Singapore Banking Monthly – Singapore Interest Rates Remain Flattish

traderhub8

Publish date: Mon, 03 Jul 2023, 10:52 AM

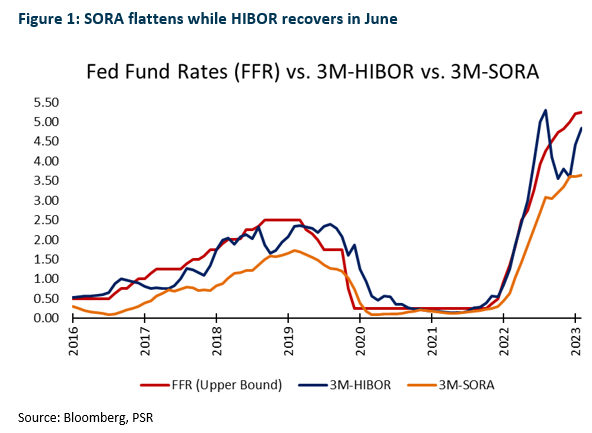

- June’s 3M-SORA was up 3bps MoM to 3.64% and 3M-HIBOR was up 43bps MoM to 4.84%.

- Singapore domestic loans dipped 4.88% YoY in May, below our estimates. The loan decline has slightly reversed from the previous month. CASA balance is flat at 18.8% (Apr23: 18.8%), the first in 14 months.

- Maintain OVERWEIGHT. We remain positive on banks. Bank dividend yields are attractive at 5.7% with upside surprise in dividends due to excess capital ratios and push towards higher ROEs. SGX is another major beneficiary of higher interest rates (SGX SP, BUY, TP S$11.71).

3M-SORA growth flattens; 3M-HIBOR continues recovery in June

Singapore interest rates flattened in June. The 3M-SORA was up 3bps MoM to 3.64%. June’s 3M-SORA surged by 301bps YoY. 2Q23 3M-SORA average of 3.62% (1Q23: 3.20%).

Hong Kong interest rates continued to surge and reversed the decline from 1Q23. The 3M-HIBOR was up 43bps MoM to 4.84%, lower than May’s MoM increase of 82bps but this is the highest the 3M-HIBOR has reached for 1H23. June’s 3M-HIBOR improved by 359bps YoY and was 56bps higher than 2Q23 3M-HIBOR average of 4.28% (Figure 1).

Singapore loans growth decline flattened in May

Overall loans to Singapore residents – which captured lending in all currencies to residents in Singapore – fell by 4.88% YoY in May to S$799bn. This was below our estimate of low to mid-single digit growth for 2023 as the rise in interest rates started to be fully felt by consumers, nonetheless it is a 98bps improvement from April’s YoY decline of 5.86%.

Business loans fell by 6.82% YoY in May. Loans to the building and construction segment, the single largest business segment, fell 2.48% YoY to S$170bn, while loans to the manufacturing segment fell 13.28% YoY in May to S$24.5bn.

Consumer loans were down 1.63% YoY in May to S$309bn, as dips in other segments were offset slightly by strong loan demand in the housing segment. Housing loans, which make up ~70% of consumer lending, grew 1.46% YoY in May to S$222bn for the month.

Total deposits and balances – which captured deposits in all currencies to non-bank customers – grew by 5.25% YoY in May to S$1,781bn. The Current Account and Savings Account, or CASA proportion was flat at 18.8% (Apr23: 18.8%) of total deposits, or S$336bn, CASA ratio did not decline YoY for the first time in 14 months.

Hong Kong loans growth continues to decline

Hong Kong’s domestic loans growth declined 4.33% YoY and declined 0.63% MoM in May. The YoY decline in loans growth for May was higher than the decline of 3.28% in April 2023, while the MoM decline of 0.63% was lower than the decline of 0.69% in April 2023.

Source: Phillip Capital Research - 3 Jul 2023

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024