Keppel DC REIT – a Steady Quarter With Stable DPU

traderhub8

Publish date: Wed, 26 Jul 2023, 10:53 AM

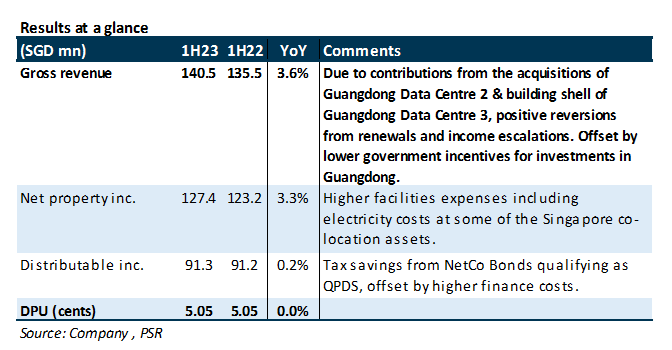

- 1H23 DPU of 5.051 Singapore cents (unchanged YoY) was in line and formed 51% of our FY23e forecast.

- Contributions from the acquisitions of Guangdong Data Centre 2 and 3, along with renewals, income escalations, and tax savings resulting from the approval of the NetCo Bonds as Qualifying Project Debt Securities, or QPDS, were offset by higher facilities expenses including increased electricity costs at some of its Singapore co-location assets, and higher finance costs due to refinanced loans, as well as floating interest rate loans.

- Downgrade from ACCUMULATE to NEUTRAL due to the recent share price performance. DDM derived target price remains unchanged at S$2.26. Catalysts include more accretive acquisitions and lower-than-expected interest costs. The current share price implies FY23e/24e DPU yields of 4.4%/4.5%.

The Positives

+ Maintained high portfolio occupancy of 98.5% (unchanged YoY), with a portfolio WALE of 8 years. 12.2% of leases by rental income will expire in 2023. Leases renewed in 1H23 were in Singapore, Ireland and the Netherlands with overall positive rental reversions. In our view, the likelihood of lease renewal is high due to the high costs of tenant re-location; and 54% of its assets are located in Singapore. Cyxtera, the client at GV7 which filed for Chapter 11 bankruptcy, remains current on its rent payments with nothing owed.

+ Prudent capital management, with 73% of debt on fixed rate. Average cost of debt increased from 2.8% in 1Q23 to 3.3% in 2Q23 after refinancing all loans due in 2023 in Apr23, with the bulk of debt expiring from 2026 and beyond. A 100bps increase in interest rates would lower DPU by c.2.2%. Gearing improved 50bps from 36.8% in 1Q23 to 36.3%. Forecast foreign sourced income is also substantially hedged till June 2024. EU accounts for c.23% of income.

The Negative

– Potential Equity Fund Raising. There is a final payment of c.S$142mn upon the completion of Guangdong Data Centre 3, expected to take place in 3Q23. If this is funded by a cash call, the new shares in the market might be a near term overhang to share price.

Source: Phillip Capital Research - 26 Jul 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024