Sheng Siong Group Ltd – Back to Revenue Growth

traderhub8

Publish date: Mon, 31 Jul 2023, 11:23 AM

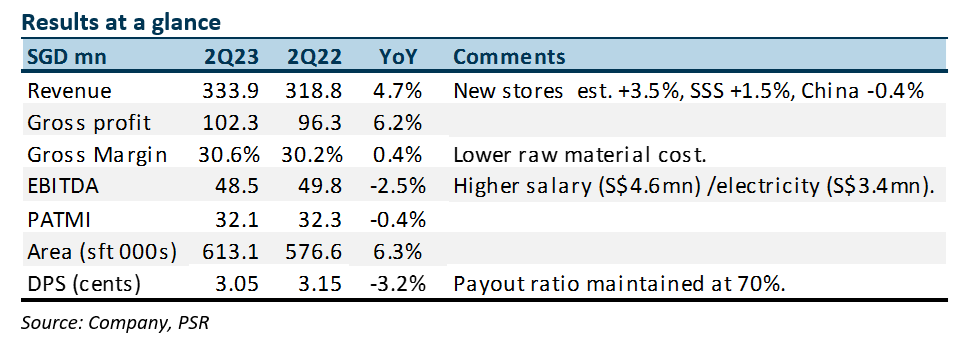

- 2Q23 results were within expectations. 1H23 revenue and PATMI were 50%/48% of our FY23e forecast. Despite record gross margins, PATMI was down 0.4% YoY due to a jump in wages and utilities.

- After four quarters of decline, revenue grew 4.7% YoY in 2Q23. We estimate growth was driven by new stores (+3.5% pts) and same-store sales (+1.5% pts).

- New stores, recovery in same-store sales, interest income and higher gross margins will support earnings. But any improvement will be offset by a jump in operating expenses led by utilities and wages. Our FY23e expectations are a modest 1.5% earnings growth. No change to our FY23e earnings and target price of S$1.98, pegged to 22x PE, a 10-15% discount to the 5-year historical average of 25x PE. We upgrade to BUY from ACCUMULATE due to the recent performance of the share prices.

The Positives

+ Same-store sales back to growth. After four quarters of decline, we estimate same-store sales rose 1.5% YoY in 2Q23 (1Q23 -3.6% YoY). We believe market share gains and household budgets returning to home dining drove the improvement in same-store sales.

+Gross margins climb to record levels. 2Q23 gross margins rose to a record 30.6%. The drivers to higher margins were leaner inventory relative to peers (especially in fresh products) and lower purchasing costs. The supply chain was less disrupted and fuel costs were falling. Sales contribution from private labels and fresh is relatively stable as a percentage of sales.

The Negative

– 2Q23 operating expenses jumped 13% YoY. The re-contracting to higher electricity expenses and increased wages, caused operating expenses to rise 13% YoY or S$8mn. Opex to revenue nudged up 1.3% points to 20.1%. Higher wages from the progressive wage model and tight labour conditions will keep fixed costs elevated. An offset will be the lower variable wages or staff bonus.

Source: Phillip Capital Research - 31 Jul 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024