-SORA average of 3.62%.

Hong Kong interest rates continued to surge and reversed the decline from 1Q23. The 3M-HIBOR was up 26bps MoM to 5.10%, the highest the 3M-HIBOR has reached since Dec 2022’s 3M-HIBOR of 5.29%. July’s 3M-HIBOR improved by 324bps YoY and was 82bps higher than 2Q23 3M-HIBOR average of 4.28% (Figure 1).

2Q23 RESULTS HIGHLIGHTS

- Continued NII and NIM growth boost earnings

DBS’ 2Q23 adjusted earnings of S$2.69bn were above our estimates, and 1H23 adjusted PATMI was 57% of our FY23e forecast. 2Q23 DPS is raised 33% YoY to 48 cents, bringing 1H23 dividend to 90 cents. We raise our FY23e DPS from S$1.68 to S$1.86. NII spiked 40% YoY to S$3.43bn due to a NIM surge of 58bps YoY to 2.16% despite loan growth dipping 2% YoY. Management spoke of an upside bias to NIM from its current levels and said that NIM will likely peak in 2H23, we could expect FY23e NIM at around 2.15%.

OCBC’s 2Q23 earnings of S$1.71bn were above our estimates and came from higher net interest income and insurance income offset by lower fee income and higher allowances. 1H23 PATMI was 53% of our FY23e forecast. 2Q23 DPS was up 43% YoY to 40 cents. We raise our FY23e DPS from S$0.80 to S$0.85. NII grew 41% YoY led by NIM improvement of 55bps YoY to 2.26% despite loan growth remaining flat YoY. NIM expansion was mainly due to the continued and rapid rise in interest rates during the year. OCBC has increased its NIM guidance for FY23e from 2.20% to above 2.20%.

UOB’s 2Q23 adjusted earnings of S$1.51bn were above our estimates due to higher other non-interest income and higher NII offset by lower-than-expected fee income growth and higher allowances. 1H23 adjusted PATMI was 54% of our FY23e forecast. 2Q23 DPS was up 42% YoY to 85 cents. We raise our FY23e DPS from S$1.65 to S$1.75. NII grew 31% YoY, despite a decline in loans growth of 1% YoY, while NIM surged 45bps YoY to 2.12% but declined 2bps QoQ due to excess liquidity deployed to high-quality assets. UOB has maintained its loan growth guidance of low to a mid-single digit and NIM to stay around current levels for FY23e.

- Allowances higher across the board

DBS’ 2Q23 total allowances were higher 57% YoY due to SPs increasing by 65% YoY offset by higher GP write-back of S$42mn for the quarter (2Q22: write-back of S$23mn). Resultantly, 2Q23 credit costs rose by 2bps YoY to 10bps. Nonetheless, the NPL ratio declined to 1.1% (2Q22: 1.3%) as new NPA formation fell by 39% YoY. GP reserves rose slightly to S$3.80bn.

OCBC’s management set aside 31bps of credit cost for 2Q23 (1Q23: 12bps), the second highest in six quarters, even though asset quality is still benign, with new NPAs during the quarter only at S$289mn (1Q23: S$174mn) and NPL ratio at 1.1%. 2Q23 total allowances rose 250% YoY mainly due to an increase in GPs, which were mainly set aside for changes in risk profiles, macro-economic variables updates and management overlays (40% of GP or ~S$1bn).

UOB’s total allowances rose by 38% YoY to S$238mn mainly due to specific allowances increasing by 22% YoY to S$202mn largely due to a major Thailand corporate account and general allowance of S$36mn (2Q22: S$7mn). This resulted in credit costs increasing by 8bps YoY to 30bps. Management said that the major Thailand corporate account is in the manufacturing sector and was hit by fraud, for which they had to fully provide for, nonetheless, they do not see any systemic risk from this account.

Source: Phillip Capital Research - 11 Aug 2023

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024